Baltimore City has long been known for its high taxes, consistently ranking among the highest in the nation. Many residents and businesses in the city are left wondering why their tax burden is so heavy.

There are several factors that contribute to the high taxes in Baltimore City. Firstly, the city faces unique challenges that require significant financial resources to address. With a high poverty rate and aging infrastructure, the city needs to invest heavily in education, public safety, and essential services. This necessitates a higher tax rate to generate the necessary revenue.

Another contributing factor is the city’s extensive reliance on property taxes. Baltimore City primarily funds its operations through property taxes, which puts a disproportionate burden on homeowners and businesses. The lack of other revenue sources, such as a local income tax or sales tax, further exacerbates this issue.

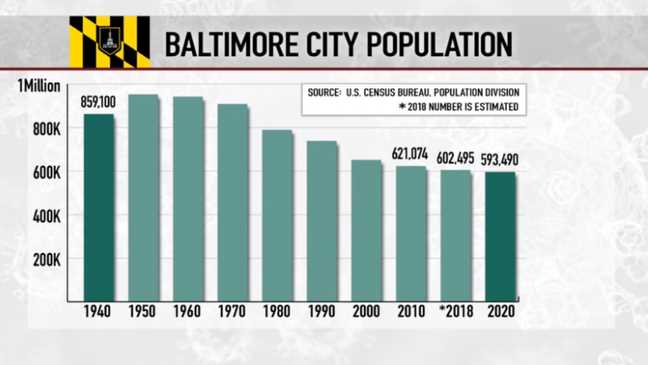

Furthermore, Baltimore City’s tax base is relatively small compared to other major cities. The population has been declining for decades, resulting in a smaller tax base to support the city’s budget. With fewer taxpayers contributing, the burden on each individual or business increases.

In addition to these factors, the city also faces challenges with tax delinquency. Many property owners in Baltimore City are behind on their taxes or fail to pay them altogether. This places an additional burden on those who do pay their taxes, as the city needs to make up for the lost revenue.

In conclusion, the high taxes in Baltimore City are a result of a combination of factors, including the need for funding essential services, the heavy reliance on property taxes, a small tax base, and tax delinquency issues. Addressing these challenges will require a comprehensive approach that focuses on increasing revenue and reducing the burden on taxpayers.

- High Property Taxes in Baltimore City

- Effects on Homeowners

- Efforts to Address the Issue

- The Impact of High Income Taxes in Baltimore City

- Sales Tax Rates in Baltimore City

- Exploring the Cost of Living in Baltimore City

- Housing Costs in Baltimore City

- Transportation Expenses in Baltimore City

- Taxes in Baltimore City

- Conclusion

- Evaluating the Benefits of High Taxes in Baltimore City

- Potential Solutions to the High Tax Burden in Baltimore City

- 1. Streamlining Government Operations

- 2. Attracting and Retaining Businesses

- 3. Prioritizing Economic Development

- 4. Addressing the Cost of Public Services

- 5. Collaboration with State and Federal Authorities

- Q&A,

- Why are Baltimore City taxes higher than in other cities?

- How are Baltimore City taxes used?

- Are Baltimore City taxes progressive?

- Do Baltimore City taxes provide good value for residents?

- Are there any plans to lower Baltimore City taxes?

- Why are Baltimore City taxes higher than in other cities?

High Property Taxes in Baltimore City

Baltimore City has some of the highest property taxes in the United States. This has long been a point of contention for homeowners in the city, who often struggle to pay their tax bills on time. The high property taxes contribute to the overall high cost of living in Baltimore City, making it difficult for residents to afford other necessary expenses.

There are several factors that contribute to the high property taxes in Baltimore City. One of the main factors is the city’s significant reliance on property taxes as a source of revenue. Property taxes account for a large portion of the city’s budget, and the high tax rates help fund essential services and infrastructure projects.

Another factor is the high property values in certain areas of Baltimore City. Properties in neighborhoods with high property values are subject to higher tax rates, which can significantly increase the amount homeowners have to pay in taxes. This can be particularly burdensome for long-time residents who have seen their property values rise over the years.

The high property taxes in Baltimore City also reflect the challenges the city faces in terms of economic development and population loss. The city’s tax base has been shrinking over the years, as more people have moved out of the city and businesses have closed. This has put additional pressure on the remaining residents and businesses to shoulder the burden of funding city services.

Effects on Homeowners

The high property taxes in Baltimore City have a significant impact on homeowners. Many homeowners struggle to keep up with the tax payments, which can lead to late fees, penalties, and even the potential loss of their homes through tax liens or foreclosure. The high tax burden also limits homeowners’ ability to make improvements to their properties or invest in their neighborhoods.

