When it comes to choosing a place to live or start a business in the United States, taxes are an important factor to consider. Some states have significantly lower taxes compared to others, making them attractive options for individuals and companies looking to save money. But which state has the lowest taxes?

In this guide, we will explore the top low tax states in America, highlighting their tax advantages and what makes them unique. Whether you’re a business owner looking to decrease your tax burden or an individual seeking to maximize your income, this article will provide valuable insights to help you make an informed decision.

One state that consistently ranks as having the lowest tax burden is Texas. With no state income tax and relatively low property taxes, Texas is a popular destination for both individuals and businesses. The state’s pro-business environment, coupled with its economic growth and job opportunities, make it an attractive choice for those seeking lower taxes.

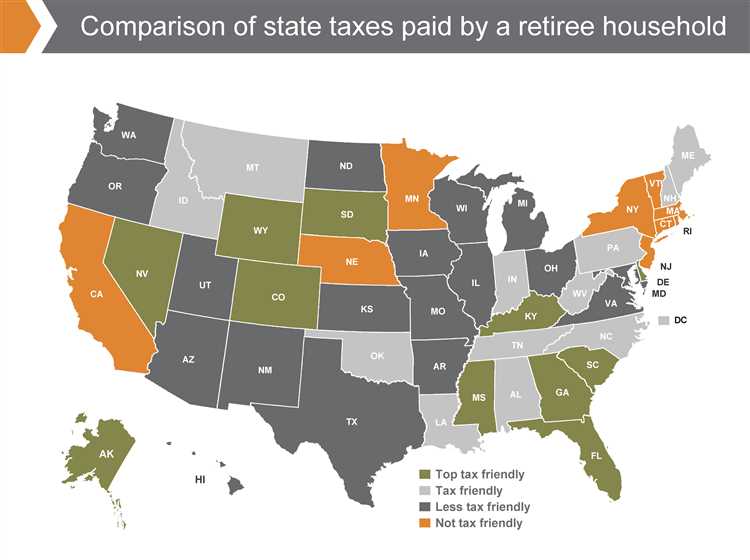

Another state worth mentioning is Florida. Similar to Texas, Florida has no state income tax, which allows residents to keep more of their hard-earned money. In addition, the cost of living in Florida is relatively affordable, making it an appealing option for retirees and individuals looking to stretch their dollars further.

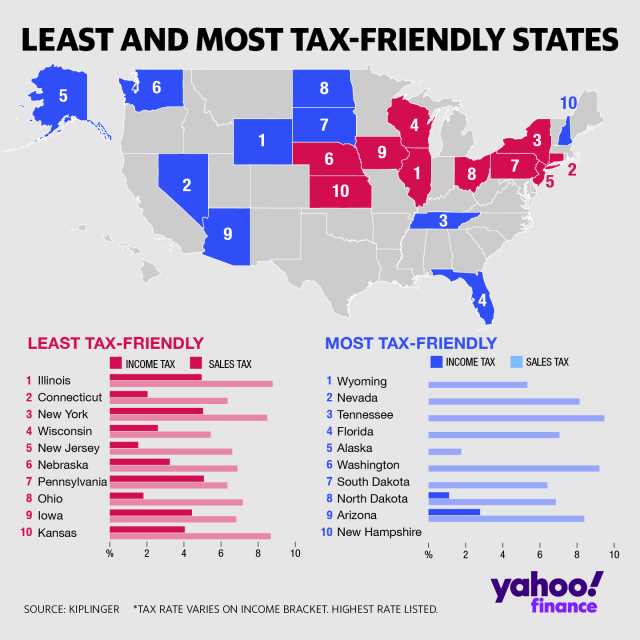

Other states known for their low tax rates include Nevada, Tennessee, and Wyoming. Nevada boasts no state income tax or corporate income tax, making it a magnet for entrepreneurs and businesses. Tennessee, on the other hand, does tax certain types of income but offers significant exemptions and a low overall tax burden. Wyoming is known for its business-friendly environment and no state income tax, making it an attractive option for individuals and corporations alike.

