Taxes are a fundamental aspect of any economy, and the United States is no exception. As one of the largest economies in the world, the US relies on tax revenue to fund various government programs and services. However, not all taxpayers contribute equally to the nation’s tax burden. In fact, there is a group of individuals and entities that stand out as the highest taxpayers in the country.

When it comes to the highest taxpayers in the USA, it’s important to differentiate between individual taxpayers and corporate entities. While both contribute significantly to the nation’s tax revenue, individuals often bear the brunt of the tax burden. This is due to progressive taxation, where the tax rate increases as income increases. High-income earners, such as CEOs, entrepreneurs, and professionals in lucrative fields, find themselves in the highest tax brackets.

Individual taxpayers in the highest tax brackets often face a hefty tax bill. The progressive tax system ensures that those who earn more contribute a higher percentage of their income in taxes. This means that the top earners in the US pay a substantial amount of their income to the federal government. To put it into perspective, this group of taxpayers, which represents a small portion of the overall population, contributes a significant portion of the total tax revenue collected in the country.

- Understanding the Tax System in the USA

- Types of Taxes

- Tax Brackets and Rates

- Tax Deductions and Credits

- The Role of the Internal Revenue Service (IRS)

- Who Are the Highest Taxpayers in the USA?

- 1. High-Income Earners

- 2. Business Owners

- Breaking Down the Tax Contributions

- Factors Influencing Tax Payments

- 1. Income Level

- 2. Deductions and Credits

- Question-answer:

- Who are the highest taxpayers in the USA?

- How much taxes do the highest taxpayers pay?

- What are the reasons behind the highest taxpayers paying more taxes?

- Do the highest taxpayers get any benefits or exemptions?

- Are there any changes regarding the tax rates for the highest taxpayers?

Understanding the Tax System in the USA

The tax system in the United States is a complex and multifaceted structure that plays a critical role in funding the government’s operations. It is designed to collect revenue from various sources, including individuals, businesses, and investments. Understanding how the tax system works can help individuals and businesses navigate their tax obligations more effectively.

Types of Taxes

In the United States, there are several types of taxes that individuals and businesses may be required to pay. Some of the most common types of federal taxes include:

- Income Tax: This is the tax imposed on individuals and businesses based on their income.

- Corporate Tax: This is the tax levied on the profits of corporations.

- Payroll Tax: This tax is deducted from employees’ wages to fund programs such as Social Security and Medicare.

- Capital Gains Tax: This tax is imposed on the profits earned from the sale of capital assets, such as stocks or real estate.

Tax Brackets and Rates

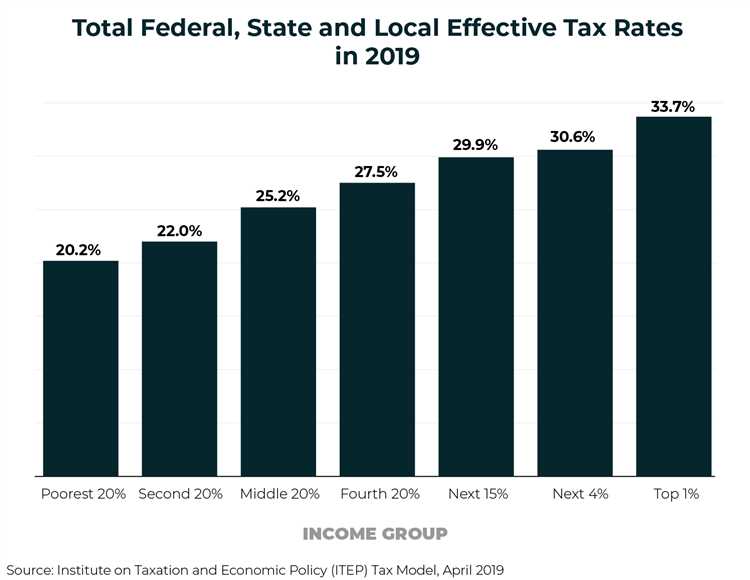

The United States uses a progressive tax system, which means that individuals and businesses are taxed at different rates depending on their income or profits. The tax rates are divided into several brackets, with higher-income individuals and businesses generally subjected to higher tax rates. The tax brackets and rates are periodically adjusted by the government to account for changes in the economy.

Tax Deductions and Credits

The tax system in the United States allows individuals and businesses to take advantage of various deductions and credits to reduce their tax liability. Deductions are expenses that can be subtracted from their taxable income, while credits directly reduce the amount of tax owed. Common deductions and credits include those for mortgage interest, charitable contributions, and educational expenses.

