When it comes to taxation, Virginia is known for its relatively low overall tax burden. However, many people wonder if there is a luxury tax in Virginia. The answer to that question is both yes and no.

Virginia does not have a specific luxury tax that targets high-end or luxury goods and services. Unlike some other states, Virginia does not impose additional taxes on items such as luxury cars, yachts, or high-end jewelry.

However, it is important to note that Virginia does have a general sales tax that applies to a wide range of goods and services, including luxury items. The current sales tax rate in Virginia is 5.3%. This means that any luxury item purchased in Virginia would be subject to this sales tax.

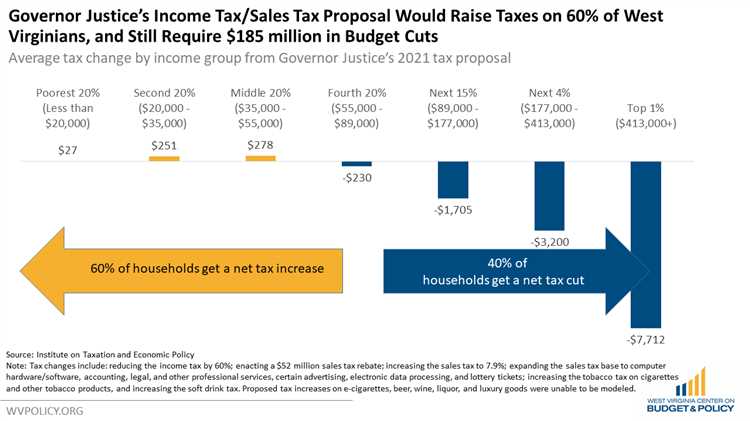

Additionally, it is worth mentioning that Virginia has a higher income tax rate for high-income earners. Individuals and couples who earn above a certain threshold are subject to a higher income tax rate. While this is not specifically a luxury tax, it affects higher-income individuals in a way that could be considered similar to a luxury tax.

In conclusion, while Virginia does not have a specific luxury tax, high-end purchases are still subject to the general sales tax. Furthermore, higher-income individuals may also experience a higher income tax rate. It is important to consult with a tax professional or the Virginia Department of Taxation for specific information and guidance on taxes in Virginia.

- What is the Luxury Tax in Virginia?

- How does the Luxury Tax work?

- Why is there a Luxury Tax?

- Understanding the Basics of Luxury Tax in Virginia

- What is considered a luxury item?

- How does the luxury tax work?

- Are there any exemptions?

- Who is Subject to Paying the Luxury Tax?

- How is the Luxury Tax Calculated in Virginia?

- Are There any Exemptions or Thresholds for the Luxury Tax?

- Exemptions

- Thresholds

- Consequences of Not Paying the Luxury Tax in Virginia

- 1. Penalties and Interest

- 2. Legal Action

- 3. Damage to Credit Rating

- Tips for Minimizing Luxury Tax Liability in Virginia

- Q&A,

- Is there a luxury tax in Virginia?

- What is considered a luxury item in Virginia?

- How much is the luxury tax in Virginia?

- Do I have to pay luxury tax when buying a luxury car in Virginia?

- Are there any exemptions to the luxury tax in Virginia?

- Is there a luxury tax in Virginia?

- What is the luxury tax threshold in Virginia?

What is the Luxury Tax in Virginia?

In Virginia, there is a luxury tax that is imposed on certain high-end purchases. The luxury tax is an additional tax that is charged on top of the regular sales tax for items that are considered to be luxury goods.

The luxury tax applies to a range of products including expensive cars, boats, and jewelry. It is designed to target items that are considered to be nonessential and are typically purchased by wealthier individuals.

How does the Luxury Tax work?

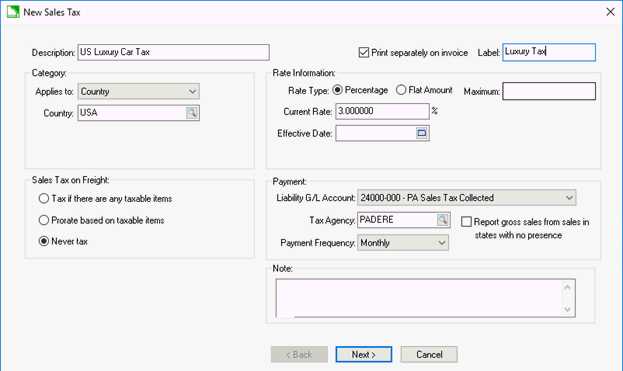

The luxury tax in Virginia is calculated as a percentage of the purchase price of the luxury item. The exact percentage varies depending on the type of item being purchased. For example, the luxury tax on cars may be different from the luxury tax on jewelry.

When making a luxury purchase, the seller is responsible for collecting the luxury tax from the buyer at the time of sale. The seller then remits the luxury tax to the Virginia Department of Taxation on a regular basis.

Why is there a Luxury Tax?

The luxury tax in Virginia serves several purposes. First, it generates revenue for the state, which can be used to fund various government programs and services. Second, it helps to reduce income inequality by placing a higher tax burden on those who can afford expensive luxury items. Finally, it can also act as a deterrent for excessive consumption and promote more responsible spending habits.