Efforts to Address the Issue

The city government in Baltimore has recognized the issue of high property taxes and has taken steps to address it. In recent years, there have been efforts to provide tax relief for low-income homeowners and to reassess property values to ensure fairness in the tax system. However, these efforts have been met with mixed results, and the issue of high property taxes remains a significant challenge for the city.

In conclusion, high property taxes in Baltimore City are a result of the city’s reliance on property taxes as a revenue source, high property values in certain areas, and economic challenges faced by the city. The high taxes place a burden on homeowners and limit their ability to invest in their properties and communities. While efforts have been made to address the issue, it remains a significant challenge that the city must continue to tackle.

The Impact of High Income Taxes in Baltimore City

Baltimore City is known for having some of the highest income tax rates in the United States. The impact of these high taxes on individuals and businesses in the city cannot be understated.

For individuals and families, high income taxes in Baltimore City can greatly reduce the amount of money they take home each paycheck. This can make it more difficult for residents to afford their daily expenses, save for the future, or invest in their community. The burden of high income taxes can be particularly challenging for low-income families who are already struggling to make ends meet.

In addition to the impact on individuals, high income taxes in Baltimore City can also have a negative effect on businesses. High tax rates can discourage businesses from locating or expanding in the city, leading to a decrease in job opportunities and economic growth. Small businesses, in particular, may struggle to survive in an environment with high taxes, as they have less room to absorb the additional costs.

Furthermore, high income taxes can contribute to a decrease in disposable income, limiting residents’ ability to support local businesses and contribute to the local economy. This can create a cycle where businesses suffer from reduced customer spending, leading to further economic decline.

It’s important to note that high income taxes in Baltimore City are not the only factor influencing the city’s tax burden. Property taxes, sales taxes, and other fees also contribute to the overall tax burden faced by residents and businesses. However, the impact of high income taxes cannot be ignored.

Efforts to reduce income taxes in Baltimore City have been made in the past, as policymakers recognize the importance of creating a favorable environment for residents and businesses. However, finding a balance between funding necessary public services and alleviating the burden on taxpayers can be a difficult task.

In conclusion, the impact of high income taxes in Baltimore City is significant for both individuals and businesses. It reduces disposable income for residents, limits job opportunities, and can hinder economic growth. Finding a solution to the high tax burden is crucial for the city’s long-term prosperity.

Sales Tax Rates in Baltimore City

Baltimore City imposes a sales tax on various goods and services purchased within its jurisdiction. The sales tax rate in Baltimore City is currently 6% as of [current year]. This means that for every dollar spent on taxable goods or services, an additional 6 cents is collected as sales tax.

The sales tax in Baltimore City applies to a wide range of items, including but not limited to clothing, electronics, furniture, and groceries. However, it’s important to note that certain necessities, such as prescription medication and most types of food, are exempt from the sales tax.

The sales tax revenue collected by Baltimore City plays a crucial role in funding essential public services, such as education, infrastructure maintenance, public safety, and social programs. These funds help support the overall development and well-being of the city and its residents.

It’s worth mentioning that the sales tax rate in Baltimore City is subject to change over time. It is therefore advisable to stay updated on any potential changes in the sales tax rate by referring to official sources, such as the Baltimore City Department of Finance or the Maryland Comptroller’s website.

Understanding the sales tax rates in Baltimore City is important for residents and businesses alike, as it directly impacts the affordability and cost of goods and services within the city. Being aware of these rates can help individuals and businesses make more informed financial decisions and plan their budgets accordingly.

Exploring the Cost of Living in Baltimore City

When considering why Baltimore City taxes are so high, it’s important to examine the overall cost of living in the city. Several factors contribute to the high cost of living in Baltimore City, including housing, transportation, and taxes.

Housing Costs in Baltimore City

Baltimore City has relatively high housing costs compared to other cities in the United States. The median home price in Baltimore City is higher than the national average, making it more expensive to purchase a home in the city.

Rental prices in Baltimore City are also on the higher side. The average rent for a one-bedroom apartment in the city is higher than the national average, which can be a significant factor in the high cost of living. Many residents find it challenging to afford housing on their own, leading to the need for multiple roommates or shared living spaces.

Transportation Expenses in Baltimore City

Transportation costs can also contribute to the high cost of living in Baltimore City. The city’s public transportation system, while extensive, may not always be the most convenient option for all residents. This may force them to rely on private vehicles, which can be expensive due to fuel costs, insurance premiums, and parking fees.

