Chicago, known as “The Windy City,” is renowned for its stunning architecture, vibrant cultural scene, and bustling business district. However, behind its shiny exterior lies a complex web of factors that contribute to its high taxes, making it one of the most expensive cities to live in across the United States.

One of the primary reasons for Chicago’s high taxes is the extensive network of public services provided to its residents. From well-maintained public parks to an efficient public transportation system, the city strives to ensure a high quality of life for its inhabitants. These services, although beneficial, require a significant amount of funding, which is primarily derived from taxes.

Another contributing factor to the high taxes in Chicago is the city’s dire financial situation. Over the years, Chicago has faced significant economic challenges, including pension deficits and mounting debt. To address these issues and maintain essential services, the city has had to increase taxes to generate additional revenue. This has placed a heavy burden on taxpayers, particularly homeowners who bear the brunt of these tax hikes.

Furthermore, Chicago’s high taxes can also be attributed to the city’s complex tax structure. With multiple layers of taxation, including state, county, and city taxes, it becomes increasingly difficult for taxpayers to navigate and understand the intricacies of the tax system. This complexity often leads to confusion and in some cases, may result in taxpayers paying more than necessary.

In this comprehensive analysis, we will delve deeper into the various reasons behind Chicago’s high taxes, examining the role of public services, the city’s financial situation, and the complexities of its tax structure. By gaining a better understanding of these factors, we can shed light on potential solutions to alleviate the tax burden on Chicago residents and ensure a more affordable and sustainable future for the city.

- The Historical Context of Chicago’s Taxation

- Economic Factors Contributing to Chicago’s High Taxes

- Government Spending and its Impact on Taxation

- Allocation of Funds

- Investment in Infrastructure

- Pension Liabilities

- The Pensions Crisis: A Major Driver of High Taxes

- Question-answer:

- What are some of the factors contributing to Chicago’s high taxes?

- How do Chicago’s taxes compare to those of other major cities in the United States?

- What are some potential solutions to reduce Chicago’s high taxes?

- How do Chicago’s high taxes impact its residents and businesses?

- Are there any proposed reforms or initiatives to address Chicago’s high taxes?

- Why are taxes in Chicago so high compared to other cities?

The Historical Context of Chicago’s Taxation

Chicago’s tax system has a long and complex history that can be traced back to its early days as a small trading post in the early 19th century. In its early years, Chicago relied heavily on property taxes to fund its basic services and infrastructure. As the city grew rapidly during the 19th and early 20th centuries, so did the need for increased tax revenue to support its expanding population and economy.

During the early part of the 20th century, Chicago faced various challenges that impacted its tax system. The Great Depression of the 1930s hit the city hard, leading to a decrease in tax revenue as businesses closed and unemployment rose. To address this crisis, the city had to rely on federal aid and increase tax rates to generate additional revenue.

Another significant development in Chicago’s tax history was the implementation of the Illinois state income tax in 1969. This shifted the tax burden from primarily property taxes to a combination of property and income taxes. The introduction of the income tax was a response to the changing economic landscape and the need for a more progressive tax system.

In recent years, Chicago has faced ongoing financial challenges, including large pension obligations and a persistent budget deficit. To address these issues, the city has implemented various tax increases, such as raising property taxes and implementing new taxes on services like transportation and entertainment.

It is important to note that Chicago’s tax system is influenced by various factors, including state legislation, economic conditions, political decisions, and the needs of the city’s residents. Understanding the historical context of Chicago’s taxation is crucial to gaining insight into the reasons behind its high tax rates and the challenges faced by the city in providing essential services to its residents.

Economic Factors Contributing to Chicago’s High Taxes

Chicago’s high taxes can be attributed to a variety of economic factors that contribute to the city’s financial burden. These factors include:

- The cost of public services: Chicago provides a wide range of public services, including education, healthcare, transportation, and public safety. The cost of providing these services is high, resulting in increased tax rates to cover the expenses.

- Pension obligations: Like many other cities, Chicago faces significant pension obligations for its employees, particularly for public safety personnel such as police and firefighters. These pension payments contribute to the city’s high tax burden.

