When it comes to taxes, it’s no secret that Illinois is often considered one of the highest-taxed states in the country. However, within the state itself, tax rates can vary significantly from one city to another. So, which city in Illinois has the highest taxes?

One city that consistently tops the list for the highest tax rates in Illinois is none other than Chicago. With its bustling urban center, diverse neighborhoods, and iconic skyline, Chicago may be a desirable city to live in, but it also comes with a hefty tax burden. Property taxes, sales taxes, and income taxes in Chicago are all higher than the state average, making it the city with the highest overall tax rates.

But Chicago is not the only city in Illinois with high taxes. Other cities like Aurora, Rockford, and Joliet also have tax rates that are above the state average. These cities, while not as well-known as Chicago, still have significant populations and economic activity, leading to higher tax rates to support local government services.

It’s important to note that higher taxes in a city do not necessarily mean that it is a less desirable place to live. Many factors come into play when choosing a city to call home, and tax rates are just one piece of the puzzle. Some cities with higher tax rates may offer a higher quality of life, better schools, or more amenities that make up for the additional tax burden.

In conclusion, while Chicago may have the highest taxes in Illinois, it is not the only city in the state with high tax rates. The tax rates across the state can vary significantly from one city to another. When considering where to live, it’s important to take into account the overall cost of living, quality of life, and other factors beyond just tax rates.

- What City in Illinois Has the Highest Taxes?

- Chicago

- Exploring the Tax Rates Across the State

- Understanding Taxes in Illinois

- State Taxes

- County and Municipal Taxes

- Tax Rates Across the State

- An Overview of How Taxes Work in the State

- State Income Tax

- Sales Tax

- Property Tax

- Other Taxes

- Question-answer:

- What city in Illinois has the highest taxes?

- Why does Chicago have the highest taxes in Illinois?

- How do the tax rates in Chicago compare to other cities in Illinois?

- What are some of the services and projects that the high taxes in Chicago fund?

- Are there any cities in Illinois with low taxes?

- Which city in Illinois has the highest tax rates?

- What are the tax rates like in other major cities in Illinois?

What City in Illinois Has the Highest Taxes?

When it comes to taxes in Illinois, there are several cities that have higher tax rates compared to others. However, one city stands out as having the highest taxes in the state.

Chicago

Chicago, the largest city in Illinois, has the highest tax rates in the state. This includes property taxes, sales taxes, and income taxes. The combination of these taxes makes Chicago one of the most tax-heavy cities in the country.

