As environmental concerns grow, many states and cities have implemented measures to reduce the use of single-use plastic bags. One such measure is the implementation of a bag tax, which charges a fee for each bag used at checkout. This fee serves as an incentive for consumers to bring their own reusable bags and reduce their reliance on disposable plastics.

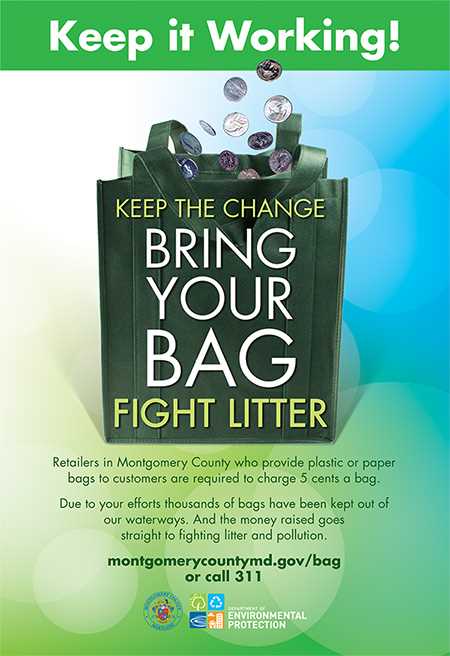

In the case of Maryland, the state does have a bag tax in place. This tax, known as the “bag fee,” was implemented in 2011 as part of an effort to reduce litter and pollution. Under this law, most retailers in Maryland are required to charge customers a fee of 5 cents for each disposable paper or plastic bag used at checkout.

It’s important to note that there are some exemptions to this bag fee. Certain types of bags are not subject to the fee, including bags used for bulk items, bags used for prescription medication, and bags used for take-out food. Additionally, customers who participate in government assistance programs, such as the Supplemental Nutrition Assistance Program (SNAP), are exempt from paying the bag fee.

The revenue generated from the bag fee is intended to be used for environmental initiatives, such as cleaning up waterways and funding education programs on recycling and waste reduction. By implementing this bag tax, Maryland aims to encourage individuals to make more sustainable choices and reduce the negative impact of single-use plastics on the environment.

- Overview of Maryland’s Bag Tax Policy

- Understanding the Purpose of the Bag Tax

- The Environmental Effects

- Efficiency and Effectiveness

- The Environmental Impact of Maryland’s Bag Tax

- The Economic Effects of Maryland’s Bag Tax

- Compliance and Enforcement of Maryland’s Bag Tax

- Public Opinion and Future Outlook of Maryland’s Bag Tax

- Q&A:

- Is there a bag tax in Maryland?

- Why does Maryland have a bag tax?

- Where does the money from the bag tax in Maryland go?

- How much money has the bag tax in Maryland raised?

- Are there any exemptions to the bag tax in Maryland?

- Is there a bag tax in Maryland?

- When was the bag tax implemented in Maryland?

Overview of Maryland’s Bag Tax Policy

The state of Maryland has implemented a bag tax as part of its efforts to reduce plastic waste and encourage the use of reusable bags. The bag tax policy applies to all retailers, including grocery stores, convenience stores, and retail establishments.

Under this policy, customers are required to pay a fee for each disposable bag they use at these retailers. The fee is typically a few cents per bag, and it is added to the total cost of their purchase. The purpose of this fee is to encourage consumers to bring their own reusable bags when shopping, therefore reducing the consumption of single-use plastic bags.

The revenue generated from the bag tax is directed towards environmental initiatives, such as recycling programs and educational campaigns on reducing plastic waste. By implementing this tax, Maryland aims to not only decrease the environmental impact of plastic bags but also promote sustainable habits among its residents.

It is important to note that there are exemptions to this bag tax policy. Certain types of bags are excluded, such as bags used for raw meat, poultry, or fish, as well as bags used for prescription drugs. Additionally, bags used for carryout food and bags provided by pharmacies for prescription medication are also exempt from the tax.

In summary, Maryland’s bag tax policy is designed to reduce plastic waste by imposing a fee on disposable bags used by customers at retailers. The revenue generated from this tax is directed towards environmental initiatives, and certain bags are exempt from the tax.

Understanding the Purpose of the Bag Tax

The bag tax, also known as the disposable bag fee, is a policy implemented in several states and cities to discourage the use of single-use plastic and paper bags. In the case of Maryland, the bag tax was introduced as a measure to reduce the negative environmental impact caused by the excessive consumption and improper disposal of these bags.

