When it comes to taxes, it’s no secret that the United States has a complex and varied system. Taxes can vary greatly from state to state, but what about taxes at the county level? Which county in the US has the highest tax burden?

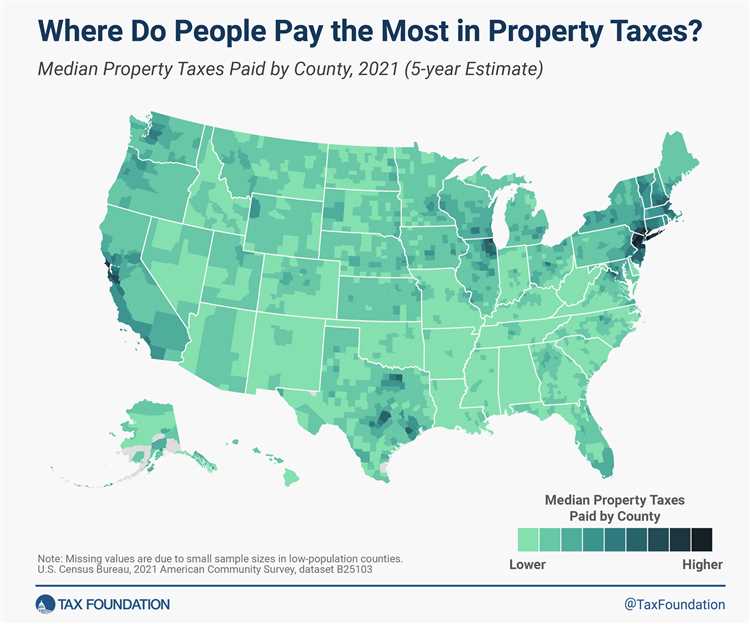

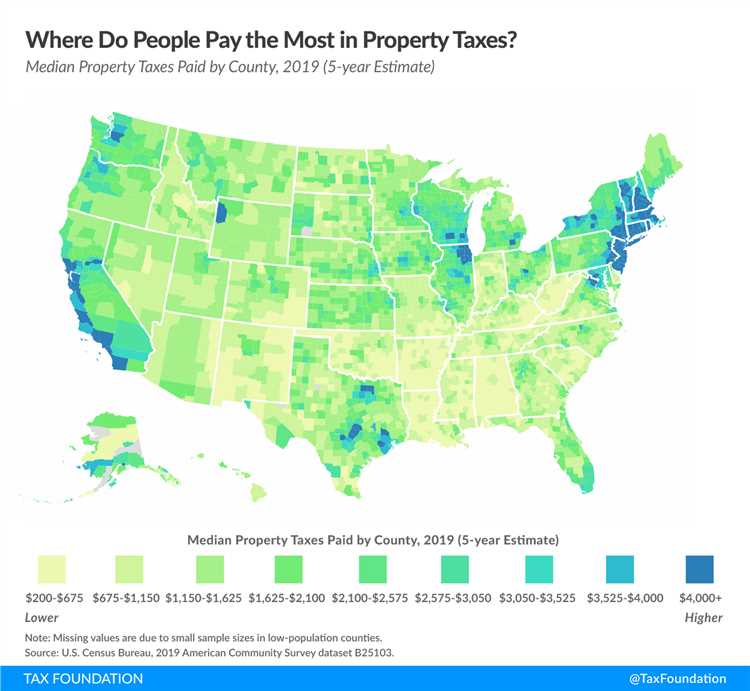

The answer may surprise you. According to a recent study, Westchester County in New York has the highest property taxes of any county in the US. Homeowners in Westchester County can expect to pay an average of $17,179 in property taxes each year.

So, what makes Westchester County’s taxes so high? One reason is its close proximity to New York City. Being just a short commute away from the Big Apple, many residents are willing to pay a premium for the convenience and amenities the county offers. Additionally, Westchester County is known for its excellent schools and well-maintained infrastructure, which can drive up property values and, in turn, property taxes.

It’s worth noting that while Westchester County has the highest property taxes, it may not have the highest overall tax burden. Other factors, such as income and sales taxes, can also significantly impact a county’s total tax burden. However, when it comes to property taxes specifically, Westchester County takes the top spot.

- Top 6 US Counties With the Highest Taxes

- 1. Westchester County, New York

- 2. Bergen County, New Jersey

- 3. Nassau County, New York

- 4. Rockland County, New York

- 5. Essex County, New Jersey

- 6. Fairfield County, Connecticut

- Westchester County, New York

- Nassau County, New York

- Tax Rates

- Property Taxes

- Income Taxes

- Sales Taxes

- Bergen County, New Jersey

- Fairfield County, Connecticut

- Marin County, California

- Tax Rates

- Reasons for High Taxes

- Alexandria City, Virginia

- Tax Rates in Alexandria City

- Public Services and Infrastructure

- Q&A,

- Which county in the US has the highest taxes?

