Chicago, known as the Windy City, is not only famous for its stunning architecture and vibrant culture, but also for its sales tax rate. When making purchases in the city, it’s important to be aware of the applicable tax rate, as it can vary depending on the type of goods or services being purchased.

The sales tax rate in Chicago consists of various components, including the state sales tax, county sales tax, and local sales tax. At the state level, Illinois has a sales tax rate of 6.25%. However, additional taxes are imposed at the county and local levels, which can increase the overall sales tax rate in Chicago.

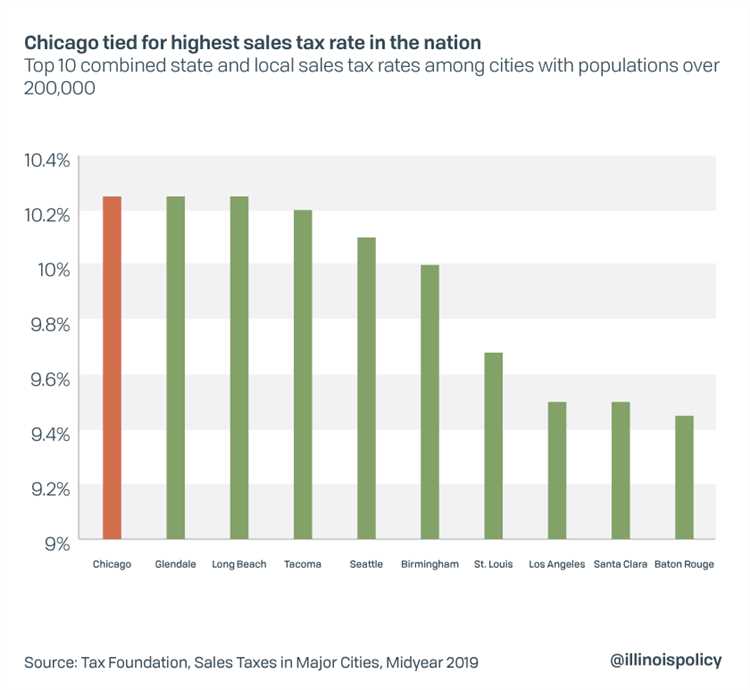

As of October 2021, the total sales tax rate in Chicago is 10.25%. This means that for every $100 spent on eligible goods or services, an additional $10.25 will be added in sales tax. It’s essential to factor in this amount when budgeting for purchases in the city.

It’s worth noting that certain items may be exempt from sales tax, such as groceries, prescription medications, and certain types of clothing. However, other goods and services, such as restaurant meals, entertainment tickets, and luxury items, may be subject to the full sales tax rate.

Understanding the sales tax rate in Chicago is crucial for both residents and visitors alike, as it directly affects the cost of living and the affordability of goods and services in the city. Whether you’re planning a shopping spree on the Magnificent Mile or simply grabbing a bite to eat, knowing the sales tax rate will help you make informed decisions and avoid any surprises at the register.

- Overview of Sales Tax in Chicago

- State Sales Tax

- County and City Sales Tax

- Understanding the Sales Tax Calculation

- Factors Influencing Sales Tax Rate

- Current Sales Tax Rate in Chicago

- Exemptions and Exceptions

- 1. Food and Prescription Drugs

- 2. Clothing and Shoes

- 3. Medical Devices and Equipment

- 4. Government and Non-profit Organizations

- Question-answer:

- What is the current sales tax rate in Chicago?

- Has the sales tax rate in Chicago changed recently?

- Are there any additional local taxes on top of the sales tax rate in Chicago?

- Why is the sales tax rate in Chicago higher than in some other cities?

- Are there any exemptions or special rates for certain goods or services in Chicago?