While these states offer attractive tax benefits, it’s essential to consider other factors like the cost of living, quality of life, and job opportunities when making a decision. Ultimately, the best state for you will depend on your individual circumstances and priorities. By understanding the tax advantages of these low tax states, you can make an informed choice that aligns with your financial goals.

- Which US State Has the Lowest Taxes?

- Low Income Taxes

- Business-Friendly Tax Policies

- A Guide to Low Tax States in America

- Overview of Taxation in the United States

- Understanding the US Tax System

- Question-answer:

- What is the state with the lowest taxes in the US?

- Are there any other states that have no state income tax?

- What are some other states that have low tax rates?

- Are there any states that have low property taxes?

- What are some factors to consider when deciding which state to live in based on tax rates?

Which US State Has the Lowest Taxes?

When it comes to taxes, the United States is known for having a complex and varied system. Each state sets its own tax rates, which can make a significant difference in the amount of taxes an individual or business pays.

For those looking to minimize their tax burden, there are several states that offer low taxes across the board. One state that consistently ranks as having some of the lowest taxes in the US is Texas.

Low Income Taxes

One of the main reasons Texas is often considered a low tax state is its lack of a personal income tax. This means individuals and families in Texas do not have to pay a state income tax on their earnings. This can result in substantial savings for residents, particularly those with high incomes.

In addition to no income tax, Texas also has relatively low sales and property taxes. The state has a sales tax rate of 6.25%, which is below the national average. Property tax rates in Texas are also generally lower compared to many other states.

Business-Friendly Tax Policies

Texas is known for its business-friendly environment, which includes favorable tax policies. The state has no corporate income tax, making it an attractive place for businesses to establish themselves or expand operations. This can lead to job creation and economic growth, further solidifying Texas’s reputation as a low tax state.

- Texas does have a franchise tax, which is a tax on businesses. However, the tax is only applicable to certain types of businesses and has a relatively low rate compared to other states.

- Additionally, Texas offers various tax incentives and exemptions to businesses, further reducing their tax liability.

Overall, Texas emerges as a clear frontrunner when it comes to low taxes in the US. From no personal income tax to business-friendly policies, the state offers individuals and businesses the opportunity to keep more of their hard-earned money.

A Guide to Low Tax States in America

When it comes to finding a state with the lowest taxes in America, there are a few options that stand out. Whether you are looking to save on income tax, property tax, or sales tax, these states have some of the lowest tax rates in the country.

One of the most popular low tax states is Texas. As a state with no income tax, residents can keep more of their hard-earned money. Texas also has relatively low property and sales taxes, making it a great option for those looking to save on all fronts.

Another state worth considering is Florida. Like Texas, Florida has no income tax, which means more money in your pocket. Additionally, Florida has a low sales tax rate and no state-level property tax. This combination of low taxes can make a significant difference in your overall financial picture.

For those seeking a state with low taxes and stunning natural beauty, Alaska is an attractive option. Alaska has no state-level income tax or sales tax, and residents also receive an annual dividend from the Alaska Permanent Fund based on the state’s oil revenues. While property taxes can vary, the lack of income and sales taxes can offset these costs.

If you’re willing to consider moving to the Midwest, South Dakota is a state worth exploring. South Dakota has no income tax and a low sales tax rate. Property taxes can be higher in some areas, but many residents find the overall tax burden to be quite manageable.

Finally, New Hampshire is a state known for its low tax rates. New Hampshire has no state income tax or sales tax. However, property taxes can be higher in some areas, so it’s important to research specific locations before making a move.

Remember, while moving to a low tax state can help you save money, it’s important to consider other factors such as job opportunities, cost of living, and quality of life. Each state has its own unique advantages and drawbacks. Be sure to weigh all of your options before making a decision.

In conclusion, if you’re looking to minimize your tax burden, these low tax states in America offer some attractive options. Whether you choose Texas, Florida, Alaska, South Dakota, or New Hampshire, you can find a state that aligns with your financial goals.

