When it comes to taxes, Maryland has often been a topic of debate. Some argue that the state’s tax system is friendly, while others claim it is unfriendly. So, what is the truth? Let’s dive in and explore the various aspects of Maryland’s tax system to determine whether it leans towards being friendly or unfriendly for its residents.

One key aspect of Maryland’s tax system is its income tax rates. The state has a progressive income tax system, meaning that the tax rates increase as income levels rise. This can be seen as unfriendly by those who fall into higher income brackets, as they often end up paying a larger portion of their income in taxes. On the other hand, lower-income individuals and families may find the progressive system friendly, as it allows for a more equitable distribution of the tax burden.

In addition to income taxes, Maryland also has property taxes, which can have a significant impact on homeowners. The state’s property tax rates are slightly above the national average, which may be seen as unfriendly by some homeowners. However, Maryland does offer several tax credits and exemptions for certain individuals, such as seniors and veterans, which can help offset the property tax burden and make it more friendly for eligible residents.

Another factor to consider is Maryland’s sales tax rate. The state has a 6% sales tax rate, which is lower than the national average. This can be seen as friendly, especially for those who frequently make large purchases or enjoy shopping. However, it’s important to note that certain counties in Maryland have additional local sales taxes, which can increase the overall tax rate. This variation in sales tax rates can make it difficult to determine whether Maryland’s sales tax system is truly friendly or unfriendly.

In conclusion, whether Maryland’s tax system is considered friendly or unfriendly depends on various factors and individual circumstances. While the progressive income tax system may be seen as unfriendly by some, the availability of tax credits and exemptions can alleviate the burden for certain individuals. The property tax rates may be slightly above average, but the exemptions and credits offered make it more friendly for eligible residents. Lastly, the sales tax rate is below the national average, although the presence of additional local sales taxes can complicate the overall assessment. Ultimately, each resident’s perception of Maryland’s tax system will depend on their specific financial situation and priorities.

- Overview of Taxes in Maryland

- Income Tax Rates

- Tax Brackets

- Property Taxes in Maryland

- Sales and Use Taxes

- Estate and Inheritance Taxes

- Q&A,

- What is the current tax rate in Maryland?

- Are property taxes high in Maryland?

- Are the sales tax rates in Maryland reasonable?

- What are the tax deductions available in Maryland?

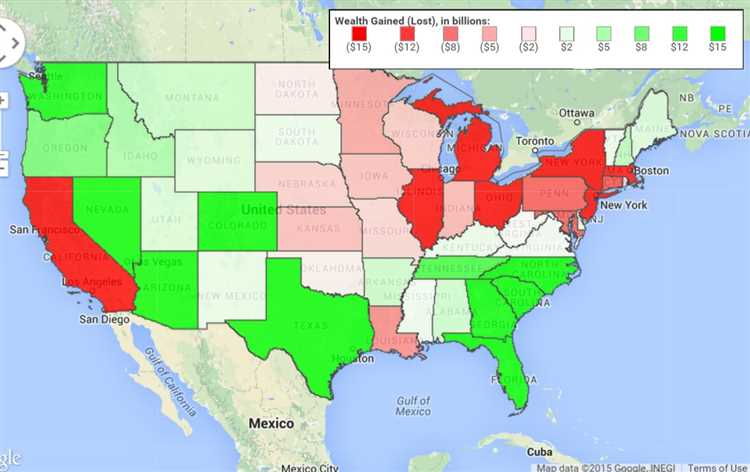

- How does Maryland compare to other states in terms of tax-friendliness?

- What are the taxes in Maryland like?

- How does Maryland compare to other states in terms of tax friendliness?

Overview of Taxes in Maryland

Maryland has a complex tax structure that includes a variety of taxes imposed at both the state and local levels. Understanding these taxes is essential for individuals and businesses residing in or operating in the state.

One of the most significant taxes in Maryland is the state income tax. It is imposed on individuals and businesses based on their taxable income. Maryland has a progressive income tax system, meaning that individuals with higher incomes are subject to higher tax rates.