Overview of Sales Tax in Chicago

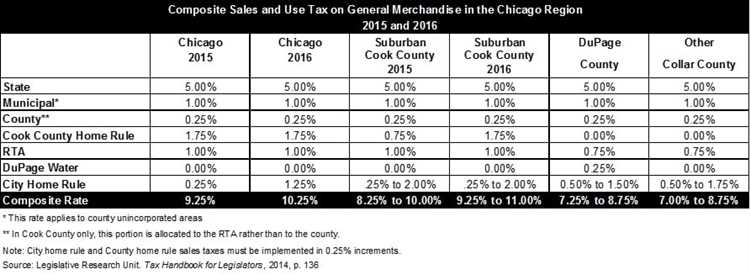

When conducting business or making purchases in Chicago, it’s important to be aware of the sales tax rate that applies. Sales tax is a percentage-based tax imposed on the sale of goods and services. In Chicago, the sales tax rate consists of multiple components, including the state sales tax, county sales tax, and city sales tax.

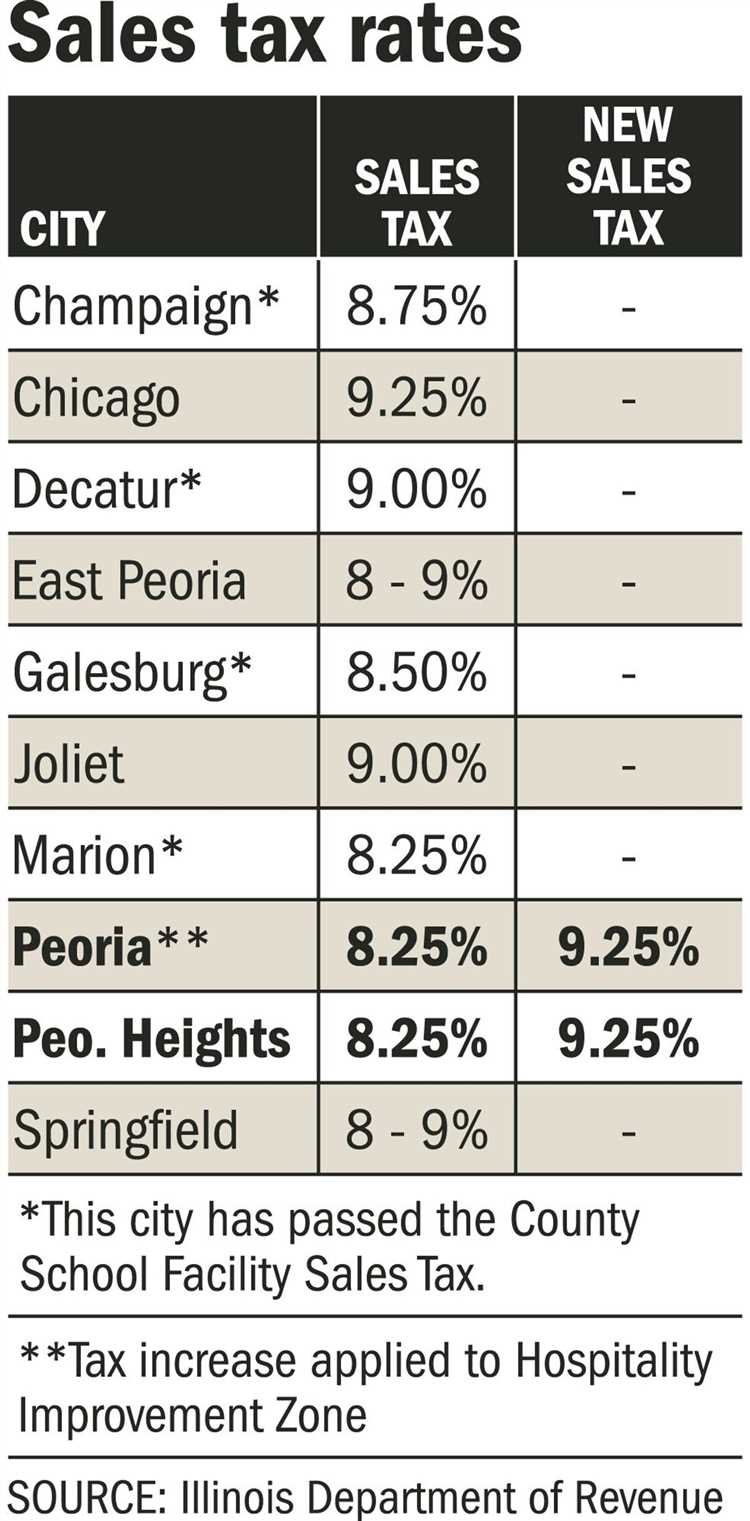

State Sales Tax

The state sales tax in Illinois is currently set at 6.25%. This means that any purchase made within the state will be subject to this rate, unless it is specifically exempt or subject to a different tax rate.

County and City Sales Tax

In addition to the state sales tax, Cook County and the city of Chicago both impose their own sales tax rates. Cook County currently has a sales tax rate of 1.75%, while the city of Chicago has a sales tax rate of 1.25%. This means that the total combined sales tax rate in Chicago is 9.75%.

It’s important to note that certain items may be subject to additional taxes or exemptions. For example, groceries and prescription medications are generally not subject to the sales tax in Chicago. Additionally, certain services may also be either exempt or subject to a different tax rate.

It’s always a good idea to check with the Illinois Department of Revenue or a tax professional to ensure that you are collecting and remitting the correct amount of sales tax for your business in Chicago.

Understanding the Sales Tax Calculation

When it comes to understanding the sales tax calculation in Chicago, there are a few key factors to consider. The city of Chicago imposes a sales tax rate, which is a percentage applied to the final purchase price of goods and services.

The sales tax rate in Chicago consists of two main components: the state sales tax and the local sales tax. The state sales tax rate is currently 6.25%, while the local sales tax rate in Chicago is an additional 2.25%. This brings the total sales tax rate in Chicago to 8.5%.

It’s important to note that the sales tax rate can vary depending on the specific location within Chicago. Different municipalities and special taxing districts within the city may impose additional local taxes, resulting in a higher overall sales tax rate.

Calculating the sales tax on a purchase is relatively straightforward. To find the sales tax amount, you would multiply the purchase price by the sales tax rate. For example, if you purchase an item for $100 in Chicago, the sales tax would be $8.50 (100 x 8.5%). Therefore, the total amount you would pay for the item including sales tax would be $108.50.

