Chicago, the bustling city on Lake Michigan, is known for its vibrant culture, stunning architecture, and deep-dish pizza. However, like any other city, it also has its fair share of taxes. Whether you’re a resident or a visitor, it’s essential to understand the various taxes you may encounter during your time in the Windy City.

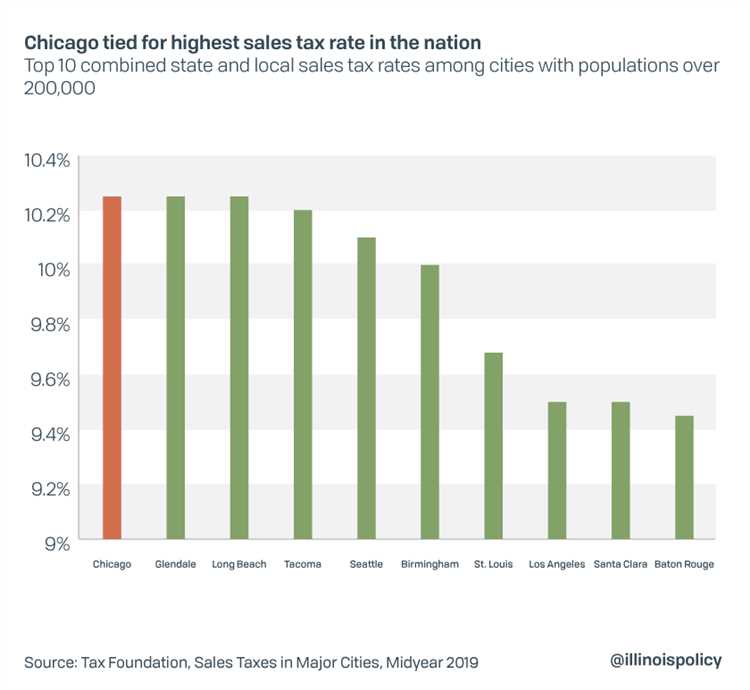

One of the most significant taxes in Chicago is the sales tax. Currently, the combined sales tax rate in Chicago is one of the highest in the United States, reaching a staggering 10.25%. This tax is applied to most goods and services purchased within the city, including clothing, electronics, dining out, and entertainment.

In addition to the sales tax, residents and non-residents alike are subject to income taxes in Chicago. Illinois, the state in which Chicago is located, imposes a flat income tax rate of 4.95%. This means that regardless of your income level, you’ll be paying the same percentage of your earnings to the state.

If you own property in Chicago, you’ll also be responsible for property taxes. The amount you pay is determined by the assessed value of your property and the local tax rate. Property tax rates in Chicago can vary significantly depending on the specific neighborhood and district in which your property is located.

While these are some of the primary taxes in Chicago, it’s worth noting that the city may also impose additional taxes on specific goods or services. For example, there are taxes on gasoline, cigarettes, and alcoholic beverages. Additionally, there are hotel taxes for those staying in accommodations within the city’s limits.

Understanding the taxation landscape in Chicago is crucial for both residents and visitors. By knowing what taxes to expect, you can better plan your budget and avoid any surprises when it comes time to settle your financial obligations.

In this guide, we’ll delve deeper into the various taxes in Chicago, providing you with a comprehensive overview of what is taxed in the city. Whether you’re looking to relocate to Chicago or plan an extended stay, this guide will equip you with the knowledge you need to navigate the tax system successfully.

- Overview of Taxes in Chicago

- Sales Tax in Chicago

- Property Tax in Chicago

- Assessment Process

- Calculation of Property Taxes

- Exemptions and Rebates

- Paying Property Taxes

- Income Tax in Chicago

- State Income Tax

- Local Income Tax

- Question-answer:

- What is the sales tax rate in Chicago?

- Is there an income tax in Chicago?

- What is the property tax rate in Chicago?

- Are there any additional taxes or fees in Chicago?

- Are there any tax credits or exemptions available for residents of Chicago?

- What is the sales tax rate in Chicago?

- Do I have to pay an income tax in Chicago?

Overview of Taxes in Chicago

When it comes to taxes, Chicago residents and businesses have many obligations to fulfill. The city imposes a variety of taxes to fund government services and programs. Understanding these taxes is essential to avoid any legal issues and make informed financial decisions.

