Virginia, also known as the Old Dominion State, is a popular destination for both individuals and businesses due to its favorable tax policies.

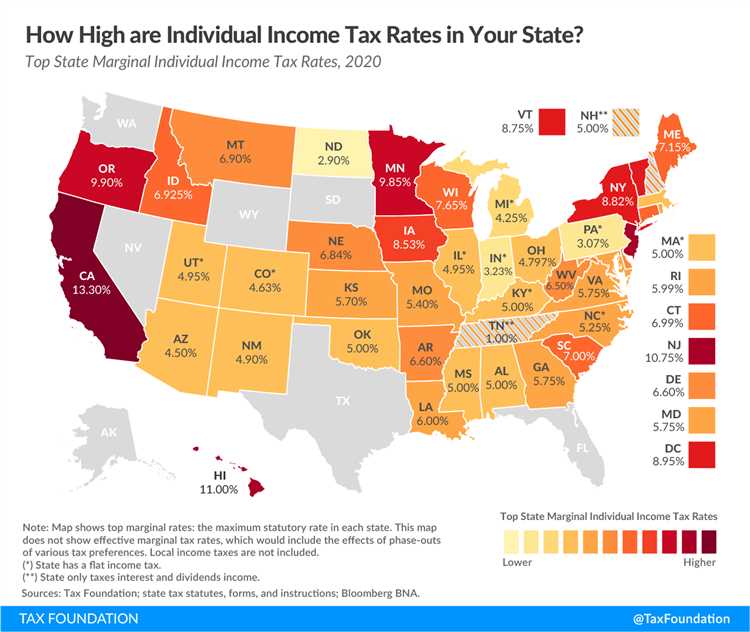

One of the main reasons why Virginia is considered tax friendly is its relatively low individual income tax rates. The state has a progressive income tax system with rates ranging from 2% to 5.75%. This means that individuals with higher incomes are subject to higher tax rates, while those with lower incomes benefit from lower rates.

In addition to its favorable individual income tax rates, Virginia also offers several tax deductions and credits that can help reduce tax liabilities. For example, individuals can claim deductions for mortgage interest, property taxes, and charitable contributions. There are also credits available for certain expenses, such as child and dependent care expenses.

Virginia is also attractive to businesses due to its low corporate income tax rate of 6%. This rate is significantly lower than the national average, making it an appealing location for companies looking to minimize their tax burden. Furthermore, the state offers various incentives for businesses, such as tax credits for job creation and investments in certain industries.

Overall, Virginia’s tax-friendly policies make it an attractive option for individuals and businesses alike. Whether you are considering relocating or starting a business, the state’s low tax rates and incentives can help you save money and achieve your financial goals.

- Why Virginia is considered a tax-friendly state

- Favorable income tax rates

- No tax on Social Security benefits

- The low state income tax rate in Virginia

- Virginia’s lack of tax on Social Security benefits

- The absence of an inheritance tax in Virginia

- Other considerations

- Virginia’s favorable property tax rates

- The tax exemptions for military retirement income in Virginia

- Virginia’s tax-friendly policies for small businesses

- Low Business Taxes

- No Sales Tax on Essential Business Purchases

- Q&A,

- Is Virginia considered a tax-friendly state?

- What is the individual income tax rate in Virginia?

- Does Virginia tax Social Security benefits?

- Are property taxes high in Virginia?

- Is there an estate tax in Virginia?

- Is Virginia tax-friendly for retirees?

- Are property taxes high in Virginia?

Why Virginia is considered a tax-friendly state

Virginia is often regarded as a tax-friendly state due to several key factors that make it attractive for residents and businesses alike.

Favorable income tax rates

One of the main reasons why Virginia is considered tax-friendly is its favorable income tax rates. The state income tax is progressive, with a top rate of 5.75% for individuals and a flat rate of 5.75% for corporations. Compared to other states with higher income tax rates, Virginia offers a competitive tax environment, allowing individuals and businesses to keep a larger portion of their earnings.

No tax on Social Security benefits

In addition to its income tax rates, Virginia also does not tax Social Security benefits. This can be a significant advantage for retirees who rely on Social Security income as it allows them to save on taxes and stretch their retirement funds further.

| No inheritance tax |

|---|

| Virginia also does not impose an inheritance tax, making it an attractive state for individuals who wish to pass on their wealth to their heirs without incurring additional taxes. |

Overall, Virginia’s combination of favorable income tax rates, exemption from taxing Social Security benefits, and lack of an inheritance tax make it a tax-friendly state for both individuals and businesses.