In addition, Baltimore City has one of the highest car insurance rates in the United States, adding to the financial burden of owning a car in the city.

Taxes in Baltimore City

Taxes are a significant factor in the high cost of living in Baltimore City. The city has several taxes that contribute to the overall tax burden on its residents, including property taxes, income taxes, and sales taxes.

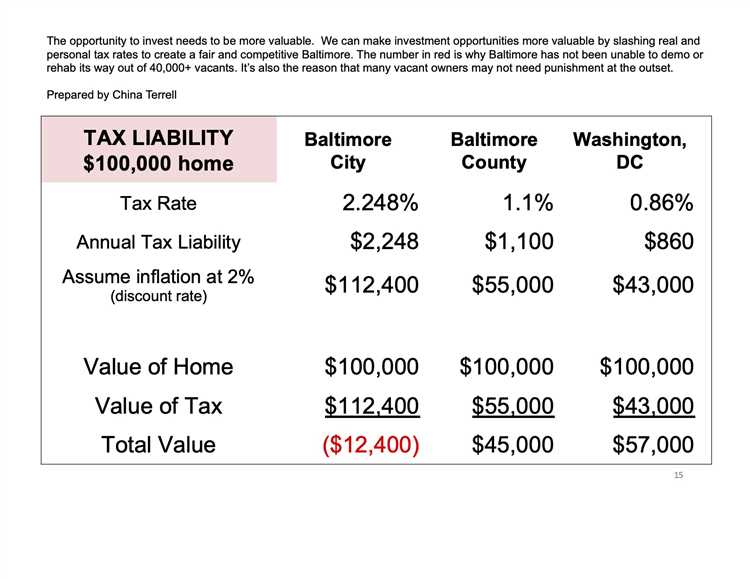

Baltimore City has relatively high property tax rates compared to other jurisdictions in Maryland. These property taxes can be a significant financial burden for homeowners, especially those with higher-valued properties.

The city’s income tax rates are also higher than the state average, further contributing to the overall tax burden for residents. Additionally, sales tax rates in Baltimore City are higher than in some surrounding jurisdictions, impacting the cost of goods and services for residents.

Conclusion

The high cost of living in Baltimore City is influenced by various factors, including housing costs, transportation expenses, and taxes. Understanding these factors is crucial in comprehending why Baltimore City taxes are so high. Residents should carefully consider these costs when deciding whether to live or work in the city.

Evaluating the Benefits of High Taxes in Baltimore City

While it is true that Baltimore City has some of the highest taxes in the country, it is important to evaluate the benefits that these taxes bring to the city and its residents. Although high taxes may initially seem burdensome, they contribute to various services and investments that ultimately improve the quality of life in Baltimore City.

One of the key benefits of high taxes in Baltimore City is the funding of public education. A significant portion of the tax revenue goes towards improving schools, ensuring that students have access to quality education. This investment in education helps to create better opportunities for the city’s youth and sets them up for future success.

Additionally, high taxes contribute to funding public safety initiatives in Baltimore City. The police and fire departments receive essential resources and equipment, which helps to ensure the safety of residents and protect their well-being. With well-funded public safety departments, the city is better equipped to handle emergencies and maintain a secure environment.

Moreover, high taxes support the development and maintenance of Baltimore City’s infrastructure. From roads to public transportation, tax revenue is used to repair and improve essential infrastructure systems. This investment enhances transportation options for residents, facilitates economic growth, and improves the overall livability of the city.

Furthermore, high taxes also support social welfare programs in Baltimore City, such as healthcare and public assistance. These programs provide vital support to vulnerable populations, ensuring that their basic needs are met and helping them to overcome socio-economic barriers.

Lastly, high taxes contribute to the cultural and recreational offerings in Baltimore City. Museums, parks, and community centers receive funding from tax revenue, allowing residents to enjoy a wide range of activities and events. These cultural amenities add to the vibrancy and attractiveness of the city, enhancing the overall quality of life for its residents.

While it is important to carefully evaluate the impact of high taxes on the affordability of living in Baltimore City, it is equally crucial to recognize the positive benefits that these taxes bring. The funding from high taxes supports vital services, infrastructure improvements, and social programs that enhance the overall well-being and livability of Baltimore City.

Potential Solutions to the High Tax Burden in Baltimore City

While the high tax burden in Baltimore City may seem overwhelming, there are several potential solutions that could help alleviate the financial strain on residents and businesses. These solutions aim to address the root causes of the high taxes and promote economic growth and financial stability for the city.