It’s important for both consumers and businesses to understand the sales tax rate in Chicago to ensure accurate pricing and budgeting. By knowing the sales tax rate and properly calculating it, you can avoid any surprises and ensure compliance with local tax laws.

Please note: It’s always a good idea to consult with a tax professional or refer to the official website of the City of Chicago for the most up-to-date information on sales tax rates and regulations.

Factors Influencing Sales Tax Rate

There are several factors that can influence the sales tax rate in a specific location. These factors may vary from one jurisdiction to another and can affect the overall tax burden on consumers and businesses. Here are some of the key factors that influence the sales tax rate:

- Government Budget Requirements: The revenue requirements of the local government play a crucial role in determining the sales tax rate. If the government needs more funds to meet its budgetary obligations, it may increase the sales tax rate to generate additional revenue.

- Economic Conditions: The economic conditions prevailing in a jurisdiction can also impact the sales tax rate. In periods of economic growth and prosperity, governments may choose to reduce the sales tax rate to encourage consumer spending and stimulate the economy. Conversely, during economic downturns, governments may increase the sales tax rate to generate more revenue.

- Political Considerations: Political factors can also influence the sales tax rate. The views and policies of elected officials and government leaders can shape the tax landscape. For example, politicians may advocate for higher or lower sales tax rates depending on their ideology and the preferences of their constituents.

- Legal and Regulatory Framework: The legal and regulatory framework within a jurisdiction can determine the allowable tax rates. Some jurisdictions may have legal restrictions on how high or low the sales tax rate can be, while others may have more flexibility to adjust the rate based on their needs.

- Historical Tax Rates: The historical tax rates in a jurisdiction can also have an impact on the current sales tax rate. If a jurisdiction has a history of high tax rates, it may be more likely to maintain or increase those rates in the future. Conversely, if a jurisdiction has a history of low tax rates, it may be more inclined to keep the rates low.