The low state income tax rate in Virginia

One of the reasons why Virginia is considered tax-friendly is its low state income tax rate. The state has a progressive income tax system with tax rates ranging from 2% to 5.75%. This means that individuals who earn higher incomes will pay a higher tax rate, while those with lower incomes will pay a lower rate.

Virginia’s low income tax rates provide some relief for residents, allowing them to keep more of their hard-earned money. This can be especially beneficial for individuals and families who are looking to save or invest their income for the future.

Additionally, Virginia also offers a variety of tax deductions and credits that can further reduce the overall tax burden for its residents. These deductions and credits may include deductions for mortgage interest, property taxes, college tuition expenses, and contributions to certain retirement accounts.

It’s important to note that while Virginia’s income tax rates are relatively low compared to some other states, individuals may still be subject to other taxes such as federal income tax, sales tax, and property tax. It’s recommended to consult with a tax professional or use tax preparation software to ensure accurate and complete tax filing.

In conclusion, the low state income tax rate in Virginia is one of the factors that make the state tax-friendly. It provides residents with the opportunity to retain a higher portion of their income and take advantage of various deductions and credits to help reduce their overall tax liability.

Virginia’s lack of tax on Social Security benefits

One of the reasons why Virginia is considered tax-friendly is because it does not tax Social Security benefits. This can be a significant advantage for retirees who rely on Social Security as their main source of income.

In many states, Social Security benefits are subject to taxation, which can significantly reduce the amount of money retirees receive. However, in Virginia, retirees do not have to worry about this additional tax burden.

This lack of taxation on Social Security benefits allows retirees in Virginia to keep more of their hard-earned money, providing them with a higher quality of life during their retirement years.

Furthermore, Virginia also offers other tax benefits for retirees, such as a low tax rate on pension income and exemptions for certain retirement income. These factors combined make Virginia an attractive destination for retirees looking to maximize their retirement savings and minimize their tax liabilities.

Overall, Virginia’s lack of tax on Social Security benefits is an important factor to consider for individuals planning their retirement. It provides an opportunity for retirees to enjoy a higher standard of living while keeping more money in their pockets.

The absence of an inheritance tax in Virginia

One significant factor that makes Virginia tax-friendly is the absence of an inheritance tax. Unlike some states, Virginia does not impose a tax on inherited assets. This means that if you inherit money, property, or other assets from a deceased family member or loved one, you won’t have to pay any state taxes on those inherited assets.

In states that do have an inheritance tax, the amount you are taxed on the inherited assets can vary depending on your relationship to the deceased person. However, in Virginia, regardless of your relationship to the deceased, you won’t have to pay any additional taxes on the assets you inherit.

This absence of an inheritance tax can be a significant advantage for individuals and families who are planning for their financial future and want to ensure that their loved ones can inherit assets without the burden of additional taxes. It can also be beneficial for those who are considering moving to Virginia and want to understand the tax implications of their estate planning decisions.

Other considerations

While the absence of an inheritance tax is a positive aspect of Virginia’s tax-friendly environment, there are other factors to consider when it comes to taxes in the state. For example, Virginia does have an estate tax, which is imposed on the value of a person’s estate at the time of their death. However, this tax only applies to estates with a value exceeding a certain threshold, which is adjusted annually.

Additionally, it’s important to keep in mind that federal estate tax laws still apply in Virginia. These laws impose taxes on estates that exceed a certain value, which is also adjusted annually. Therefore, it’s essential to consult with a qualified tax professional or estate planning attorney to fully understand the potential tax implications of your specific situation.

In conclusion, the absence of an inheritance tax in Virginia is a significant advantage for individuals and families when it comes to estate planning and passing on assets to loved ones. However, it’s essential to consider other factors such as estate taxes and federal estate tax laws to ensure comprehensive tax planning and minimize any potential tax liabilities.

Virginia’s favorable property tax rates

Virginia offers residents some of the most favorable property tax rates in the United States. The state’s property tax system is designed to provide relief for homeowners and promote economic growth.

One of the key advantages of Virginia’s property tax system is its low tax rates. Compared to other states, Virginia has relatively low property tax rates, making it an attractive place to own property. This means homeowners in Virginia pay less in property taxes compared to residents of many other states.

Another benefit of Virginia’s property tax system is the availability of various tax relief programs. The state offers exemptions for certain types of properties, such as primary residences and historic properties. These exemptions can lower the assessed value of a property and, in turn, reduce the amount of property tax owed.

Furthermore, Virginia has a generous homestead exemption, which allows homeowners to exempt a portion of their property’s assessed value from taxation. This exemption provides additional relief for homeowners, reducing their overall property tax burden.