- What factors contribute to high taxes in Westchester County?

- Are there any other counties in New York with high taxes?

- How do the taxes in Westchester County compare to the national average?

- What are some of the consequences of high taxes in Westchester County?

- Which county in the US has the highest taxes?

Top 6 US Counties With the Highest Taxes

When it comes to taxes, we often hear about the different tax rates that exist in various US counties. It’s interesting to explore which counties have the highest taxes and how these taxes may impact the residents.

1. Westchester County, New York

Located just north of New York City, Westchester County has the highest taxes in the United States. The combination of high property taxes, income taxes, and sales taxes contributes to this distinction. Residents of this county may find themselves paying a significant portion of their income in taxes.

2. Bergen County, New Jersey

Bergen County is another county known for its high taxes. With a high property tax rate and income tax rate, residents here are also burdened with higher tax bills. The area’s proximity to New York City and its thriving economy may contribute to the higher tax rates.

3. Nassau County, New York

Nassau County, also located in New York, is another county with high taxes. The combination of high property taxes and income taxes makes this county one of the most expensive places to live in terms of taxation. Homeowners often face substantial tax bills that can be a financial strain.

4. Rockland County, New York

Rockland County, situated in the southern part of New York State, is known for its high taxes as well. Residents here pay high property taxes, income taxes, and sales taxes. The county’s close proximity to New York City may also be a contributing factor to the higher tax rates.

5. Essex County, New Jersey

Essex County is another county in New Jersey that ranks high in terms of taxes. High property taxes and income taxes are common in this area. The county’s location near major cities like New York City and Newark may also drive the tax rates up.

6. Fairfield County, Connecticut

Located in southwestern Connecticut, Fairfield County is known for its high taxes. The county has a high property tax rate and income tax rate, making it one of the costliest places to live in terms of taxation. The region’s proximity to New York City and its affluent population may impact the tax rates.

In conclusion, these six US counties have the highest taxes in the country. Residents of these counties often face hefty tax bills due to high property taxes, income taxes, and sales taxes. The proximity to major cities and thriving economies may contribute to the higher tax rates. It’s important for individuals living in these areas to plan their finances accordingly to accommodate these higher tax burdens.

Westchester County, New York

Westchester County, located in the state of New York, is known for having some of the highest property taxes in the United States.

The county is home to affluent communities, including Scarsdale, Chappaqua, and Bronxville, where property values are high. As a result, homeowners in Westchester County often face significant tax bills.

One of the reasons for high taxes in Westchester County is its extensive public school system, which is funded by property taxes. This means that homeowners bear a large portion of the burden when it comes to funding education in the county.

Furthermore, Westchester County offers various municipal services, including police and fire departments, which are funded through property taxes as well. These services contribute to the overall high tax rates in the county.

It’s important to note that tax rates can vary within Westchester County, with some municipalities having higher rates than others. However, overall, Westchester County consistently ranks among the highest in terms of property taxes in the United States.

Despite the high taxes, Westchester County also offers many amenities and advantages to its residents. The county boasts a beautiful suburban landscape, proximity to New York City, and excellent schools and universities.

While the high taxes may be a drawback for some, many residents of Westchester County believe the benefits outweigh the financial cost.

Nassau County, New York

Nassau County, located in the state of New York, is known for having some of the highest taxes in the United States.

Tax Rates

The high tax rates in Nassau County can be attributed to various factors, including the cost of living, property values, and local government expenses. Property taxes, income taxes, and sales taxes are among the highest in the country.

Property Taxes

Property taxes in Nassau County are known to be particularly high. The county’s property tax rates are determined by local assessment authorities and can vary depending on the location and value of the property. Homeowners in Nassau County often face high property tax bills, which can be a significant financial burden.

Income Taxes

In addition to high property taxes, Nassau County residents also experience high income tax rates. The state of New York has a progressive income tax system, with higher earners paying a higher percentage of their income in taxes. This can further contribute to the overall tax burden for residents of Nassau County.