Overview of Taxation in the United States

The United States has a complex and multi-faceted system of taxation. Taxes are collected at various levels of government, including federal, state, and local levels. Taxes play a crucial role in funding government operations, public services, and infrastructure development.

At the federal level, the Internal Revenue Service (IRS) is responsible for overseeing the collection of taxes. The major sources of federal revenue are individual income taxes, corporate income taxes, and payroll taxes. Individual income taxes are progressive, meaning that higher-income individuals pay a higher percentage of their income in taxes.

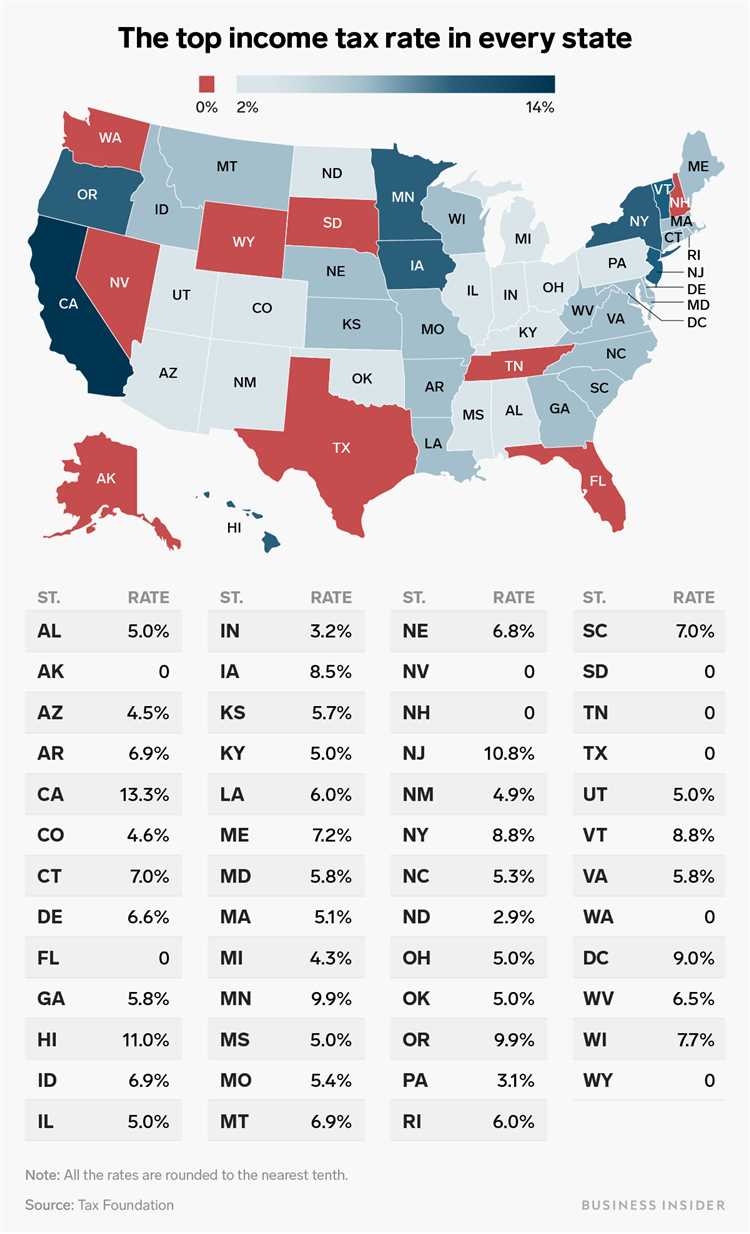

State taxation varies across the country, with some states imposing higher taxes than others. The primary state taxes include income taxes, sales taxes, and property taxes. States have the authority to determine their own tax rates and structure, which leads to significant variation between states.

Local governments also collect taxes to fund their operations and provide services to their residents. This is often done through property taxes, which are levied on residential and commercial real estate. Additionally, local governments may also impose sales taxes or special taxes for specific purposes such as education or transportation.