The Environmental Effects

Plastic and paper bags have become a significant environmental concern due to their harmful effects on wildlife, marine ecosystems, and landfills. These bags are often not biodegradable, leading to long-lasting pollution. Animals can mistake them for food and suffer injury or death by ingestion or entanglement. Additionally, the production of single-use bags contributes to deforestation, air pollution, and the release of greenhouse gases.

The Purpose

The primary purpose of the bag tax is to encourage individuals to adopt more sustainable alternatives such as reusable bags. By placing a financial burden on the use of disposable bags, the tax aims to incentivize consumers to bring their own bags when shopping. This behavioral change can significantly reduce the amount of waste generated from single-use bags and promote a more eco-friendly lifestyle.

Moreover, the revenue generated from the bag tax is often directed towards environmental initiatives, waste management programs, or educational campaigns about the importance of recycling and waste reduction. This indirect benefit helps fund initiatives that further promote sustainable practices and environmental conservation.

Efficiency and Effectiveness

The effectiveness of the bag tax in achieving its intended environmental goals has varied across different regions. While some studies have shown a significant reduction in the use of disposable bags, others argue that the tax has merely shifted consumer behavior towards alternative single-use options, such as thicker reusable plastic bags.

Nevertheless, the bag tax serves as an important step towards raising awareness about the environmental impact of disposable bags and encouraging individuals to make more sustainable choices. It complements other initiatives like recycling programs and efforts to reduce plastic waste, contributing to a more environmentally conscious society.

The Environmental Impact of Maryland’s Bag Tax

The bag tax implemented in Maryland has had a significant positive impact on the environment. By discouraging the use of single-use plastic bags, the state has taken a proactive step towards reducing plastic waste and protecting natural resources.

One of the main environmental benefits of the bag tax is the reduction in plastic pollution. Plastic bags, when not properly disposed of, can end up in waterways, forests, and other natural habitats, causing harm to wildlife and ecosystems. By charging customers for each bag they use, the tax has effectively decreased the demand for plastic bags, leading to fewer bags being produced and potentially ending up in the environment.

Furthermore, the bag tax has encouraged consumers to adopt more sustainable alternatives, such as reusable bags. These bags are often made of durable materials like canvas or cloth, reducing the need for plastic bags and their associated waste. Reusable bags can be used repeatedly, significantly reducing the overall consumption of single-use bags and the environmental impact of their production and disposal.

In addition to reducing plastic waste, the bag tax has also helped conserve energy and natural resources. Plastic bags are derived from non-renewable resources, such as petroleum, and their production requires significant energy consumption. By reducing the demand for plastic bags, the bag tax has indirectly contributed to the conservation of these precious resources and reduced greenhouse gas emissions associated with their production.

Overall, the bag tax in Maryland has had a positive environmental impact by reducing plastic pollution, promoting the use of sustainable alternatives, and conserving energy and natural resources. It serves as an example of how targeted government policies can effectively address environmental issues and contribute to a more sustainable future.

The Economic Effects of Maryland’s Bag Tax

Maryland’s bag tax, which was first implemented in 2010, has had significant economic effects on the state. The tax imposes a fee on every plastic bag provided by retailers, with the goal of reducing plastic waste and encouraging consumers to bring reusable bags.

One of the most immediate economic effects of the bag tax is the increase in revenue for the state. The tax generates millions of dollars each year, which is used to fund environmental initiatives and programs. This additional revenue has helped to support projects aimed at cleaning up and preserving Maryland’s natural resources.

Another economic impact of the bag tax is the shift in consumer behavior. Since the implementation of the tax, there has been a noticeable decrease in the use of plastic bags. Consumers are now more likely to opt for reusable bags or no bags at all, which has led to a reduction in plastic waste. This change in behavior has not only helped the environment but has also created opportunities for businesses that produce and sell reusable bags.

While the bag tax has had positive economic effects, it has also faced criticism from some businesses and consumers. Opponents argue that the tax places an unnecessary burden on retailers and low-income individuals, who may struggle to afford the additional cost of bags. However, supporters of the tax argue that the long-term benefits, such as reduced waste and improved environmental sustainability, outweigh the short-term costs.

In conclusion, Maryland’s bag tax has had significant economic effects on the state. It has generated additional revenue, reduced plastic waste, and encouraged changes in consumer behavior. While there has been some criticism, the overall impact of the bag tax has been positive in terms of environmental and economic sustainability.

Compliance and Enforcement of Maryland’s Bag Tax

Since its implementation in 2015, the bag tax in Maryland has aimed to reduce the consumption of single-use plastic bags and encourage the use of reusable alternatives. The tax applies to all retail establishments, including grocery stores, convenience stores, and pharmacies, among others.