- Public Opinion: The public opinion and perception of sales taxes can also play a role in determining the tax rate. If there is widespread support for lower taxes among the public, policymakers may be more inclined to lower the sales tax rate.

These factors and others can shape the sales tax rate in a specific jurisdiction, and understanding them can provide valuable insights into the tax landscape.

Current Sales Tax Rate in Chicago

The current sales tax rate in Chicago is 10.25%. This rate includes a state sales tax of 6.25%, a local sales tax of 1.75%, and a county sales tax of 1.25%. The sales tax applies to the purchase of tangible personal property and certain services within the city of Chicago.

The state sales tax rate of 6.25% is levied on the sale of most goods, including clothing, electronics, and household items. The local sales tax rate of 1.75% is imposed by the City of Chicago and is applicable to taxable items sold within the city limits. The county sales tax rate of 1.25% is collected by Cook County and is also applied to taxable goods and services within the county.

It is important to note that certain items may be exempt from sales tax in Chicago, such as groceries, prescription medications, and certain medical devices. Additionally, there may be additional taxes imposed on specific goods or services, such as alcohol or dining at restaurants.

Businesses in Chicago are responsible for collecting and remitting the appropriate sales tax to the Illinois Department of Revenue. Failure to do so can result in penalties and fines.

For more information on the current sales tax rates and exemptions in Chicago, individuals and businesses can visit the Illinois Department of Revenue’s website or consult with a tax professional.

Exemptions and Exceptions

While the sales tax rate in Chicago is generally 10.25%, there are some exemptions and exceptions to this rate. Here are a few key points to keep in mind:

1. Food and Prescription Drugs

Food and prescription drugs are exempt from the Chicago sales tax. This means that when you purchase groceries or prescription medications, you will not be charged the 10.25% sales tax rate. However, it is important to note that prepared meals, such as those purchased from restaurants, are not exempt and will be subject to the sales tax.

2. Clothing and Shoes

Clothing and shoes priced at $110 or less are exempt from the Chicago sales tax. This means that if you purchase clothing or shoes that are priced at $110 or lower, you will not be charged the 10.25% sales tax rate. However, any clothing or shoes priced above $110 will be subject to the sales tax.

3. Medical Devices and Equipment

Medical devices and equipment used for the treatment, cure, or mitigation of illness or disease are exempt from the Chicago sales tax. This exemption applies to items such as wheelchairs, crutches, and hearing aids. However, it is important to note that this exemption does not apply to items that are primarily used for cosmetic purposes.

4. Government and Non-profit Organizations

Government agencies and non-profit organizations may be exempt from the Chicago sales tax depending on their specific status and the nature of the goods or services they are purchasing. These exemptions are subject to certain requirements and qualifications, so it is important for these organizations to verify their eligibility with the relevant authorities.

It is important to consult the official website of the City of Chicago or speak with a tax professional for detailed and up-to-date information on exemptions and exceptions to the sales tax rate in Chicago. This will ensure that you are aware of any changes or additional exemptions that may apply to your specific situation.

Question-answer:

What is the current sales tax rate in Chicago?

The current sales tax rate in Chicago is 10.25%.

Has the sales tax rate in Chicago changed recently?

No, the sales tax rate in Chicago has not changed recently. It has been at 10.25% for some time now.

Are there any additional local taxes on top of the sales tax rate in Chicago?

Yes, in addition to the 10.25% sales tax rate, there is also a local transportation tax of 1.25% in Chicago.

Why is the sales tax rate in Chicago higher than in some other cities?

The sales tax rate in Chicago is higher than in some other cities because it includes additional local taxes, such as the local transportation tax. These additional taxes contribute to the higher overall rate.

Are there any exemptions or special rates for certain goods or services in Chicago?

Yes, there are certain exemptions and special rates for certain goods and services in Chicago. For example, groceries and prescription drugs are subject to a lower sales tax rate of 2.25%.