When it comes to minimizing taxes, choosing the right state to live in can make a huge difference. Taxes play a significant role in our financial well-being, so it’s essential to consider the tax policies of different states before making a decision.

Some states have a reputation for being tax-friendly, offering lower tax rates and various tax incentives to their residents. These states understand the importance of attracting businesses and individuals by providing an environment conducive to financial growth.

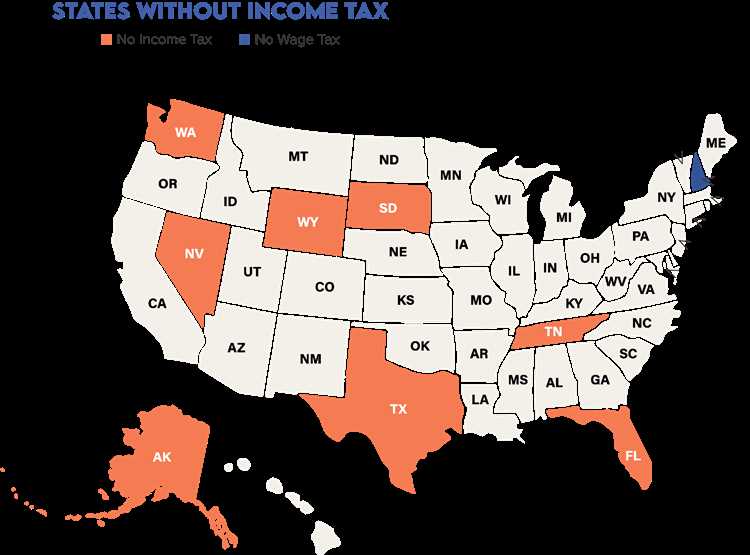

One factor to consider is the absence of a state income tax. States like Texas, Nevada, and Florida are known for not imposing an income tax on their residents, making them highly attractive to those looking to minimize their tax burden. This means that individuals can keep more of their hard-earned money and allocate it towards other financial goals.

- Overview of Tax-Friendly States

- 1. Alaska

- 2. Nevada

- 3. Florida

- Factors Affecting Tax Friendliness

- Top Tax-Friendly States

- 1. Florida

- 2. Texas

- 3. Nevada

- Tax-Friendly States for Individuals

- 1. Nevada

- 2. Florida

- 3. Texas

- 4. Wyoming

- 5. South Dakota

- Tax-Friendly States for Businesses

- Q&A,

- Which states have the lowest taxes?

- What are the advantages of living in a tax-friendly state?

- Are tax-friendly states more suitable for retirees?

- Do tax-friendly states provide quality public services?

- What factors should I consider when choosing a tax-friendly state to live in?

Overview of Tax-Friendly States

When it comes to minimizing taxes, some states offer more advantages than others. These tax-friendly states have various tax incentives and policies in place that make them attractive options for individuals and businesses looking to reduce their tax burden. Here, we provide an overview of some of the most tax-friendly states in the United States.

1. Alaska

Alaska is known for being one of the most tax-friendly states in the country. It doesn’t have a state income tax or a statewide sales tax. Instead, it relies on revenue from oil and gas production. This means that individuals and businesses in Alaska can enjoy significant tax savings.

2. Nevada

Nevada is another state known for its tax-friendly environment. It also doesn’t impose a state income tax or a corporate income tax. Moreover, it doesn’t have a franchise tax or a personal property tax. These factors make Nevada an attractive destination for individuals and businesses looking to save on taxes.

3. Florida

Florida is a popular choice for individuals looking to minimize their tax burden. The state doesn’t have a state income tax, meaning individuals can keep more of their earnings. Additionally, Florida doesn’t have an inheritance tax or an estate tax, making it an appealing option for retirees and individuals with significant assets.

In addition to these states, others such as Texas, Wyoming, South Dakota, and Washington also offer tax advantages. Each state has its own unique tax policies and incentives, so it’s important to thoroughly research and consider the specific tax benefits and regulations of the state you are interested in.