In addition to these tax relief programs, Virginia also offers tax deferral options for eligible residents. These options allow homeowners, particularly seniors and disabled individuals, to defer the payment of property taxes until a later date. This can provide much-needed financial flexibility for those who may be facing financial challenges.

Overall, Virginia’s property tax rates and relief programs make it a tax-friendly state for homeowners. It’s important for residents to take advantage of the available exemptions and programs to minimize their property tax burden and enjoy the benefits of living in Virginia.

The tax exemptions for military retirement income in Virginia

Virginia offers generous tax exemptions for military retirement income, making it a tax-friendly state for veterans. Under Virginia law, military retirees can exclude up to $15,000 of their military retirement income from state income taxes. This exemption applies to retired members of the United States Armed Forces, as well as the National Guard and Reserves.

In order to qualify for this exemption, military retirees must meet certain criteria. They must be at least 65 years old or have a 100% permanent and total disability. Additionally, they must have received military pay for at least 90 days during active duty, or received military pay for at least 90 days during active duty and have served in a combat zone or qualified hazardous duty area.

This tax exemption is a significant benefit for military retirees in Virginia. It helps to reduce their overall tax burden and allows them to keep more of their retirement income. The $15,000 exemption can make a noticeable difference in their annual tax liability.

It’s important to note that this exemption only applies to military retirement income and not to other forms of retirement income, such as pensions or Social Security benefits. Military retirees may still be subject to state taxes on these other sources of income.

Overall, Virginia’s tax exemptions for military retirement income make the state an attractive option for military retirees looking for a tax-friendly place to live. Not only does Virginia have a strong military presence, but it also offers financial incentives to retired service members.

Virginia’s tax-friendly policies for small businesses

Virginia is known for its tax-friendly policies, particularly for small businesses. The state has implemented various measures to attract and support entrepreneurs, making it an ideal location to start and grow a business.

Low Business Taxes

One of the main reasons why Virginia is considered tax-friendly for small businesses is its low business tax rates. The state has a corporate income tax rate of 6%, which is well below the national average. Additionally, Virginia has a lowpersonal property tax rate, which is a significant advantage for small business owners. By keeping taxes low, Virginia encourages entrepreneurship and helps businesses retain more of their profits.

No Sales Tax on Essential Business Purchases

Virginia exempts essential business purchases from sales tax, providing significant savings for small business owners. This exemption covers items such as machinery, equipment, and tools necessary for the operation of the business. By eliminating the sales tax burden on these essential purchases, Virginia encourages investment and growth in the small business sector.

Investment Credits and Incentives

Virginia offers various investment credits and incentives for businesses that choose to locate or expand in the state. One example is the Virginia Jobs Investment Program, which provides grants and customized recruitment and training assistance for qualifying businesses. Additionally, the state offers tax credits for industries such as film production, research and development, and clean energy. These incentives can significantly reduce the tax liability for small businesses, providing them with a competitive advantage.

Conclusion

In conclusion, Virginia’s tax-friendly policies make it an attractive destination for small businesses. Its low business taxes, exemption on essential business purchases from sales tax, and investment credits and incentives all contribute to a favorable business environment. By creating a welcoming tax environment, Virginia supports small business growth and fosters economic development in the state.

Q&A,

Is Virginia considered a tax-friendly state?

Yes, Virginia is generally considered to be a tax-friendly state. It has relatively low individual and corporate tax rates compared to many other states.

What is the individual income tax rate in Virginia?

The individual income tax rate in Virginia varies depending on your income. As of 2021, the rates range from 2% to 5.75%. The top rate of 5.75% applies to income over $17,000.

Does Virginia tax Social Security benefits?

No, Virginia does not tax Social Security benefits. They are exempt from state income tax.

Are property taxes high in Virginia?

Property taxes in Virginia are generally lower than the national average. However, the exact amount varies by county. It is advisable to check the specific property tax rates in the area you are interested in.

Is there an estate tax in Virginia?

No, Virginia does not currently have an estate tax. However, it’s worth noting that federal estate tax laws still apply.

Is Virginia tax-friendly for retirees?

Yes, Virginia is considered to be tax-friendly for retirees. The state does not tax Social Security benefits, and there is a deduction available for certain types of retirement income. Additionally, the tax rates in Virginia are generally lower compared to some other states.

Are property taxes high in Virginia?

Property taxes in Virginia vary depending on the county or city. Overall, the state has a relatively low property tax rate compared to many other states. However, it’s important to note that individual property tax bills can still be significant depending on the value of the property.