Retailers are required to charge a fee of $0.05 for each disposable bag provided to customers at checkout. However, there are certain exemptions to the bag tax, such as bags used for certain food items, bags used to package bulk items, bags used for prescription medication, and bags used for newspapers, among others.

The Maryland Department of the Environment (MDE) is responsible for enforcing compliance with the bag tax regulations. They conduct regular audits and inspections of retail establishments to ensure that the fee is being charged correctly and that the collected revenue is being reported and remitted to the state.

In order to comply with the bag tax, retailers must keep accurate records of the number of bags distributed and the fees collected. They are required to maintain these records for a period of three years and make them available for inspection by the MDE if requested.

If a retailer fails to comply with the bag tax regulations, they may be subject to penalties and fines. The MDE has the authority to issue citations and impose fines on non-compliant retailers. The amount of the fine depends on the severity of the violation and can range from $100 for minor offenses to $500 for repeated violations.

Overall, the compliance and enforcement of Maryland’s bag tax are crucial in ensuring the effectiveness of the policy in reducing plastic bag waste. By holding retailers accountable and incentivizing the use of reusable bags, Maryland is taking proactive steps towards a more sustainable and eco-friendly future.

Public Opinion and Future Outlook of Maryland’s Bag Tax

Since the implementation of Maryland’s bag tax, public opinion has been divided. Supporters of the tax argue that it has successfully reduced plastic waste and litter in the state. They believe that the tax encourages individuals to bring their own reusable bags and promotes environmentally friendly habits. Additionally, proponents of the tax argue that the revenue generated from the tax can be used to fund environmental initiatives and programs.

On the other hand, opponents of the bag tax argue that it places an unnecessary burden on consumers. They argue that the tax unfairly targets low-income individuals who may not be able to afford reusable bags. Some opponents also question the effectiveness of the tax, suggesting that it may not necessarily lead to a significant reduction in plastic waste.

Despite the differences in opinion, the bag tax in Maryland has been in place for several years, and it has become a part of people’s daily routines. Many individuals have adapted to the tax by bringing their own reusable bags when shopping. As a result, the use of single-use plastic bags has significantly decreased in the state.

Looking to the future, it is likely that Maryland’s bag tax will continue to face scrutiny and debate. As environmental concerns grow, there may be calls to increase the tax or expand its scope to include other environmentally harmful items. Alternatively, there may be efforts to repeal the tax altogether, especially if opponents are successful in arguing against its effectiveness.

Ultimately, the future outlook of Maryland’s bag tax will depend on public opinion, legislative decisions, and the success of alternative solutions for reducing plastic waste. It remains to be seen how the state will address these issues and whether the bag tax will continue to be a part of Maryland’s environmental policies.

Q&A:

Is there a bag tax in Maryland?

Yes, there is a bag tax in Maryland. Since October 1, 2016, retailers in Maryland have been required to charge customers 5 cents per bag used at checkout.

Why does Maryland have a bag tax?

Maryland implemented the bag tax as a way to reduce the use of disposable bags and encourage people to bring their own reusable bags when shopping. It is an effort to promote environmental sustainability and reduce waste.

Where does the money from the bag tax in Maryland go?

The revenue generated from the bag tax in Maryland goes towards various environmental programs and initiatives. It is used to fund projects that aim to improve water quality, reduce pollution, and protect natural resources in the state.

How much money has the bag tax in Maryland raised?

Since its implementation in 2016, the bag tax in Maryland has raised millions of dollars. The exact amount varies from year to year, but it has been a significant source of revenue for environmental programs and initiatives in the state.

Are there any exemptions to the bag tax in Maryland?

Yes, there are exemptions to the bag tax in Maryland. Certain types of bags, such as those used for prescription drugs, newspapers, and dry cleaning, are not subject to the tax. Additionally, individuals who participate in the Supplemental Nutrition Assistance Program (SNAP) are exempt from the bag tax.

Is there a bag tax in Maryland?

Yes, Maryland has a bag tax. The state implemented the tax in 2021 in an effort to reduce plastic waste and promote the use of reusable bags. The tax applies to all retailers who provide single-use plastic or paper bags to customers at checkout. The current bag tax rate is 5 cents per bag.

When was the bag tax implemented in Maryland?

The bag tax was implemented in Maryland in 2021. The state recognized the environmental impact of single-use plastic bags and decided to impose a tax to discourage their use. By implementing the bag tax, Maryland aims to reduce plastic waste and promote the use of reusable bags.