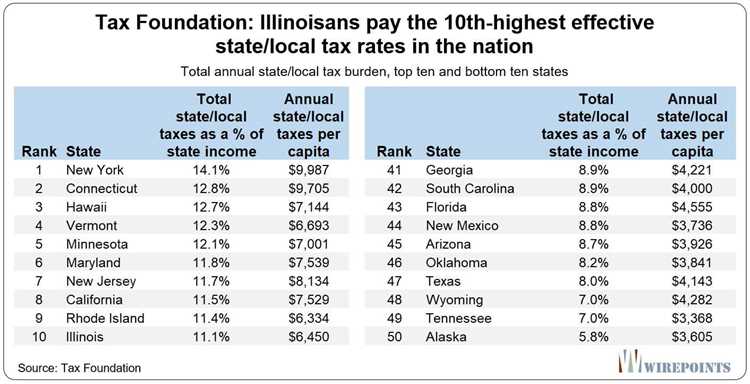

When it comes to taxes, Chicago is often a topic of discussion. With its high property taxes, sales tax, and income tax rates, it’s no wonder people are curious about how the city compares to others in terms of taxation. Chicago is known for having some of the highest taxes in the nation, but is it really that bad?

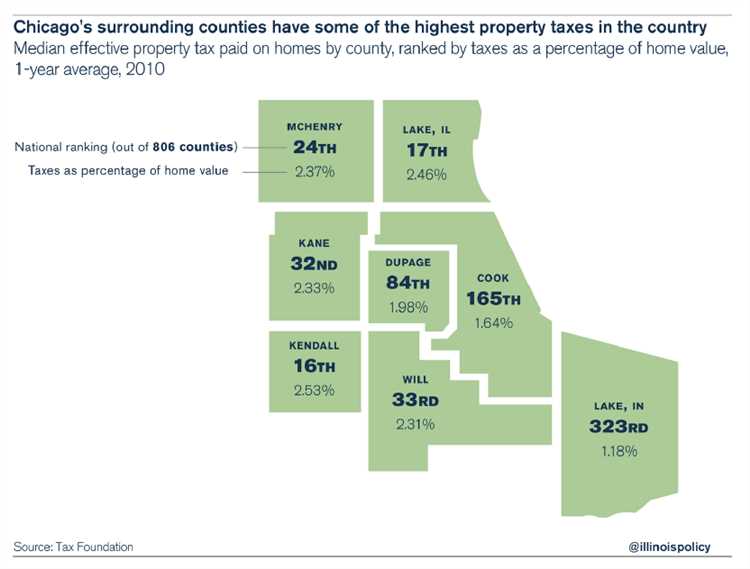

Let’s start with property taxes. Chicago holds the title for having some of the highest property tax rates in the country. Homeowners in the city often find themselves paying a significant portion of their income towards property taxes alone. This is due to a combination of factors, including the city’s pension crisis and the high cost of maintaining the city’s infrastructure.

In addition to property taxes, Chicago also has a high sales tax rate. At a combined rate of 10.25%, Chicago’s sales tax is one of the highest in the country. This means that consumers in the city pay a significant amount in taxes every time they make a purchase. While this may not seem like a big deal for occasional shoppers, it can add up quickly for those who live and work in Chicago.

Lastly, let’s talk about income taxes. Illinois, the state in which Chicago is located, has a flat income tax rate of 4.95%. While this may seem relatively low compared to some other states, it can still take a chunk out of residents’ income. However, it’s worth noting that the state is considering implementing a graduated income tax system, which would increase taxes for higher earners.

In conclusion, Chicago does have a reputation for high taxes, particularly in terms of property taxes and sales tax rates. However, it’s important to consider the services and amenities that residents receive in return. Chicago is a city with a rich culture and a vibrant economy, and these taxes help fund the infrastructure and public services that make it such a desirable place to live. So while taxes may be high, many would argue that the benefits outweigh the costs.

