If you are considering moving to Maryland or already live there, you may be wondering about the salary tax rates in the state. Salary tax, also known as income tax, is a significant part of a person’s earnings that goes towards funding various state programs and services.

In Maryland, the salary tax rates range from 2% to 5.75%, depending on your income level. The state follows a progressive tax system, which means that individuals with higher incomes pay a higher percentage of their earnings in taxes compared to those with lower incomes.

It is essential to understand the salary tax rates in Maryland, as they can impact your financial planning and budgeting. By knowing how much of your income will go towards taxes, you can better plan for your expenses and savings goals.

- What is Salary Tax?

- Understanding Maryland’s Salary Tax

- Maryland State Income Tax Rates

- Local Taxes

- Withholding and Filing Taxes

- Tax Credits and Deductions

- Calculating Salary Tax in Maryland

- Determine your Taxable Income

- Refer to Maryland’s Tax Brackets

- Exemptions and Deductions for Salary Tax in Maryland

- Exemptions

- Deductions

- Medical Expenses Deduction

- Contributions to Retirement Accounts

- Filing and Paying Salary Tax in Maryland

- Filing Requirements

- Filing Deadlines

- Payment Options

- Filing as a Nonresident

- Q&A,

- How much is the salary tax rate in Maryland?

- What is the highest salary tax rate in Maryland?

- How much salary tax do I need to pay in Maryland if I earn $50,000 a year?

- Do I have to pay any additional local taxes on top of the salary tax in Maryland?

- Is there a standard deduction for salary tax in Maryland?

What is Salary Tax?

Salary tax, also known as income tax, is a tax imposed on an individual’s earnings or salary. It is a percentage of the money that a person earns, which is deducted by the government for various purposes such as funding public services and government programs.

The amount of salary tax an individual is required to pay depends on their income level and the tax rates set by the government. Generally, the higher the income, the higher the tax rate.

The salary tax is usually deducted from an individual’s paycheck by their employer. The employer calculates the amount to be deducted based on the employee’s income, tax bracket, and any deductions or allowances that the employee is entitled to.

The collected salary tax is then paid by the employer to the government on behalf of the employee. The government uses these funds to finance various public services such as education, healthcare, infrastructure development, and defense.

It is important for individuals to understand their salary tax obligations and comply with the tax laws of their respective countries or states. Failure to pay the required salary tax can result in penalties, fines, and legal consequences.

In Maryland, the salary tax rates vary based on income brackets. Maryland uses a progressive income tax system with rates ranging from 2% to 5.75%. The tax brackets and rates are updated periodically by the Maryland state government.

Understanding salary tax and managing one’s tax obligations is an important aspect of personal finance and responsible citizenship.

Understanding Maryland’s Salary Tax

When it comes to living and working in Maryland, it is important to understand the salary tax implications. Maryland has its own state income tax system, which means residents must pay both federal and state income taxes on their wages.

Maryland State Income Tax Rates

Maryland has a progressive income tax system, which means that individuals with higher incomes pay a higher percentage of their income in taxes. The state income tax rates range from 2% to 5.75%, depending on income brackets. It is important to note that these rates are subject to change, so it’s always a good idea to check the most up-to-date rates when filing your taxes.

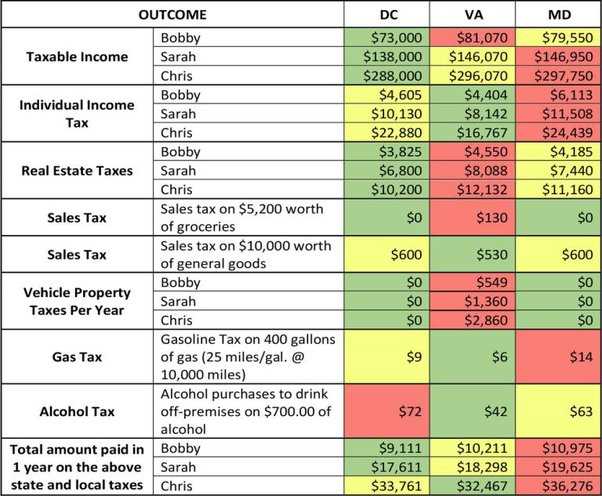

Local Taxes

In addition to state income taxes, residents of Maryland may also be subject to local taxes, depending on the county in which they live. Some counties have their own local income tax rates, while others do not. It is important to familiarize yourself with the local tax regulations in your specific county to ensure you are paying the correct amount.