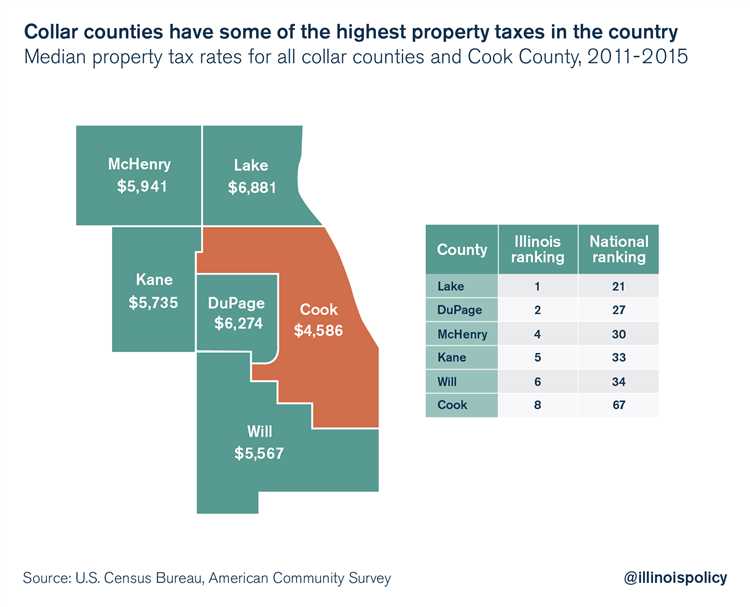

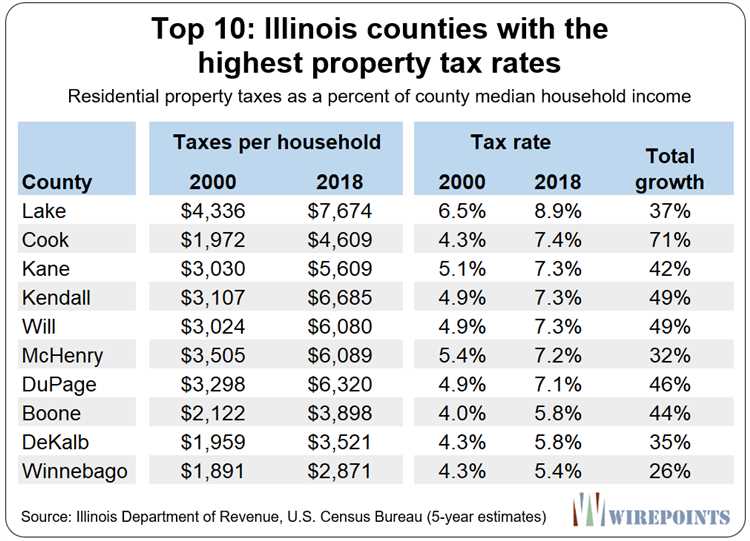

Property taxes in Chicago are particularly high, with homeowners paying some of the highest rates in the nation. This is due to a combination of factors, including the city’s high property values and the need for revenue to support the city’s infrastructure and services.

In addition to property taxes, sales taxes in Chicago are also high. The city has a combined sales tax rate of over 10%, which is one of the highest in the country. This can make purchasing goods and services in the city more expensive compared to other areas of Illinois.

Income taxes in Chicago are also higher compared to other cities in the state. The city imposes an additional income tax on residents, known as the “City of Chicago Income Tax.” This tax is in addition to the state income tax and can further contribute to the overall tax burden for individuals living and working in Chicago.

While Chicago may have the highest taxes in Illinois, it’s important to note that the overall tax burden can vary depending on factors such as income level, property value, and individual circumstances. Additionally, other cities in the state may have high taxes in specific areas, such as sales taxes or property taxes, but not necessarily across all tax categories.

When considering the tax rates in Illinois, it’s important for individuals and businesses to understand the specific tax rates and how they may impact their finances. Consulting with a tax professional can help navigate the complex tax landscape and ensure compliance with all applicable tax laws and regulations.

Exploring the Tax Rates Across the State

Illinois is a state known for its high tax rates, and understanding the variations in these rates across different cities can be crucial for residents and businesses. By exploring the tax rates across the state, individuals can make informed decisions regarding where to live, work, or invest in Illinois.

From the bustling city of Chicago to the smaller suburban towns, each region within Illinois has its tax structure that affects both residents and businesses. The tax rates typically include income taxes, sales taxes, property taxes, and various local taxes levied by municipalities.

One of the primary tax rates residents focus on is the income tax rate, which can significantly impact an individual’s take-home pay. In Illinois, the income tax rate is a flat rate of 4.95%, regardless of income level. This means that high-income earners and low-income earners pay the same rate, unlike some states with progressive income tax systems.