It is important to note that not all states have a luxury tax, and the specific rules and rates may vary from state to state. Therefore, it is advisable to consult the Virginia Department of Taxation or a tax professional for specific information regarding the luxury tax in Virginia.

Understanding the Basics of Luxury Tax in Virginia

When it comes to luxury goods, Virginia imposes a luxury tax on certain items considered to be extravagant or non-essential. The purpose of the luxury tax is to generate revenue for the state and discourage excessive and unnecessary spending.

What is considered a luxury item?

A luxury item is typically a high-end product that is both expensive and non-essential. For example, luxury cars, yachts, private jets, designer clothing, and jewelry are often subject to luxury tax in Virginia.

How does the luxury tax work?

In Virginia, the luxury tax is calculated as a percentage of the sale price of the luxury item. The specific rate may vary depending on the type of item being purchased. For instance, luxury vehicles may have a higher tax rate than luxury clothing.

It’s important to note that luxury tax rates can change over time as the state legislature adjusts tax laws.

For example, let’s say you purchased a luxury car worth $100,000 in Virginia, and the luxury tax rate for vehicles is 10%. You would be required to pay an additional $10,000 in luxury tax.

Are there any exemptions?

While many luxury items are subject to the luxury tax, there are exceptions. Items that are considered essential, such as basic clothing and essential medical devices, are usually exempt from the tax. It’s essential to review the current tax laws or consult a tax professional to determine which items are subject to the luxury tax.

In conclusion, the luxury tax in Virginia is imposed on certain extravagant and non-essential items. It is essential for residents and visitors to be aware of these tax laws to avoid any penalties or surprises when making luxury purchases.

Who is Subject to Paying the Luxury Tax?

Virginia imposes a luxury tax on certain high-end purchases. This tax applies to individuals or businesses who purchase or lease specific luxury items.

Those who are subject to paying the luxury tax in Virginia include:

- Individuals who buy a luxury vehicle with a purchase price of $50,000 or more;

- Individuals who lease a luxury vehicle with a total lease value of $20,000 or more;

- Individuals or businesses who purchase or lease a boat or watercraft with a purchase price or total lease value of $100,000 or more;

- Individuals or businesses who purchase or lease an aircraft with a purchase price or total lease value of $25,000 or more;

- Individuals or businesses who purchase or lease a recreational vehicle (RV) with a purchase price or total lease value of $100,000 or more;

- Individuals or businesses who purchase or lease jewelry, gems, precious metals or stones, or watches with a purchase price or total lease value of $10,000 or more.

It’s important to note that the luxury tax is in addition to any other taxes and fees that may apply to these purchases or leases. The luxury tax rate varies depending on the type of luxury item being purchased or leased.

Individuals or businesses who are subject to paying the luxury tax in Virginia should consult with a tax professional or refer to the official Virginia tax guidelines to ensure compliance with the tax laws.

How is the Luxury Tax Calculated in Virginia?

In Virginia, the luxury tax is calculated based on the purchase price of certain high-value items. The luxury tax rate varies depending on the type of item being purchased. It is important to note that not all items are subject to the luxury tax in Virginia.

To calculate the luxury tax, you need to determine the purchase price of the item. The purchase price generally includes the cost of the item itself, any additional accessories or upgrades, and any applicable taxes or fees.

Once you have the purchase price, you can apply the luxury tax rate. For example, if the luxury tax rate for a specific item is 5%, and the purchase price is $10,000, the luxury tax would be $500 ($10,000 * 0.05).

It is essential to consult the Virginia Department of Taxation or a tax professional to determine the specific luxury tax rates for different categories of items. The luxury tax rates may vary and can change over time.

Before making a luxury purchase in Virginia, it is advisable to factor in the potential luxury tax to ensure you are aware of the total cost of the item.

Are There any Exemptions or Thresholds for the Luxury Tax?

While Virginia does not have a specific luxury tax, there are certain exemptions and thresholds that apply to certain luxury items and purchases. These exemptions and thresholds can affect whether or not you will be subject to additional taxes on your luxury purchases.

Exemptions

One exemption to keep in mind is the exemption for purchases of items intended for resale. If you are purchasing luxury items with the intention of reselling them, you may be exempt from paying the luxury tax. This exemption is commonly used by businesses that buy luxury goods for resale, such as high-end retailers or art galleries.

Another exemption applies to purchases made for certain medical purposes. If you are purchasing luxury items that are necessary for medical treatment or are prescribed by a medical professional, you may be exempt from paying the luxury tax. This exemption ensures that individuals who require luxury medical equipment or supplies are not burdened with additional taxes.

Thresholds

In addition to exemptions, there are also thresholds that determine whether or not you will be subject to the luxury tax. These thresholds are based on the total value of the luxury items you have purchased.

For example, if your total purchases of luxury items exceed a certain amount, you may be required to pay the luxury tax. The exact threshold amount may vary depending on the type of luxury item. It is important to consult the Virginia Department of Taxation or a tax professional to determine the specific thresholds that apply to your luxury purchases.