One of the primary taxes in Chicago is the sales tax. The city has one of the highest combined sales tax rates in the United States, with a local rate of 1.25% in addition to the state rate. This tax is levied on most goods and services, including groceries, clothing, electronics, and dining out.

In addition to the sales tax, Chicago also imposes a separate tax on specific items, such as bottled water, soda, and tobacco products. This additional tax is known as the “soda tax” or “pop tax” and is designed to discourage the consumption of unhealthy goods.

Property owners in Chicago are subject to property taxes, which are used to fund local schools, parks, and other public services. The rate of property tax varies depending on the assessed value of the property. It’s important for homeowners to stay updated on any changes in these rates to plan their budgets accordingly.

Businesses in Chicago are subject to various taxes as well. The city imposes a business license tax, which is required for most businesses to operate legally. Additionally, businesses may be subject to taxes such as a personal property lease transaction tax, a Chicago employer expense tax, and a ground transportation tax for rideshare services.

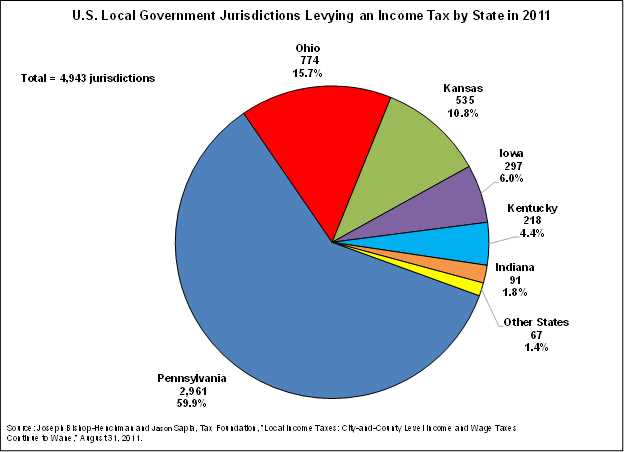

Finally, Chicago residents are also responsible for paying income taxes. The city has its own income tax rate in addition to the state income tax. Individuals who live or work in Chicago are required to file income tax returns and pay the appropriate amount based on their income.

Overall, Chicago has a complex tax structure that affects residents and businesses in various ways. Staying informed and understanding these taxes is crucial for ensuring compliance and managing finances effectively in the city.

Sales Tax in Chicago

Sales tax in Chicago is assessed on most retail sales of goods and services. The current sales tax rate in Chicago is 10.25%. This rate includes the state sales tax rate of 6.25%, the Chicago city sales tax rate of 1.25%, and additional local sales tax rates.

The additional local sales tax rates vary depending on the location within Chicago. For example, certain areas within the city may have additional special taxing districts that impose additional sales taxes. It is important to be aware of the specific sales tax rates that apply in your particular area.

It is worth noting that certain items are exempt from sales tax in Chicago. Some of these exempt items include prescription drugs, groceries, and some medical and professional services. Additionally, certain transactions may be subject to a reduced sales tax rate, such as the sale of qualifying food and beverages sold by qualified grocery retailers.

When making a purchase in Chicago, it is important to keep in mind that the sales tax rate will be added to the purchase price at the time of sale. This means that the total amount paid for a purchase will be higher than the listed price due to the inclusion of sales tax.

| Tax Type | Tax Rate |

|---|---|

| State Sales Tax | 6.25% |

| Chicago City Sales Tax | 1.25% |

| Additional Local Sales Tax | Varies |

Overall, understanding the sales tax rate in Chicago is important for both residents and visitors to the city. By being aware of the applicable sales tax rate, individuals can better budget and plan for their purchases in order to avoid any surprises at the time of sale.

Property Tax in Chicago

Property tax is a significant source of revenue for the city of Chicago. It is a tax on the value of real estate properties, including residential, commercial, and industrial properties. Property tax rates in Chicago are among the highest in the nation, making it important for property owners to understand how the tax system works.

Assessment Process

Property taxes in Chicago are based on an assessment process that determines the value of the property. The Cook County Assessor’s Office is responsible for assessing the value of all properties in Chicago. Assessments are conducted every three years, and the assessed value is used to calculate property taxes.