Factors Affecting Tax Friendliness

When determining the tax friendliness of a state, several factors come into play. These factors can have a significant impact on the overall tax burden for residents and businesses. Here are some key factors to consider:

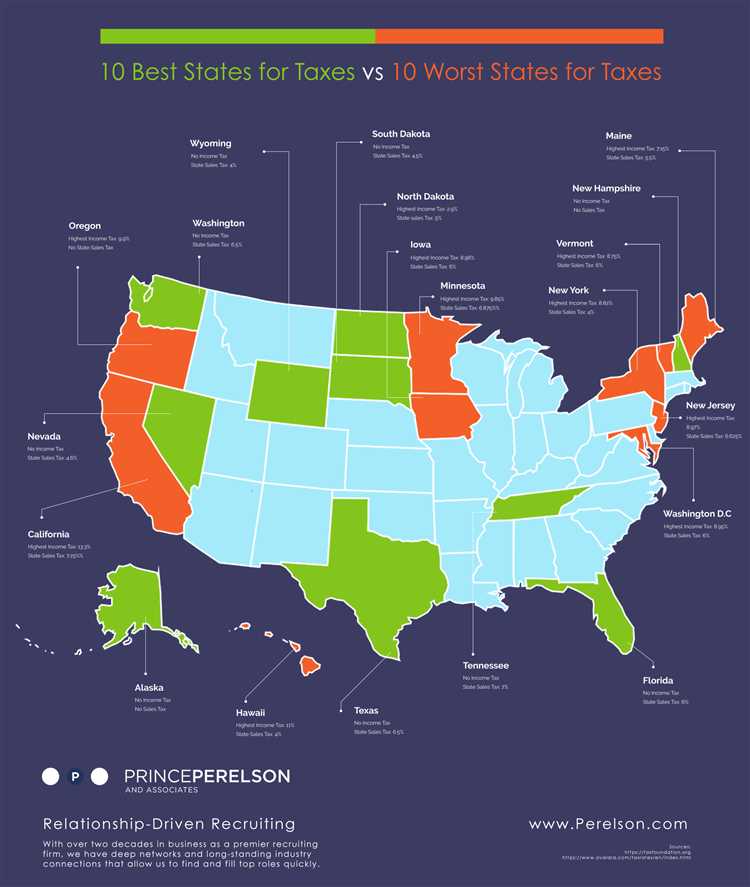

Income Taxes: The presence and level of income taxes can greatly affect a state’s tax friendliness. States with no income taxes, such as Texas and Florida, are often considered more tax-friendly for individuals and businesses alike.

Sales Taxes: Sales taxes can also influence the tax-friendliness of a state. Higher sales tax rates can increase the cost of goods and services, reducing a consumer’s purchasing power. States with low or no sales taxes, such as Alaska and Delaware, are often seen as more tax-friendly in this regard.

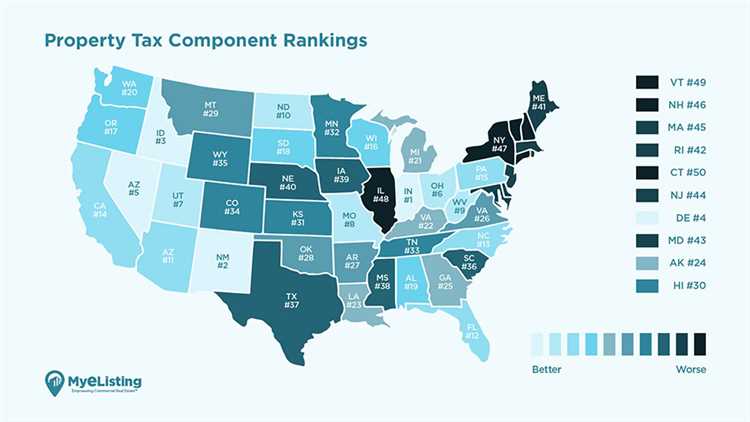

Property Taxes: Property taxes can vary widely from state to state. High property tax rates can significantly impact homeowners and businesses. States like Hawaii and Alabama offer lower property tax rates, making them more attractive to potential residents.

Estate Taxes: The presence of estate taxes can also affect a state’s tax-friendliness. Some states have high estate tax rates or low exemption thresholds, while others have no estate taxes at all. These differences can have a substantial impact on the wealth transfer and succession planning for individuals and families.