Sales Taxes

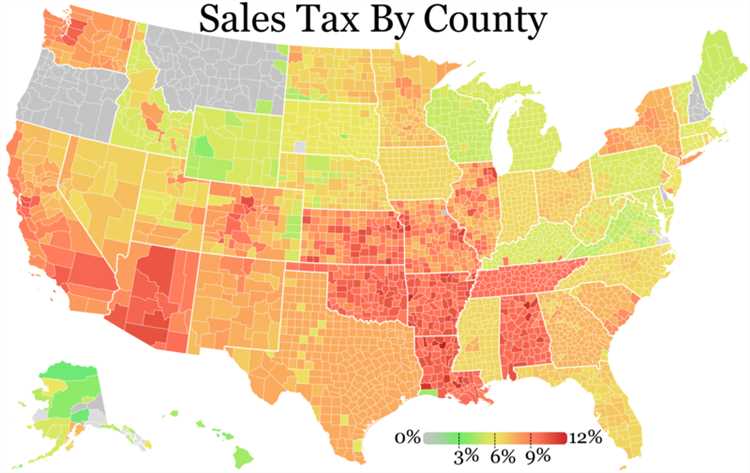

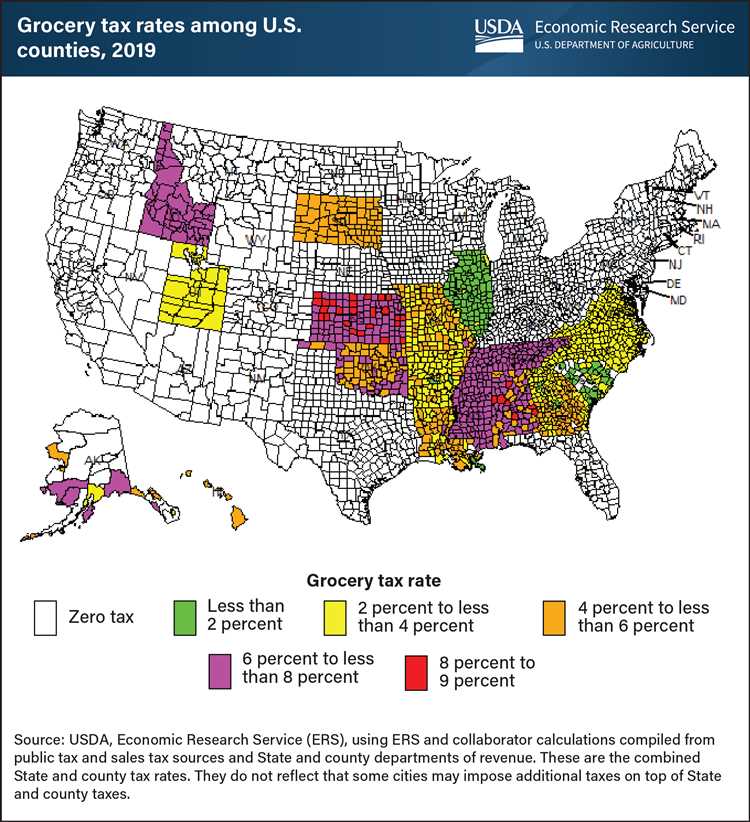

The sales tax rate in Nassau County is comparable to the rest of New York state. However, the combined state and local sales tax rate can still be considered high compared to other states. This means that residents of Nassau County pay more in taxes when purchasing goods and services.

Overall, Nassau County, New York, stands out as one of the US counties with the highest taxes. The combination of high property taxes, income taxes, and sales taxes can make it a challenging place to live financially.

Bergen County, New Jersey

Bergen County, located in the state of New Jersey, is known for having some of the highest taxes in the United States. The county has a large population and a high cost of living, which contributes to the overall tax burden for its residents.

One of the main reasons for the high taxes in Bergen County is the cost of public services. The county has a well-funded school system, which requires a significant amount of funding. Additionally, the county provides a wide range of public services, such as transportation infrastructure, police and fire departments, and healthcare facilities.

Another factor contributing to the high taxes in Bergen County is the high property values. The county has a strong real estate market, with many expensive homes and commercial properties. As a result, property taxes are relatively high, as they are based on the assessed value of the property.

In addition to property taxes, residents of Bergen County also face high income taxes. New Jersey has a progressive income tax system, meaning that higher earners are subject to higher tax rates. This can contribute to the overall tax burden for residents of the county.

Despite the high taxes, Bergen County offers its residents a high quality of life. The county has a strong economy, with a wide range of job opportunities and amenities. Additionally, the county is located near New York City, providing easy access to cultural and recreational activities.

Overall, while Bergen County may have some of the highest taxes in the United States, it also offers its residents many benefits in terms of public services and quality of life.