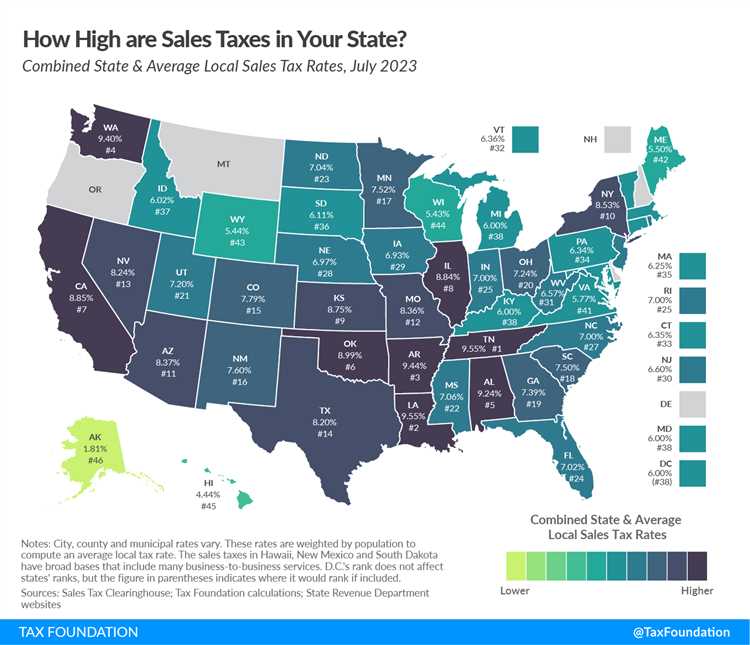

Another essential tax to consider is the sales tax rate. The state of Illinois has a base sales tax rate of 6.25%. However, additional local sales taxes can be imposed, which may vary depending on the city or county. For example, the city of Chicago has a combined sales tax rate of 10.25%, one of the highest in the state.

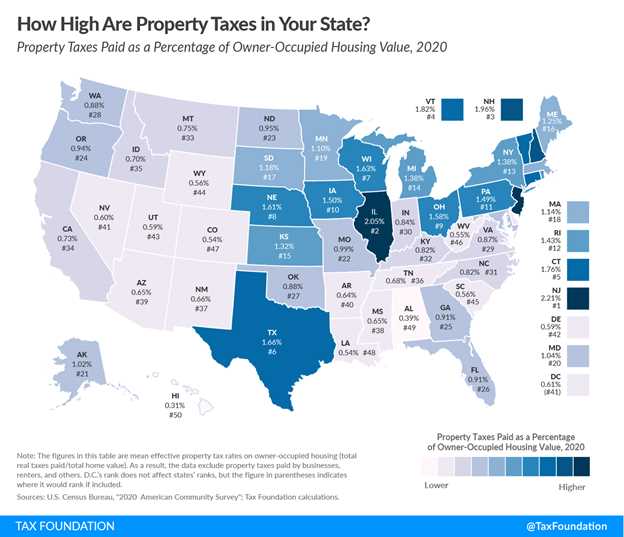

In addition to income and sales taxes, property taxes play a significant role in determining the overall tax burden for homeowners. The property tax rate in Illinois is among the highest in the nation, with an average effective rate of 2.31% in 2020. However, the actual property tax rates can vary significantly between different counties and municipalities within the state.

It is also crucial to consider other local taxes, such as municipal and county taxes. Many cities and counties in Illinois impose their taxes on top of state taxes. These local taxes can include additional sales taxes, fuel taxes, hotel taxes, and utility taxes. The rates for these taxes can vary widely depending on the specific jurisdiction.

Understanding the tax rates across the state of Illinois is essential for residents and businesses to make informed financial decisions. By comparing the tax rates in different cities and regions, individuals can evaluate the overall tax burden and make choices that align with their financial goals.

Understanding Taxes in Illinois

Illinois has a complex and multifaceted tax structure, with various taxes imposed at the state, county, and municipal levels. To gain a comprehensive understanding of taxes in Illinois, it’s essential to explore the different types of taxes and their impact on the residents and businesses in the state.

State Taxes

At the state level, Illinois imposes several taxes, including income tax, sales tax, and property tax. The state income tax in Illinois is a flat rate tax, meaning that individuals and businesses are taxed at a consistent rate regardless of income level. In addition to income tax, Illinois also collects sales tax on most purchases made in the state, with the rate varying depending on the location. Property tax is another significant source of revenue for the state.

County and Municipal Taxes

County and municipal governments in Illinois also impose taxes to fund local services and initiatives. These taxes typically include property tax, sales tax, and various other local taxes, such as utilities taxes, lodging taxes, and amusement taxes. The rates of these taxes may vary from one jurisdiction to another, leading to differences in the overall tax burden across the state.

Tax Rates Across the State

Illinois has a reputation for having high tax rates compared to many other states. However, it’s important to note that the tax rates can vary significantly across different cities and municipalities within Illinois. Some cities may have higher tax rates due to additional local taxes, while others may have lower rates. The disparities in tax rates contribute to variations in the overall tax burden experienced by individuals and businesses in different parts of the state.