Withholding and Filing Taxes

When you start a new job or have changes in your income, you will need to fill out a federal Form W-4 and a Maryland Withholding Allowance Certificate to determine how much federal and state income taxes will be withheld from your salary. It is important to accurately complete these forms to avoid underpaying or overpaying taxes.

When it comes time to file your taxes, you will need to report your total income for the year, including wages, tips, and other taxable income. You will also need to calculate and deduct any applicable deductions and credits to determine your final tax liability. Maryland residents can file their state income taxes using either paper forms or electronic filing methods.

Tax Credits and Deductions

Maryland offers a variety of tax credits and deductions to help reduce your overall tax liability. Some common deductions include expenses related to education, homeownership, and retirement savings. It’s important to review the available deductions and credits to see if you qualify for any savings.

Overall, understanding Maryland’s salary tax is crucial for both residents and those considering moving to the state. By familiarizing yourself with the state’s tax rates, local taxes, and filing requirements, you can ensure that you are meeting your tax obligations and taking advantage of any available deductions or credits.

Calculating Salary Tax in Maryland

If you live and work in Maryland, it’s important to understand how the state calculates salary tax. The amount of salary tax you owe is based on your income and the state’s progressive tax rates.

Determine your Taxable Income

The first step in calculating your salary tax in Maryland is to determine your taxable income. This is done by taking your gross income and subtracting any allowable deductions. Common deductions include contributions to retirement accounts and health insurance premiums.

Once you’ve determined your taxable income, you can then refer to Maryland’s tax brackets to find out which tax rate applies to you.

Refer to Maryland’s Tax Brackets

Maryland has a progressive tax system, which means that the tax rates increase as your income goes up. As of 2021, Maryland has the following tax brackets:

- 2% tax rate on the first $1,000 of taxable income

- 3% tax rate on taxable income between $1,001 and $2,000

- 4% tax rate on taxable income between $2,001 and $3,000

- 4.75% tax rate on taxable income between $3,001 and $100,000

- 5% tax rate on taxable income between $100,001 and $125,000

- 5.25% tax rate on taxable income between $125,001 and $150,000

- 5.5% tax rate on taxable income between $150,001 and $250,000

- 5.75% tax rate on taxable income between $250,001 and $300,000

- 5.8% tax rate on taxable income between $300,001 and $350,000

- 5.9% tax rate on taxable income between $350,001 and $500,000

- 6% tax rate on taxable income between $500,001 and $1,000,000

- 6.25% tax rate on taxable income over $1,000,000

To calculate your salary tax, you will need to apply the appropriate tax rate to each portion of your taxable income that falls within a specific bracket. For example, if your taxable income is $60,000, you will pay a 4.75% tax rate on the portion between $3,001 and $60,000.

It’s important to note that Maryland also allows for various credits and deductions that can further reduce your overall tax liability. These credits include the Child and Dependent Care Tax Credit, the Earned Income Tax Credit, and the Student Loan Debt Relief Tax Credit, among others.

By understanding how Maryland calculates salary tax and taking advantage of available credits and deductions, you can effectively manage your tax obligations and potentially reduce your overall tax liability.

Exemptions and Deductions for Salary Tax in Maryland

In Maryland, individuals who are subject to salary tax may be eligible for various exemptions and deductions that can help reduce their tax liability. These exemptions and deductions can apply to different aspects of an individual’s income, such as dependents, medical expenses, and retirement savings. Understanding and utilizing these exemptions and deductions can result in significant tax savings.