- Infrastructure maintenance and improvements: The city’s aging infrastructure requires constant maintenance and improvements. Funding for these projects often comes from tax revenues, further increasing the tax burden for Chicago residents.

- Debt service: Chicago has accumulated a substantial amount of debt over the years, primarily from borrowing to fund capital projects. The city must allocate a significant portion of its budget to debt service, which increases the tax burden on residents.

- Unfavorable business climate: Chicago’s high tax rates can deter businesses from setting up shop or expanding within the city. This leads to a decrease in job opportunities and economic growth, putting additional strain on the remaining taxpayers.

- Declining population: The city’s population has been declining in recent years, resulting in a smaller tax base. With fewer taxpayers to shoulder the financial burden, taxes may need to be increased to maintain the city’s services and infrastructure.

These economic factors combined contribute to Chicago’s high taxes, creating challenges for both the city and its residents. Addressing these factors will require careful fiscal management and strategic planning to ensure a more stable and sustainable financial future for Chicago.

Government Spending and its Impact on Taxation

Government spending plays a crucial role in determining the level of taxation in Chicago. The city’s budget is largely funded through taxes imposed on its residents and businesses. The amount of money that the government needs to collect in taxes is directly influenced by the amount it spends on various programs, services, and infrastructure projects.

Allocation of Funds

Chicago’s government allocates funds to various sectors such as education, healthcare, transportation, public safety, and social services. Each allocation has its own impact on the tax burden of its citizens. For example, high spending on education and healthcare may lead to higher taxes to fund these essential services.

Investment in Infrastructure

Another significant factor influencing taxation is the government’s investment in infrastructure projects. Chicago has a vast public transportation network, which requires substantial funding to maintain and expand. Infrastructure investments often require additional tax revenue, which can impact the overall tax burden on residents.

Pension Liabilities

One major challenge facing the city is its pension liabilities. Chicago has significant obligations to public employee pensions, which requires a substantial portion of the city’s budget. These obligations may contribute to higher taxes as the government seeks to meet its pension obligations.

In conclusion, government spending is a key driver of taxation in Chicago. The allocation of funds, investment in infrastructure, and pension liabilities all impact the tax burden on residents and businesses. Understanding the relationship between government spending and taxation is essential in addressing the root causes of Chicago’s high taxes and finding potential solutions to alleviate the burden on its citizens.

The Pensions Crisis: A Major Driver of High Taxes

One of the primary reasons behind Chicago’s high taxes is the ongoing pensions crisis. The city’s pension obligations have been a significant financial burden for many years and continue to grow exponentially.

Chicago’s pension system for public sector employees, including police officers and firefighters, has been severely underfunded for decades. This underfunding has led to a massive shortfall in pension funds, making it difficult for the city to meet its obligations.

The city’s pensions crisis is characterized by a combination of factors. Firstly, the cost of providing pensions has skyrocketed due to factors such as longer life expectancy and generous retirement benefits. Secondly, the investment returns from pension funds have been lower than expected, exacerbating the funding gap.

The pensions crisis has forced the city to allocate a significant portion of its budget towards meeting pension obligations. These payments are a major drain on the city’s resources and leave little flexibility for other important expenses, such as infrastructure development or education.

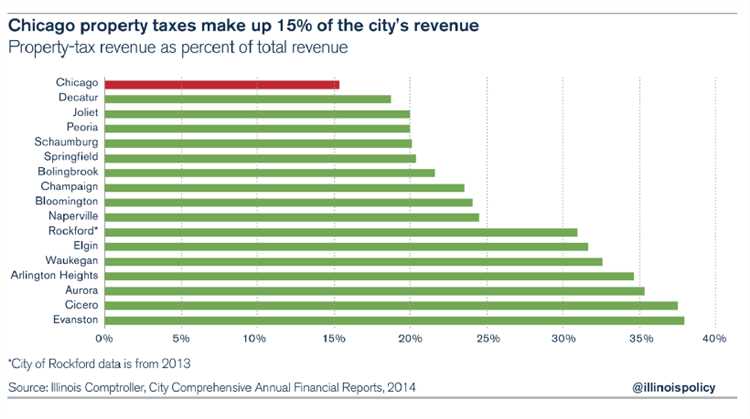

As a result, Chicago has had to resort to increasing taxes to generate revenue and meet its pension obligations. This has led to high property taxes, sales taxes, and other taxes that burden both businesses and residents.