1. Streamlining Government Operations

One potential solution is to streamline government operations and reduce inefficiencies. By eliminating duplicate services and restructuring departments, the city can cut costs and allocate resources more effectively. This could help reduce the need for high taxes to fund excessive bureaucracy.

2. Attracting and Retaining Businesses

Another solution is to actively attract and retain businesses in Baltimore City. By offering tax incentives, creating a business-friendly environment, and improving infrastructure, the city can encourage businesses to invest and thrive. This would not only create job opportunities but also expand the tax base, reducing the burden on individual taxpayers.

3. Prioritizing Economic Development

Prioritizing economic development is crucial in reducing the tax burden. By investing in job training programs, educational initiatives, and infrastructure projects, the city can create a strong foundation for economic growth. This would attract businesses, stimulate job creation, and ultimately generate more revenue for the city.

4. Addressing the Cost of Public Services

The cost of public services in Baltimore City is a significant contributor to the high tax burden. Implementing cost-saving measures, such as more efficient public transportation systems, better waste management strategies, and improved healthcare delivery, could help reduce the overall cost of providing essential services and contribute to a more sustainable tax structure.

5. Collaboration with State and Federal Authorities

Baltimore City could benefit from collaborating with state and federal authorities to address its tax burden. By working together, the city can explore opportunities for revenue sharing, seek additional funding sources, and advocate for policies that promote economic growth and financial stability.

Implementing these potential solutions requires careful planning, collaboration, and a long-term vision for Baltimore City. By addressing the underlying issues contributing to the high tax burden, the city can create a more equitable and sustainable tax system that benefits residents and businesses alike.

Q&A,

Why are Baltimore City taxes higher than in other cities?

Baltimore City taxes are higher than in other cities primarily due to the city’s budgetary needs and financial challenges. The city has a high rate of poverty, high crime rates, and aging infrastructure which require significant investments. Additionally, the city has a history of mismanagement and corruption that has contributed to its financial woes.

How are Baltimore City taxes used?

Baltimore City taxes are used to fund various city services and programs, such as education, public safety, sanitation, transportation, and maintaining public infrastructure. The revenue from taxes also goes towards paying city employees’ salaries and benefits.

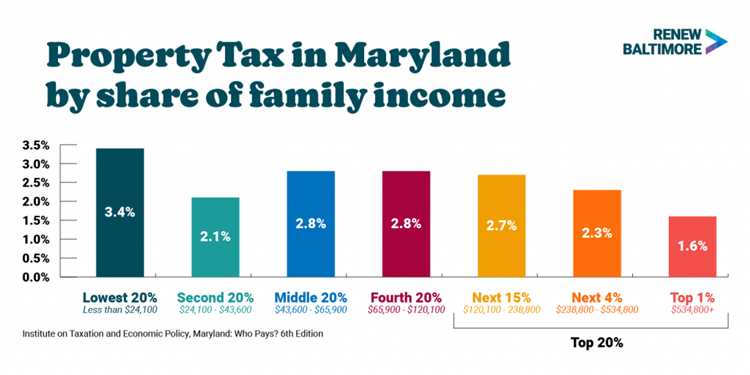

Are Baltimore City taxes progressive?

Baltimore City taxes are not considered highly progressive compared to some other cities. The city primarily relies on property taxes and income taxes, which are based on a flat rate. This means that individuals with higher incomes do not pay a significantly higher percentage of their income in taxes compared to lower-income individuals.

Do Baltimore City taxes provide good value for residents?

The value of Baltimore City taxes can vary depending on individual perspectives and experiences. Some residents may feel that they receive good value for their tax dollars, considering the services and infrastructure provided by the city. However, others may argue that the high taxes do not correspond to the quality of services and the overall condition of the city.

Are there any plans to lower Baltimore City taxes?

There have been discussions and debates about lowering Baltimore City taxes in order to attract businesses and residents. However, implementing tax reductions can be challenging due to the city’s financial constraints and the need for revenue to address pressing issues such as poverty, crime, and infrastructure improvements. Any potential tax reductions would require careful financial planning and consideration of its impact on the city’s overall budget.

Why are Baltimore City taxes higher than in other cities?

Baltimore City taxes may appear higher than in other cities due to a variety of factors. One reason is that Baltimore’s tax base is largely dependent on property taxes, which can be significant. Additionally, Baltimore faces challenges such as a high poverty rate, a declining population, and a high crime rate, which can impact the city’s tax revenue collection. These factors may contribute to the need for higher taxes to fund essential services and address the city’s unique challenges.