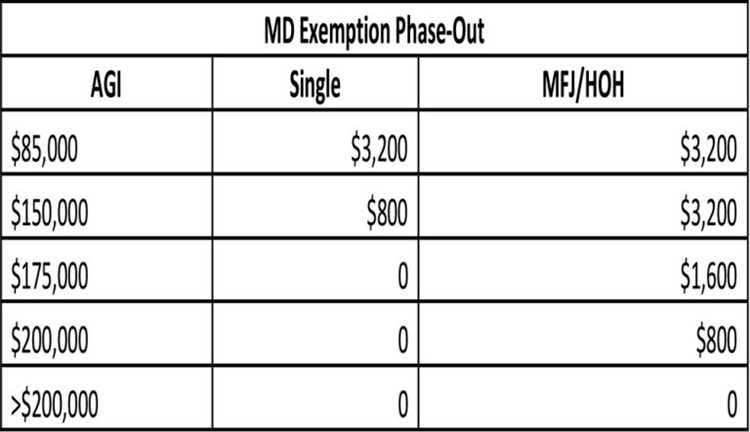

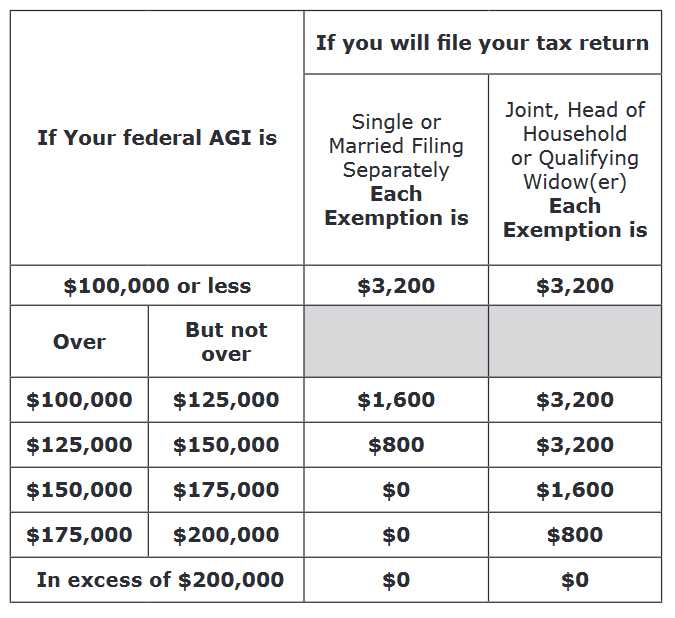

Exemptions

Maryland offers a personal exemption, which allows individuals to reduce their taxable income by a certain amount. The amount of the personal exemption varies depending on the filing status of the individual. For the tax year 2021, the personal exemption amounts are as follows:

- Single: $3,800

- Married Filing Jointly: $3,800 for each spouse

- Head of Household: $3,800

- Married Filing Separately: $3,800 for each spouse

This means that if you are filing as single, you can deduct $3,800 from your taxable income before calculating your salary tax.

Deductions

In addition to exemptions, Maryland also allows taxpayers to claim deductions to further reduce their tax liability. Some common deductions available for salary tax purposes include:

Medical Expenses Deduction

If you have significant medical expenses that exceed a certain percentage of your adjusted gross income (AGI), you may be able to deduct the excess amount. In Maryland, the deductible threshold for medical expenses is 7.5% of your AGI. This means that if your AGI is $50,000, you can deduct medical expenses that exceed $3,750. It is important to keep track of your medical expenses and retain supporting documentation to claim this deduction.

Contributions to Retirement Accounts

Maryland allows individuals to deduct contributions made to certain retirement accounts, such as traditional individual retirement accounts (IRAs) and employer-sponsored retirement plans. The maximum deduction amount varies depending on the taxpayer’s age and filing status. For the tax year 2021, the maximum deduction amounts are as follows:

- Under 50 years old: $6,500

- 50 years old and over: $7,500

By contributing to a retirement account, you not only save for the future but also reduce your taxable income, resulting in potential tax savings.