The pensions crisis is a complex issue that requires comprehensive solutions. Chicago needs to address the underfunding issue by increasing funding for pensions and exploring options to improve investment returns. Additionally, meaningful pension reforms may be necessary to ensure the long-term sustainability of the system.

Overall, the pensions crisis in Chicago has played a significant role in driving high taxes. Unless substantial measures are taken to address this crisis, the burden of high taxes is likely to continue to weigh heavily on the city and its residents.

Question-answer:

What are some of the factors contributing to Chicago’s high taxes?

There are several factors contributing to Chicago’s high taxes. One major factor is the city’s high levels of debt and unfunded pension liabilities. Additionally, the city faces significant infrastructure costs and expenses related to public services like education and healthcare.

How do Chicago’s taxes compare to those of other major cities in the United States?

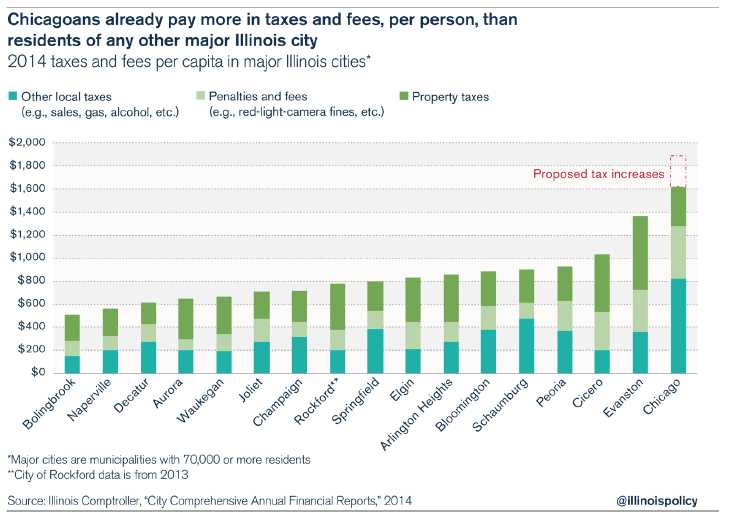

Chicago’s taxes are generally higher than those of other major cities in the United States. This is due to a combination of factors including the city’s high levels of debt, unfunded pension liabilities, and the need to finance expensive infrastructure projects and public services.

What are some potential solutions to reduce Chicago’s high taxes?

Reducing Chicago’s high taxes will require a comprehensive approach. One potential solution is to address the city’s debt and unfunded pension liabilities by implementing cost-saving measures and finding alternative sources of funding. Additionally, the city can focus on attracting new businesses and investments to increase its tax base and generate additional revenue.

How do Chicago’s high taxes impact its residents and businesses?

Chicago’s high taxes can have a negative impact on both its residents and businesses. For residents, high taxes can lead to a higher cost of living and make it more difficult to afford necessary expenses. For businesses, high taxes can reduce profitability and make it less attractive for new businesses to establish themselves in the city.

Are there any proposed reforms or initiatives to address Chicago’s high taxes?

There have been various proposed reforms and initiatives to address Chicago’s high taxes. Some proposals include restructuring the city’s tax system, implementing spending cuts, and exploring new revenue sources. However, implementing these reforms can be challenging and requires political will and support from stakeholders.

Why are taxes in Chicago so high compared to other cities?

The high taxes in Chicago can be attributed to several factors. Firstly, the city has a large and costly public sector, which requires significant funding. Additionally, Chicago has a high level of debt, which necessitates higher taxes to repay. Furthermore, the city faces various financial challenges, such as underfunded pensions and a history of corruption, which contribute to the need for higher taxes.