In addition to the state income tax, Maryland also levies a sales tax on most goods and services. The sales tax rate in Maryland is currently 6%, but it may vary in certain local jurisdictions. Some items, such as groceries and prescription drugs, are exempt from the sales tax.

Property taxes are another significant source of revenue for the state and local governments in Maryland. Property tax rates vary depending on the jurisdiction, and they are based on the assessed value of the property. Property owners in Maryland are required to pay both state and local property taxes.

Businesses in Maryland are subject to various taxes as well, including corporate income tax, franchise tax, and personal property tax. The rates and requirements for these taxes may vary depending on the size and type of the business.

Finally, it’s important to note that Maryland does not have an inheritance tax but has an estate tax that may be imposed on certain estates. The estate tax is based on the value of the estate and is paid by the estate before the assets are distributed to the heirs.

Overall, the tax landscape in Maryland can be complex and burdensome for individuals and businesses. It’s important to consult with a tax professional or accountant to ensure compliance with all tax obligations and explore any available deductions or credits.

Income Tax Rates

In Maryland, income tax rates are progressive, meaning that the more income you earn, the higher tax rate you will pay. There are currently six tax brackets in Maryland, ranging from 2% to 5.75%. This allows for a fair distribution of the tax burden based on one’s ability to pay.

Tax Brackets

The following are the current income tax brackets in Maryland:

- 2%: For taxable income up to $1,000

- 3%: For taxable income between $1,001 and $2,000

- 4%: For taxable income between $2,001 and $3,000

- 4.75%: For taxable income between $3,001 and $150,000

- 5%: For taxable income between $150,001 and $250,000

- 5.75%: For taxable income above $250,000

It is important to note that these rates are subject to change, and it is advisable to consult with a tax professional or the Maryland State Department of Assessments and Taxation for the most up-to-date information.

Disclaimer: While we strive to provide accurate and up-to-date information, we cannot guarantee its accuracy. This article is for informational purposes only and should not be considered legal or financial advice.

Property Taxes in Maryland

Property taxes in Maryland can vary significantly depending on the county and city you reside in. The state has one of the highest median property tax rates in the country, making it important to understand how property taxes are calculated and what factors can affect your tax bill.

Property taxes in Maryland are based on the assessed value of the property, which is determined by the local government. The assessed value is then multiplied by the local tax rate to determine the annual property tax bill.

It’s worth noting that Maryland has different property tax rates for residential and non-residential properties. Residential properties generally have lower tax rates compared to non-residential properties, which include commercial and industrial properties.

In addition to the local tax rate, other factors that can affect your property tax bill in Maryland include special taxing districts, such as school districts or fire districts, and any applicable tax credits or exemptions. Some counties may also offer property tax incentives for certain types of properties, such as historic or energy-efficient properties.

When purchasing a property in Maryland, it’s important to consider the potential property tax burden. Researching the property tax rates in the specific county and city can give you a better understanding of how much you can expect to pay in property taxes each year.

It’s also important to be aware of any upcoming changes to property tax rates or assessments, as these can impact your tax bill. Staying informed about local tax policies and regulations can help you plan for your property tax expenses and make informed decisions about homeownership in Maryland.

Overall, property taxes in Maryland can be considered on the higher side compared to other states. However, it’s important to assess the overall tax burden, including income taxes and sales taxes, to get a complete picture of the tax-friendly or unfriendly nature of the state.

Sales and Use Taxes

In Maryland, sales and use taxes are an important component of the state’s tax structure. These taxes are levied on the sale or use of goods and services in the state. They apply to a wide range of items, including retail sales, rentals, lodging, and meals.

The sales tax rate in Maryland is currently 6%, although local jurisdictions may impose an additional tax of up to 2.5%. This means that the total sales tax rate can vary depending on the location. Some counties and cities in Maryland have chosen to impose their own local sales tax, while others have not.