The Role of the Internal Revenue Service (IRS)

The Internal Revenue Service (IRS) is the government agency responsible for administering and enforcing the tax laws in the United States. It collects taxes from individuals and businesses through the tax return filing process and conducts audits to ensure compliance with tax laws. The IRS also provides resources and guidelines to help individuals and businesses understand and fulfill their tax obligations.

| Tax Type | Description |

|---|---|

| Income Tax | Tax imposed on individuals and businesses based on their income. |

| Corporate Tax | Tax levied on the profits of corporations. |

| Payroll Tax | Tax deducted from employees’ wages to fund programs such as Social Security and Medicare. |

| Capital Gains Tax | Tax imposed on the profits earned from the sale of capital assets, such as stocks or real estate. |

Who Are the Highest Taxpayers in the USA?

When it comes to paying taxes, there are certain individuals and groups in the United States who contribute more than others. These highest taxpayers play a significant role in funding the government and various public services. Let’s take a closer look at who they are:

1. High-Income Earners

High-income earners, such as CEOs, executives, and professional athletes, are often among the highest taxpayers in the USA. These individuals earn substantial salaries and bonuses, which can push them into higher tax brackets. As a result, these individuals contribute a significant portion of their income to federal and state taxes.

2. Business Owners

Business owners, especially those with successful companies and large profits, are also among the highest taxpayers in the USA. Whether they operate as sole proprietors, partnerships, or corporations, business owners are responsible for paying taxes on their income, as well as various business-related taxes such as property and payroll taxes. Their contributions are vital for funding the government’s operations and programs.

It’s important to note that while high-income earners and business owners make up a significant portion of the highest taxpayers in the USA, there are also other groups that contribute significantly, including high-earning professionals like doctors and lawyers, investors, and even some celebrities.

Overall, the highest taxpayers in the USA are individuals and groups who earn substantial incomes or run successful businesses. Their contributions play a crucial role in supporting the government and the country’s infrastructure and services.

Breaking Down the Tax Contributions

Understanding who pays the most taxes in the United States requires a deeper analysis of the different income brackets and their contributions. While it is well-known that higher-income individuals tend to pay more in taxes, breaking down the tax contributions reveals interesting insights into the distribution of tax burdens.

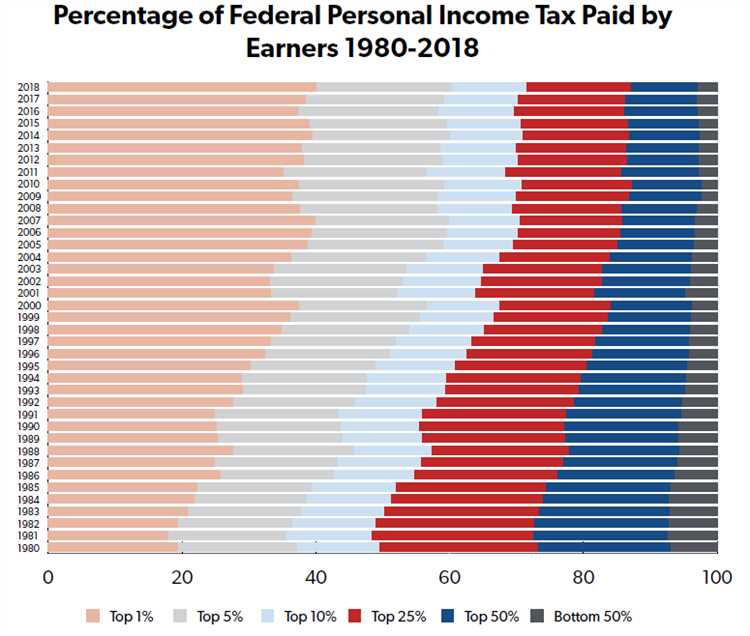

One important aspect to consider is the progressive nature of the U.S. tax system. This means that as income increases, the tax rate also increases. As a result, the top earners in the country contribute a significant portion of the total tax revenue.