Fairfield County, Connecticut

Fairfield County is located in the state of Connecticut and is known for having some of the highest property taxes in the United States. It is home to many affluent towns such as Greenwich, Westport, and Darien, which contribute to the high tax rates in the county.

The average effective property tax rate in Fairfield County is around 2.18%, which means that homeowners typically pay about 2.18% of their home’s value in property taxes each year. This rate is significantly higher than the national average of 1.07%.

In addition to high property taxes, Fairfield County also has a high sales tax rate. The state of Connecticut has a sales tax rate of 6.35%, and some municipalities within Fairfield County have additional local sales taxes, making the overall sales tax rate in the county even higher.

One factor that contributes to the high taxes in Fairfield County is the cost of living. The cost of housing, transportation, and other goods and services in the county is generally higher than the national average, which leads to higher tax rates to fund the local government.

Despite the high taxes, Fairfield County offers various amenities and services to its residents. The county has excellent schools, high-quality healthcare facilities, and many recreational opportunities. It is also close to New York City, making it an attractive place to live for those who work in the city.

Overall, Fairfield County, Connecticut has some of the highest taxes in the United States, primarily due to its high property tax rates and the cost of living in the county.

Marin County, California

Marin County, located in California, is known for having some of the highest taxes in the United States. The county is located just north of San Francisco and is known for its affluent residents and picturesque scenery.

Tax Rates

Marin County has a high property tax rate compared to the national average. Property taxes are calculated based on the assessed value of the property, and the rate in Marin County is one of the highest in the state of California.

In addition to property taxes, Marin County also has a high sales tax rate. The sales tax rate in the county is among the highest in California, which can make everyday purchases more expensive for residents and visitors alike.

Reasons for High Taxes

There are several reasons why Marin County has such high taxes. One reason is the high cost of living in the area. The county is home to many wealthy individuals who drive up property values and demand higher-quality services.

Another reason is the county’s commitment to providing excellent public services. Marin County is known for its high-quality schools, health services, and infrastructure. These services require funding, which is often provided through taxes.

The county also has a strong focus on environmental initiatives and sustainability. These efforts require funding for conservation and renewable energy projects, which can contribute to the higher taxes in the area.

While the high taxes in Marin County may be a burden for some, they also contribute to the high quality of life in the area. The county is known for its beautiful landscapes, excellent schools, and robust public services, all of which are made possible by the tax revenue generated.

Alexandria City, Virginia

Alexandria City, located in Virginia, is known for having some of the highest taxes in the United States. With a median household income of $90,256, the county has a median property tax of $5,687, making it one of the top counties in terms of high tax rates.

Tax Rates in Alexandria City

The tax rates in Alexandria City are primarily determined by the local government, which includes the City Council and the Mayor’s Office. These rates are used to fund various public services and infrastructure projects in the county.

In addition to property taxes, residents of Alexandria City also pay income taxes. The county has a progressive income tax system, meaning that the tax rates increase with higher income levels. This ensures that residents with higher incomes pay a higher percentage of their income in taxes compared to those with lower incomes.

Public Services and Infrastructure

The tax revenue collected in Alexandria City is used to fund a variety of public services and infrastructure projects. These include public schools, law enforcement, fire protection, road maintenance, and parks and recreation facilities.

| Public Service or Infrastructure | Funding |

|---|---|

| Public Schools | 40% |

| Law Enforcement | 25% |

| Fire Protection | 15% |

| Road Maintenance | 10% |

| Parks and Recreation Facilities | 10% |

These services and infrastructure projects are crucial for ensuring the well-being and quality of life for residents of Alexandria City. Although the tax rates may be high, they contribute to the overall development and maintenance of the county.

Q&A,

Which county in the US has the highest taxes?

The county with the highest taxes in the US is Westchester County, New York.

What factors contribute to high taxes in Westchester County?

Several factors contribute to high taxes in Westchester County, including expensive real estate prices, high local government spending, and generous social services.

Are there any other counties in New York with high taxes?

Yes, apart from Westchester County, Nassau County and Rockland County in New York also have high taxes.

How do the taxes in Westchester County compare to the national average?

The taxes in Westchester County are significantly higher than the national average. The average property tax rate in Westchester County is approximately 2.53%, compared to the national average of 1.07%.

What are some of the consequences of high taxes in Westchester County?

Some of the consequences of high taxes in Westchester County include a higher cost of living, difficulties for small businesses, and potential migration of residents to lower-tax areas.

Which county in the US has the highest taxes?

As of 2021, the county in the US with the highest taxes is Westchester County, located in the state of New York.