The assessment process takes into account factors such as the property’s location, size, age, and condition. Property owners have the right to appeal their assessment if they believe it is incorrect.

Calculation of Property Taxes

Property taxes in Chicago are calculated using the assessed value of the property and the tax rate. The tax rate is determined by various taxing authorities, including the City of Chicago, Cook County, and various school districts, among others.

To calculate property taxes, the assessed value is multiplied by the tax rate. Property owners can view their property’s assessed value and tax bill information on the Cook County Assessor’s Office website.

Exemptions and Rebates

There are several exemptions and rebates available to property owners in Chicago that can help reduce their property tax burden. Some common exemptions include the homeowner exemption, senior citizen exemption, and the disabled person exemption.

It is important for property owners to check their eligibility for these exemptions and apply for them if qualified. Additionally, there are rebates available for low-income homeowners and properties with green initiatives, such as energy-efficient improvements.

Paying Property Taxes

Property taxes in Chicago are billed twice a year, with the first installment due on March 1st and the second installment due on August 1st. Property owners can choose to pay their taxes in one lump sum or in installments.

Failure to pay property taxes can result in penalties, interest, and even the loss of the property through a tax sale. It is important for property owners to stay up-to-date with their tax payments to avoid any issues.

Overall, property tax in Chicago is an important consideration for property owners. Understanding the assessment process, exemptions, and payment deadlines can help ensure a smooth property tax experience.

Income Tax in Chicago

One of the taxes that residents of Chicago need to be aware of is the income tax. In Chicago, there are two levels of income tax: the state income tax and the local income tax. Both of these taxes are based on your income and are deducted from your paycheck.

State Income Tax

The state income tax in Illinois is a flat rate of 4.95%. This tax is applied to all income earned by residents of Chicago, regardless of how much they earn. The state income tax is withheld from your paycheck by your employer, and you do not need to file a separate state income tax return if you are an employee.

If you are self-employed or have other sources of income, you may need to file a separate state income tax return and pay any additional taxes owed. It is important to keep accurate records of your income and expenses when filing your state income tax return.

Local Income Tax

In addition to the state income tax, residents of Chicago also need to pay a local income tax. The local income tax rate in Chicago is 1.25%. This tax is based on your Illinois taxable income, which is your federal adjusted gross income minus any deductions or exemptions allowed by the state.

Unlike the state income tax, the local income tax is not withheld from your paycheck by your employer. Instead, you are responsible for calculating and paying the local income tax when you file your state income tax return. It is important to accurately calculate your local income tax liability to avoid any penalties or interest.

It is worth noting that some income, such as Social Security benefits and retirement income, may be exempt from the local income tax. It is recommended to consult with a tax professional or review the Illinois Department of Revenue’s guidelines to understand any exemptions or deductions that may apply to you.

Understanding and properly managing your income tax obligations in Chicago is important to ensure compliance with the law and avoid any penalties or interest. Keeping accurate records, staying informed about any changes to tax laws, and seeking professional tax advice when needed can help you navigate the complexities of income tax in Chicago.

Question-answer:

What is the sales tax rate in Chicago?

The sales tax rate in Chicago is currently 10.25%.

Is there an income tax in Chicago?

No, there is no separate income tax in Chicago. However, residents of Chicago are still subject to the Illinois state income tax.

What is the property tax rate in Chicago?

The property tax rate in Chicago varies depending on the neighborhood, but it is typically around 2-3% of the property’s assessed value.

Are there any additional taxes or fees in Chicago?

Yes, there are a few additional taxes and fees in Chicago. These include a gasoline tax, a hotel tax, and a restaurant tax.

Are there any tax credits or exemptions available for residents of Chicago?

Yes, there are some tax credits and exemptions available for residents of Chicago. These include the homeowner exemption for property taxes and the earned income tax credit for low-income individuals.

What is the sales tax rate in Chicago?

The sales tax rate in Chicago is currently 10.25%. However, there are additional taxes, such as the special tax for dining and the tax on bottled water, which can further increase the total sales tax.

Do I have to pay an income tax in Chicago?

Yes, if you live or work in Chicago, you are subject to the city’s income tax. The individual income tax rate in Chicago is 4.95% for residents and 2.25% for non-residents.