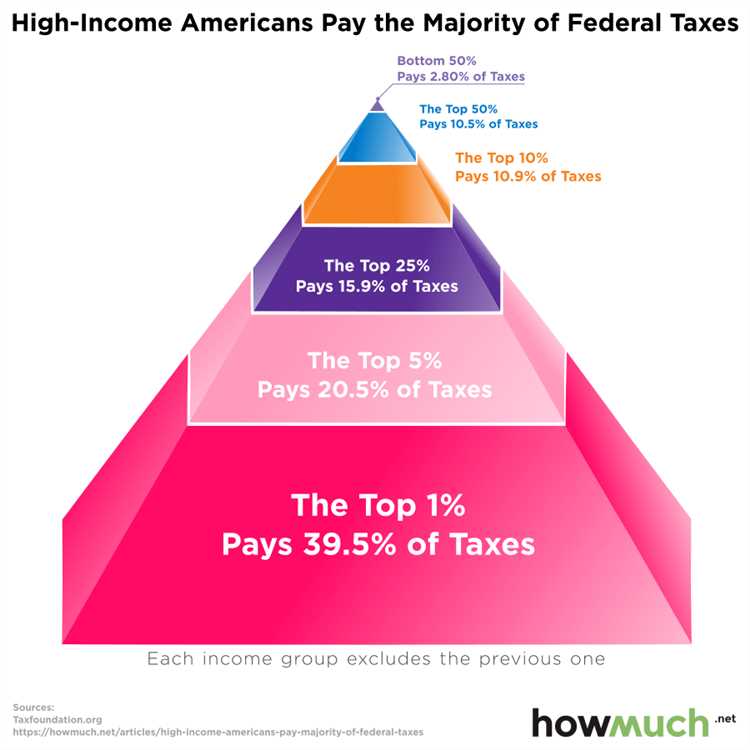

Income tax is one of the main sources of revenue for the federal government. The top 1% of taxpayers, who have an average income of over $500,000, contribute approximately 40% of the total income tax collected. This demonstrates the significant impact that high-income individuals have on the country’s tax revenue.

However, it’s not just the top 1% that shoulder a significant tax burden. The top 10% of taxpayers, with an average income of around $150,000, contribute about 71% of the total income tax revenue. This showcases the importance of the top earners in funding government programs and services.

On the other hand, lower-income individuals may pay little to no federal income tax, due to deductions, credits, and exemptions. The bottom 50% of taxpayers, with an average income of around $40,000, contribute only about 3% of the total income tax revenue.

It’s worth noting that income tax is just one component of the overall tax structure in the United States. Other taxes, such as payroll taxes and sales taxes, also contribute to the total tax revenue. However, breaking down the income tax contributions provides valuable insights into the progressive nature of the tax system and the contributions of different income brackets.

In conclusion, breaking down the tax contributions in the United States reveals the significant role played by the top earners in funding the country’s government programs and services. Understanding the distribution of tax burdens can help inform discussions on tax policies and the overall fairness of the tax system.

Factors Influencing Tax Payments

Several factors influence the amount of taxes paid by individuals and businesses in the United States. These factors can vary widely and can have a significant impact on the tax liability of taxpayers. Understanding these factors is crucial for both individuals and businesses to plan and manage their tax payments effectively.

1. Income Level

One of the most significant factors affecting tax payments is the income level of the taxpayer. Higher-income individuals and businesses generally pay more in taxes compared to those with lower incomes. This is because the U.S. tax system operates on a progressive tax model, where tax rates increase with higher levels of income.

2. Deductions and Credits

Deductions and credits play a crucial role in determining a taxpayer’s final tax liability. Deductions are amounts that taxpayers can subtract from their taxable income, while credits are direct reductions of the tax owed. Taxpayers who take advantage of available deductions and credits can significantly lower their tax payments.

| Types of Deductions and Credits | Description |

|---|---|

| Standard Deduction | A fixed amount that reduces taxable income based on filing status. |

| Itemized Deductions | Specific expenses that can be deducted, such as mortgage interest, state and local taxes, and medical expenses. |

| Tax Credits | Direct reductions of the tax owed, such as the Child Tax Credit and the Earned Income Tax Credit. |

Taxpayers should consult with a tax professional to determine which deductions and credits they qualify for and how to take advantage of them.

Question-answer:

Who are the highest taxpayers in the USA?

The highest taxpayers in the USA are typically wealthy individuals who earn a significant amount of income.

How much taxes do the highest taxpayers pay?

The highest taxpayers in the USA pay a significant amount of taxes, as they are in higher tax brackets. The exact amount can vary depending on their income and the current tax laws.

What are the reasons behind the highest taxpayers paying more taxes?

The highest taxpayers pay more taxes due to the progressive tax system in the USA, which means that tax rates increase as income levels rise. This system aims to ensure a more equitable distribution of the tax burden.

Do the highest taxpayers get any benefits or exemptions?

The highest taxpayers may have access to certain deductions and exemptions that can lower their overall tax liability. However, these are subject to specific rules and limitations set by the IRS.

Are there any changes regarding the tax rates for the highest taxpayers?

Tax rates for the highest taxpayers can change over time, as they are influenced by changes in tax laws and policies. It is important for individuals in this category to stay updated with the latest tax regulations.