When assessing the tax rates in Illinois, it’s crucial to consider not only the overall tax burden but also the services and amenities provided in return. Higher tax rates may be justified if they fund high-quality schools, infrastructure, and public services. Conversely, lower tax rates might indicate fewer services and amenities available.

Understanding the tax structure in Illinois is essential for residents and businesses to make informed financial decisions and plan for their tax obligations. It’s advisable to consult with a tax professional or utilize online resources provided by the Illinois Department of Revenue to gain a more comprehensive understanding of the tax landscape in the state.

An Overview of How Taxes Work in the State

Understanding how taxes work in the state of Illinois is crucial for both residents and businesses alike. Illinois has a complex tax system that includes various taxes at the state, county, and municipal levels. In this overview, we will explore the key aspects of Illinois taxes and how they impact individuals and businesses.

State Income Tax

One of the primary sources of revenue for the state of Illinois is the state income tax. The state income tax rate is a flat rate of 4.95% of federal taxable income. It is important to note that Illinois does not allow for deductions or exemptions, meaning that individuals must pay taxes on their entire income.

Sales Tax

In addition to the state income tax, Illinois also levies a sales tax on most retail transactions. The state sales tax rate is currently 6.25%. However, local municipalities can add their own sales tax on top of the state rate, which can vary. As a result, the total sales tax rate in some areas can be as high as 11%. It is important to check the local sales tax rate when making purchases in different parts of the state.

Property Tax

Property tax is another significant source of revenue for the state of Illinois. Property taxes are assessed and collected by local governments, including counties, school districts, and municipalities. Property tax rates can vary significantly depending on the location and the assessed value of the property. It is important for property owners to understand their property tax obligations and potential exemptions that may be available to them.

Other Taxes

In addition to the taxes mentioned above, Illinois also levies other taxes such as motor fuel tax, cigarette tax, and various business taxes. These taxes contribute to the overall revenue of the state and help fund essential services and infrastructure projects.

| Type of Tax | Rate |

|---|---|

| State Income Tax | 4.95% |

| Sales Tax | 6.25% (plus local rates) |

| Property Tax | Varies by location |

It is important to consult with a tax professional or reference official government sources for the most up-to-date and detailed information on tax rates and obligations in the state of Illinois. Being aware of the various taxes and understanding how they work can help individuals and businesses effectively manage their tax liabilities and plan for their financial future.

Question-answer:

What city in Illinois has the highest taxes?

The city in Illinois with the highest taxes is Chicago.

Why does Chicago have the highest taxes in Illinois?

There are several reasons why Chicago has the highest taxes in Illinois. One reason is the city’s high property tax rates, which are used to fund various services and projects. Additionally, Chicago has a sales tax rate of 10.25%, one of the highest in the country.

How do the tax rates in Chicago compare to other cities in Illinois?

The tax rates in Chicago are generally higher compared to other cities in Illinois. This is mainly due to the city’s higher property tax rates and sales tax rate. However, it’s important to note that different cities and municipalities in Illinois may have different tax rates depending on their individual needs and priorities.

What are some of the services and projects that the high taxes in Chicago fund?

The high taxes in Chicago fund a range of services and projects, including public schools, public safety departments, infrastructure improvements, and social welfare programs. These taxes help to support the functioning and development of the city.

Are there any cities in Illinois with low taxes?

Yes, there are cities in Illinois with low taxes. While Chicago has the highest taxes in the state, there are other cities and municipalities with lower tax rates. Factors such as population size, economic activity, and local government priorities can influence the tax rates in different cities.

Which city in Illinois has the highest tax rates?

The city in Illinois with the highest tax rates is Chicago. It has a combination of high property taxes, sales taxes, and income taxes, making it one of the most expensive cities to live in terms of taxation.

What are the tax rates like in other major cities in Illinois?

While Chicago has the highest tax rates in Illinois, other major cities in the state also have relatively high tax rates. For example, in Springfield, the state capital, property taxes are quite high. In Rockford, sales taxes are on the higher side. It’s important to consider the tax rates of each city when deciding where to live in Illinois.