- Overview of Tax Rates in Chicago

- Property Taxes in Chicago

- Exemptions and Rebates

- Recent Changes

- Sales Taxes in Chicago

- Income Taxes in Chicago

- Deductions and Credits

- Filing Options

- Business Taxes in Chicago

- Question-answer:

- What are the taxes like in Chicago compared to other cities?

- How does Chicago’s sales tax rate compare to other cities?

- Are property taxes high in Chicago?

- What are some other taxes that Chicago residents have to pay?

Overview of Tax Rates in Chicago

When it comes to taxes, Chicago residents and businesses need to be aware of several different tax rates that apply to various aspects of life in the city.

- Income Tax: Chicago residents must pay both federal and state income taxes. The federal income tax rate varies depending on income level, while the state income tax rate in Illinois is a flat rate of 4.95%.

- Sales Tax: Chicago has one of the highest sales tax rates in the country at 10.25%. This includes a state sales tax rate of 6.25%, a county sales tax rate of 1.75%, and a city sales tax rate of 1.75%.

- Property Tax: Property taxes in Chicago are determined by the Cook County Assessor’s Office. The tax rate is calculated based on the assessed value of the property and can vary depending on the location and size of the property. Property tax rates in Chicago are generally higher compared to other areas in Illinois.

- Corporate Tax: Businesses in Chicago are subject to both federal and state corporate taxes. The federal corporate tax rate is 21%, while the state corporate tax rate in Illinois is a flat rate of 7%. Additionally, businesses may also be subject to other taxes and fees imposed by the City of Chicago.

It is important for individuals and businesses in Chicago to understand these tax rates and how they may impact their finances. Consulting with a tax professional can help ensure compliance with all applicable tax laws and regulations.

Property Taxes in Chicago

When it comes to property taxes, Chicago has one of the highest rates in the country. Property owners in Chicago are subject to both city and county taxes, which can add up to a significant amount.

The property tax rate in Chicago is determined by the Cook County Assessor’s Office, which assesses the value of each property in the city. The assessed value is then multiplied by the tax rate to determine the amount of taxes owed.

One factor that can affect property taxes in Chicago is the classification of the property. Different types of properties have different tax rates, with residential properties typically having a lower rate than commercial properties. Additionally, properties located in certain tax increment financing districts may be subject to additional taxes.

Exemptions and Rebates

There are several exemptions and rebates available to property owners in Chicago that can help reduce their tax burden. The most common exemption is the homeowner exemption, which provides a reduction in the assessed value for owner-occupied residential properties. Senior citizens and individuals with disabilities may also be eligible for additional exemptions.

Additionally, there are programs available to provide property tax rebates to individuals who meet certain income requirements. These rebates can provide financial relief to low-income homeowners who may struggle to afford their property tax bills.

Recent Changes

In recent years, there have been some changes to property tax laws in Chicago. In 2020, the city implemented a new tiered assessment system that aims to make property taxes more equitable. Under this system, properties in lower-income neighborhoods are assessed at a lower rate than those in higher-income neighborhoods.

However, despite these changes, property taxes in Chicago remain high compared to many other cities. It’s important for property owners to be aware of their tax obligations and take advantage of any exemptions or rebates that may be available to them.

Sales Taxes in Chicago

When it comes to sales taxes, Chicago has some of the highest rates in the country. The combined sales tax rate in the city is currently 10.25%. This includes the Illinois state sales tax rate of 6.25% and an additional local sales tax of 1.75%. In addition to these rates, there is also a special sales tax that applies to certain goods and services, such as restaurant meals and hotel accommodations.

The high sales tax rate in Chicago can have a significant impact on consumers and businesses. For consumers, it means that they have to pay more when buying goods and services in the city. This can make living in Chicago more expensive, especially for those on a tight budget. Businesses also face challenges, as the high sales tax rate can deter customers and make it harder for them to compete with businesses in areas with lower sales taxes.