In some cases, certain states implement tax incentives and credits to attract businesses and stimulate economic growth. These incentives may include tax breaks for research and development, job creation, or investment in specific industries. Each state has its own unique set of tax laws and regulations.

- Federal taxes include individual income taxes, corporate income taxes, and payroll taxes.

- State taxes include income taxes, sales taxes, and property taxes.

- Local taxes include property taxes, sales taxes, and special taxes.

- Tax incentives and credits are sometimes used to attract businesses and promote economic growth.

It is worth noting that this overview of taxation in the United States is general in nature and does not cover all aspects of the tax system. The tax code is extensive and subject to regular changes and updates.

Understanding the taxation system is important for individuals and businesses to ensure compliance and make informed financial decisions. It is advisable to consult with a tax professional or seek expert advice to navigate the complexities of the tax system.

Understanding the US Tax System

The US tax system can be complex and confusing, with a wide range of federal, state, and local taxes. Understanding how these taxes work and how they are calculated is essential for individuals and businesses operating in the United States. Here are some key points to help you grasp the basics of the US tax system:

- Federal Income Tax: The federal income tax is the main tax levied on individuals and businesses by the US government. It is a progressive tax, meaning that the tax rate increases as income rises. Individuals and businesses must file annual tax returns with the Internal Revenue Service (IRS) to report their income and calculate their tax liability.

- State Income Tax: While not all US states have an income tax, most do. State income tax rates vary widely, with some states having a flat tax rate and others implementing a progressive tax system similar to the federal government. The rates and brackets for state income tax can fluctuate from year to year, so it’s important to stay informed about changes that may affect your taxes.

- Sales Tax: Sales tax is imposed on the purchase of goods and services at the state and local levels. The rates and rules regarding sales tax also vary by state and locality. Some jurisdictions have a single statewide rate, while others allow local governments to impose additional sales taxes. It’s important to factor sales tax into your budget when making purchases.

- Property Tax: Property tax is levied at the local level on real estate and personal property such as vehicles. The tax is based on the assessed value of the property and is used to fund local government services like schools and infrastructure. Property tax rates vary widely by locality, and exemptions and deductions may be available to reduce your tax burden.

- Payroll Taxes: Payroll taxes are deducted from employees’ wages to fund social security and Medicare programs. Employers also have to contribute a matching amount. Self-employed individuals are responsible for paying both the employee and employer portions of payroll taxes. Understanding your payroll tax obligations is crucial for both employees and employers.

- Other Taxes: In addition to the major taxes mentioned above, there are other taxes that individuals and businesses may need to consider, such as estate tax, gift tax, excise tax, and more. These taxes apply to specific situations, so it’s important to consult with a tax professional or refer to IRS guidelines if you have questions about your tax obligations.

Overall, understanding the US tax system is essential for individuals and businesses to meet their tax obligations and make informed financial decisions. Consulting a tax professional can provide you with personalized guidance based on your specific circumstances. Keeping up-to-date with changes in tax laws is also crucial, as they can have a significant impact on your tax liability.

Question-answer:

What is the state with the lowest taxes in the US?

The state with the lowest taxes in the US is Wyoming. It has no state income tax, no state sales tax, and low property taxes.

Are there any other states that have no state income tax?

Yes, besides Wyoming, there are six other states that have no state income tax. These states are Alaska, Florida, Nevada, South Dakota, Texas, and Washington.

What are some other states that have low tax rates?

Some other states that have low tax rates include Tennessee, New Hampshire, and Delaware. These states have no income tax, but they do have other types of taxes such as sales tax or property tax.

Are there any states that have low property taxes?

Yes, there are several states that have low property taxes. Some of these states include Hawaii, Alabama, Louisiana, and West Virginia. These states consistently rank among the lowest in terms of property tax rates.

What are some factors to consider when deciding which state to live in based on tax rates?

When deciding which state to live in based on tax rates, it’s important to consider factors such as income tax rates, sales tax rates, property taxes, and overall cost of living. One should also take into account other factors such as job opportunities, quality of life, and access to healthcare and education.