It is worth noting that these exemptions and thresholds may change over time, as tax laws are subject to revisions and updates. Therefore, it is always advisable to stay informed about the latest tax regulations and consult a tax professional for personalized advice regarding luxury purchases and taxes in Virginia.

Consequences of Not Paying the Luxury Tax in Virginia

If you fail to pay the luxury tax in Virginia, you may incur several consequences that can have serious ramifications on your financial and legal situation. It is essential to understand the potential penalties and take them seriously to avoid facing further complications.

1. Penalties and Interest

The Virginia Department of Taxation may impose penalties and interest on any overdue luxury tax payments. These penalties and interest rates can significantly increase the amount you owe, making it even more difficult to settle the outstanding balance.

2. Legal Action

If you continually neglect to pay the luxury tax, the Virginia Department of Taxation can take legal action against you. This can involve filing a lawsuit to recover the owed taxes, obtaining a judgment against you, and potentially placing a lien on your property or garnishing your wages to satisfy the debt.

3. Damage to Credit Rating

Not paying the luxury tax can harm your credit rating. The Virginia Department of Taxation may report your delinquent taxes to credit bureaus, which can lower your credit score. A damaged credit rating can make it challenging to secure loans, obtain favorable interest rates, or even rent an apartment.

It is crucial to pay the luxury tax promptly to avoid these consequences and maintain a good rapport with the tax authorities in Virginia. It is also advisable to consult with a tax professional if you are facing difficulties in meeting your tax obligations to explore potential options or strategies to resolve the situation.

Tips for Minimizing Luxury Tax Liability in Virginia

Virginia imposes a luxury tax on certain high-value items, such as luxury cars, boats, and aircraft, which can significantly increase the cost of these purchases. However, there are several strategies you can implement to help minimize your luxury tax liability in Virginia.

1. Consider purchasing used luxury items: Luxury tax in Virginia applies only to new items. By purchasing a used luxury car, boat, or aircraft, you can avoid the luxury tax altogether. Keep in mind that the luxury tax is based on the fair market value of the item, so it’s essential to research and negotiate the purchase price to ensure you’re getting a good deal.

2. Explore tax exemptions and credits: Virginia offers various tax exemptions and credits that may help reduce your luxury tax liability. For example, you may be eligible for a tax credit if you purchase an environmentally friendly luxury vehicle or if you make modifications to a luxury boat or aircraft to meet specific requirements. Consult with a tax professional to understand the available exemptions and credits and determine if you qualify.

3. Structure your purchase as a lease: Instead of buying a luxury item outright, you can consider leasing it. Leasing can help minimize your luxury tax liability because you’ll only pay tax on the lease payments rather than the full value of the item. However, keep in mind that leasing may come with other financial considerations, such as interest rates and lease terms, so carefully evaluate the overall cost and benefits before making a decision.

4. Explore alternative ownership structures: Depending on your specific circumstances, you may be able to structure your luxury item ownership in a way that minimizes the tax liability. For example, setting up a trust or forming a limited liability company (LLC) to own the luxury item may provide certain tax advantages. Consult with an attorney or tax advisor to discuss these options and determine the best approach for your situation.

5. Plan your purchases strategically: Review your intended luxury purchases and timing carefully. If you can delay a purchase until after the luxury tax liability has been incurred or until you qualify for a tax exemption or credit, you can significantly reduce your overall tax burden. Strategically planning your purchases can help you save money in the long run.

Remember, it’s crucial to consult with a tax professional or attorney who is familiar with Virginia tax laws and regulations to ensure you’re fully informed and making the best decisions regarding your luxury tax liability.

Q&A,

Is there a luxury tax in Virginia?

Yes, there is a luxury tax in Virginia. The state imposes a luxury tax on certain high-end goods and services.

What is considered a luxury item in Virginia?

In Virginia, luxury items can include high-end vehicles, boats, yachts, jewelry, and other luxury goods and services. These items are typically subject to the luxury tax.

How much is the luxury tax in Virginia?

The luxury tax rate in Virginia can vary depending on the item or service being taxed. The tax rate can range from 1% to 6%, with higher rates often applied to more expensive luxury items.

Do I have to pay luxury tax when buying a luxury car in Virginia?

Yes, when buying a luxury car in Virginia, you may be required to pay a luxury tax on top of the sales tax. The luxury tax rate can vary, but it is typically based on the vehicle’s purchase price.

Are there any exemptions to the luxury tax in Virginia?

There may be certain exemptions or exclusions to the luxury tax in Virginia. For example, some essential items like groceries or prescription drugs may be exempt from the luxury tax. It is best to consult with a tax professional or check the specific regulations for the most accurate information.

Is there a luxury tax in Virginia?

Yes, there is a luxury tax in Virginia. The state imposes a tax on certain luxury items, such as cars, boats, and aircraft, with a cost above a certain threshold.

What is the luxury tax threshold in Virginia?

The luxury tax threshold in Virginia varies depending on the type of luxury item. For cars, the threshold is $20,000, meaning that any car with a cost above $20,000 is subject to the luxury tax. For boats and aircraft, the threshold is $100,000.