However, it’s worth noting that there are certain exemptions and exceptions to the sales tax in Chicago. For example, groceries and prescription drugs are exempt from the sales tax, providing some relief for residents. Additionally, certain goods and services are taxed at a reduced rate, such as qualifying food and beverages sold by a retailer. It’s important for consumers and business owners to be aware of these exemptions and exceptions to ensure they are not overpaying on sales taxes.

In conclusion, sales taxes in Chicago are some of the highest in the country, which can have an impact on both consumers and businesses. It’s essential for individuals and business owners to understand the rates, exemptions, and exceptions to ensure they are properly managing their finances in the city.

Income Taxes in Chicago

When it comes to income taxes, Chicago has its own set of rules and rates. The city imposes a flat income tax rate on all residents, regardless of their income levels. Currently, the income tax rate in Chicago is 4.95%.

It’s important to note that this income tax rate is in addition to the state income tax rate that residents of Illinois must also pay. The state income tax rate varies depending on income levels but is currently set at 4.95% as well. So, residents of Chicago are subject to a combined income tax rate of 9.9%.

Residents of Chicago are required to file their income taxes annually, and they have until April 15th to submit their tax returns. It’s crucial to report all sources of income, including wages, tips, rental income, and any other taxable income.

Deductions and Credits

Like most places, Chicago offers certain deductions and credits that taxpayers can take advantage of to minimize their tax liability. Some common deductions include mortgage interest, property taxes, and medical expenses, among others. It’s important to keep detailed records and consult a tax professional to ensure that you’re taking advantage of all available deductions.

Filing Options

Residents of Chicago can choose to file their taxes in several ways. The traditional method is to file a paper return through the mail. However, the city and state also offer electronic filing options, which are generally faster and more convenient. Taxpayers can use tax preparation software or hire a professional to file their taxes electronically.

Additionally, there are certain free filing options available for low-income individuals and families. These programs aim to provide assistance to those who may not be able to afford tax preparation services.

It’s important to understand the income tax rules and regulations in Chicago to ensure that you pay your taxes accurately and on time. Failing to do so can result in penalties and interest charges. Consult the Chicago Department of Revenue or a tax professional for personalized advice based on your specific situation.

Business Taxes in Chicago

When it comes to business taxes, Chicago is known for having a relatively high tax burden compared to many other cities in the United States. The city imposes a variety of taxes on businesses, including sales taxes, property taxes, and a range of miscellaneous fees.

One of the most significant business taxes in Chicago is the sales tax. Chicago has one of the highest combined state and local sales tax rates in the country. This can make doing business in the city more expensive for both businesses and consumers.

In addition to sales taxes, Chicago businesses also have to contend with property taxes, which can be quite high. These taxes are based on the assessed value of the property and can vary widely depending on the location and type of business.

Moreover, Chicago imposes a number of miscellaneous taxes and fees on businesses. For example, businesses may be required to pay a corporate franchise tax or a business license fee. These costs can add up and make it more challenging for businesses to operate and thrive in the city.

Overall, the business tax climate in Chicago can be challenging for companies. The high sales tax rates, property taxes, and miscellaneous fees make doing business more expensive. However, it’s important to note that the city also offers certain tax incentives and programs to encourage business growth and attract companies to the area.

Question-answer:

What are the taxes like in Chicago compared to other cities?

Compared to other cities, taxes in Chicago are generally higher. The city has one of the highest sales tax rates in the country, and property taxes are also quite high.

How does Chicago’s sales tax rate compare to other cities?

Chicago has one of the highest sales tax rates in the country. The combined state and city sales tax rate is currently 10.25%, which is significantly higher than many other cities.

Are property taxes high in Chicago?

Yes, property taxes in Chicago are quite high. The city has one of the highest effective property tax rates in the country, which can significantly increase homeowners’ tax burden.

What are some other taxes that Chicago residents have to pay?

In addition to sales and property taxes, Chicago residents also have to pay income taxes. Illinois has a flat income tax rate, which means that everyone pays the same rate regardless of their income level.