When it comes to use taxes, Maryland requires residents to pay a 6% tax on out-of-state purchases if sales tax was not paid at the time of purchase. This applies to items that will be used, stored, or consumed in Maryland. It is important for individuals and businesses to keep track of their out-of-state purchases and report and pay the appropriate use tax.

Sales and use taxes can have a significant impact on consumers and businesses alike. For consumers, these taxes increase the cost of goods and services purchased in the state. For businesses, they create an additional administrative burden and can affect pricing and profitability.

Overall, the sales and use tax structure in Maryland is not particularly friendly. The varying tax rates and the requirement to pay a use tax on out-of-state purchases add complexity and can be burdensome for taxpayers. However, it is important to note that the revenue generated from these taxes helps fund important government services and programs in the state.

Estate and Inheritance Taxes

In addition to income taxes, Maryland also imposes estate and inheritance taxes. These taxes are levied on the transfer of property upon the death of an individual.

For estates with a value equal to or greater than $5 million, Maryland imposes an estate tax. The tax rates range from 0.8% to 16%. The estate tax return is due within nine months of the decedent’s death.

Furthermore, Maryland also has an inheritance tax, which is imposed on the transfer of property to certain beneficiaries. The tax rates range from 10% to 16%, depending on the relationship between the decedent and the beneficiary. Spouses, parents, and children are exempt from the inheritance tax.

It’s important to note that the Maryland estate tax is separate from the federal estate tax, and estates may be subject to both taxes. However, Maryland does allow for a credit against the state tax for any federal estate tax paid.

Understanding estate and inheritance taxes in Maryland is crucial for individuals who are planning their estates or will be receiving inheritances. Consulting with a qualified tax professional can help navigate the complexities of these taxes and ensure compliance with Maryland tax laws.

Q&A,

What is the current tax rate in Maryland?

The current tax rate in Maryland varies depending on your income bracket. As of 2021, the top marginal income tax rate for individuals is 5.75%. However, there are different tax rates for different income levels.

Are property taxes high in Maryland?

Yes, property taxes in Maryland are generally considered to be high compared to the national average. The average property tax rate in the state is around 1.04%, which is higher than the national average of 0.93%. However, it’s important to note that property tax rates can vary depending on the jurisdiction within the state.

Are the sales tax rates in Maryland reasonable?

The sales tax rates in Maryland are considered to be reasonable compared to many other states. The state has a 6% sales tax rate, which is relatively low. However, some jurisdictions within the state may add additional local sales taxes, which can vary. Overall, though, the sales tax rates in Maryland are not overly burdensome.

What are the tax deductions available in Maryland?

There are several tax deductions available in Maryland. Some of the common deductions include deductions for medical expenses, mortgage interest, charitable contributions, and property taxes. However, it’s important to note that the availability and amount of deductions may vary depending on your specific circumstances and the year in question.

How does Maryland compare to other states in terms of tax-friendliness?

Maryland is often considered to be one of the less tax-friendly states in the country. The state has relatively high income tax rates, high property taxes, and a moderate sales tax rate. Additionally, Maryland does not have any specific tax breaks or incentives that make it particularly attractive for businesses or retirees. However, it’s worth noting that everyone’s tax situation is unique, and factors such as income level and personal circumstances can greatly impact the overall tax-friendliness of a state.

What are the taxes in Maryland like?

Taxes in Maryland can vary depending on your income and location. The state has a progressive income tax rate system, which means that the tax rate increases as your income increases. In addition to the state income tax, there is also a county income tax, which varies by county. Property taxes in Maryland are also fairly high compared to other states.

How does Maryland compare to other states in terms of tax friendliness?

Maryland is generally considered to have one of the highest tax burdens in the United States. The state has high income tax rates, especially for high-income earners. Property taxes in Maryland are also above the national average. However, it’s important to note that tax friendliness can vary depending on individual circumstances, such as income level and personal financial situation.