It is important to note that these are just a few examples of the exemptions and deductions available for salary tax in Maryland. It is recommended to consult with a tax professional or refer to the Maryland State Department of Assessments and Taxation for comprehensive and up-to-date information.

Filing and Paying Salary Tax in Maryland

If you live and work in Maryland, you are required to pay state income tax on your salary. Filing and paying your salary tax is an important responsibility that every Maryland resident must fulfill. Here are some key points to keep in mind when it comes to filing and paying salary tax in Maryland.

Filing Requirements

In Maryland, you must file a state income tax return if your total income exceeds certain thresholds. The income thresholds vary depending on your filing status (single, married filing jointly, etc.) and your age. It is important to review the latest guidelines provided by the Maryland Comptroller’s Office to determine whether you need to file a state income tax return.

Even if you do not meet the income thresholds, it may still be beneficial to file a state income tax return to claim any applicable deductions or credits that may lower your tax liability.

Filing Deadlines

The deadline to file your state income tax return in Maryland is generally April 15th, unless it falls on a weekend or holiday. If the deadline falls on a weekend or holiday, the deadline is extended to the next business day.

If you are unable to file your state income tax return by the deadline, you can request a six-month extension. However, it is important to note that an extension to file does not extend the time to pay any tax owed. You must still pay your tax liability by the original filing deadline to avoid penalties and interest.

Payment Options

There are several payment options available for paying your salary tax in Maryland. You can pay online using the Maryland Comptroller’s online payment portal, where you can make a one-time payment or set up a payment plan if you are unable to pay your tax liability in full. You can also pay by check or money order by mail, or in person at one of the Maryland Comptroller’s office locations.

It is important to include your Social Security number and tax year on your payment, whether you pay online or by mail. This helps ensure that your payment is properly credited to your account.

Filing as a Nonresident

If you are a nonresident of Maryland but earn income from within the state, you may still be required to file a state income tax return. Maryland has specific rules and guidelines for nonresidents who earn income in the state, so it is important to consult the Maryland Comptroller’s Office or a tax professional for guidance on how to properly file and pay your salary tax as a nonresident.

By understanding and following the guidelines for filing and paying salary tax in Maryland, you can fulfill your tax obligations and avoid penalties and interest. If you have any specific questions or concerns, it is advisable to seek guidance from a tax professional or consult the Maryland Comptroller’s Office for accurate and up-to-date information.

Q&A,

How much is the salary tax rate in Maryland?

The salary tax rate in Maryland varies depending on your income bracket. It ranges from 2% to 5.75%.

What is the highest salary tax rate in Maryland?

The highest salary tax rate in Maryland is 5.75%.

How much salary tax do I need to pay in Maryland if I earn $50,000 a year?

If you earn $50,000 a year in Maryland, you will need to pay a salary tax of $1,272.50. This is calculated by applying the marginal tax rates to your income.

Do I have to pay any additional local taxes on top of the salary tax in Maryland?

Yes, in addition to the state salary tax, some counties in Maryland have additional local taxes. The local tax rates vary by county.

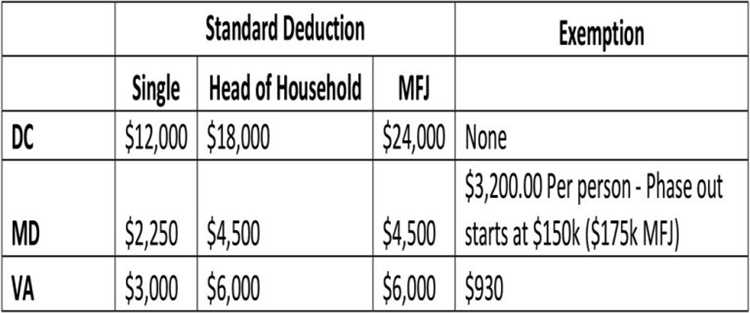

Is there a standard deduction for salary tax in Maryland?

Yes, there is a standard deduction for salary tax in Maryland. For the tax year 2021, the standard deduction is $2,250 for single filers and $4,500 for married couples filing jointly.