Business Taxes: For businesses, factors such as corporate tax rates, franchise taxes, and business-friendly regulations can impact the overall tax burden. States with lower corporate tax rates, like Nevada and Wyoming, may be more appealing to businesses looking to minimize their tax liabilities.

Other Factors: Additional factors that can affect tax-friendliness include gas taxes, sin taxes (such as taxes on alcohol and tobacco), and overall cost of living. These factors, while not directly related to income or property taxes, can still contribute to the overall tax burden for residents.

It’s important to note that while a state may be tax-friendly in one aspect, such as having no income tax, it may have higher taxes in other areas. Choosing the most tax-friendly state requires considering the overall tax picture and how it aligns with an individual or business’s specific financial situation and priorities.

Top Tax-Friendly States

When it comes to minimizing taxes, some states are more friendly than others. Whether you’re planning to retire or looking for a great place to start a business, these tax-friendly states should be at the top of your list:

1. Florida

Known for its sunny beaches and warm weather, Florida is also a top tax-friendly state. With no income tax and no inheritance tax, residents can enjoy more of their hard-earned money. Additionally, Florida has a low sales tax rate, making it an attractive place for shopping.

2. Texas

Another state with no income tax, Texas offers numerous opportunities for businesses and individuals alike. The low cost of living and business-friendly atmosphere make it an ideal place for entrepreneurs. With a high property tax rate, homeowners should be aware of this factor when considering Texas.

3. Nevada

Nevada is well-known for its entertainment capital, Las Vegas, but it is also a tax-friendly state. With no personal income tax and no corporate income tax, Nevada attracts businesses from various industries. The state relies heavily on sales tax, so residents should be prepared for that aspect.

These are just a few examples of tax-friendly states in the United States. Each state has its unique tax structure, so it’s essential to research and compare before making any final decisions. Whether you’re looking to save on income tax, property tax, or sales tax, there are options available in various states.

Tax-Friendly States for Individuals

Choosing a tax-friendly state can help individuals reduce their overall tax burden. These states often offer lower tax rates, fewer tax deductions, and various incentives that can significantly impact an individual’s financial situation. Here are some of the tax-friendly states for individuals:

1. Nevada

Nevada is known for its tax-friendly policies, including no state income tax or corporate tax. This makes it an attractive option for individuals looking to minimize their tax liability. However, keep in mind that there may still be county and local taxes to consider.

2. Florida

Florida is another state that does not impose a state income tax. This can be advantageous for individuals as they can keep more of their earnings. Additionally, Florida also has low property and sales taxes, making it an appealing choice for individuals seeking tax relief.

3. Texas

Like Nevada and Florida, Texas is a state that does not impose a state income tax. This can be a significant advantage for individuals as they can retain a larger portion of their income. Texas is also known for its business-friendly environment, offering various tax incentives for individuals starting or expanding a business.

4. Wyoming

Wyoming is another tax-friendly state for individuals. It does not impose a state income tax, which can be beneficial for those looking to reduce their tax burden. Along with no state income tax, Wyoming also has low property and sales taxes, making it an appealing option for individuals seeking tax savings.

5. South Dakota

South Dakota is a tax-friendly state that does not levy a state income tax. This can be advantageous for individuals looking to keep more of their earnings. Additionally, South Dakota has one of the lowest property tax rates in the country, contributing to its reputation as a tax-friendly state.

When considering a move to a tax-friendly state, it’s essential to weigh other factors such as cost of living, job opportunities, and quality of life. Consulting with a tax professional can also help individuals make informed decisions based on their specific financial circumstances.

Overall, these tax-friendly states offer individuals an opportunity to minimize their tax liability, allowing them to retain a larger portion of their income for other financial goals.

Tax-Friendly States for Businesses

When it comes to running a business, minimizing taxes can have a significant impact on your bottom line. Some states are more business-friendly than others when it comes to taxes. Here are a few tax-friendly states for businesses:

1. Nevada: Nevada has no state income tax, which can be a huge advantage for businesses. Additionally, the state has a low overall tax burden and a business-friendly regulatory environment.

2. Wyoming: Wyoming is another state that does not have a state income tax. This, combined with its low sales tax and minimal business taxes, makes it an attractive option for entrepreneurs.

3. South Dakota: South Dakota has no state income tax and ranks among the lowest states for overall tax burden. The state also has a well-regulated business environment and is known for its business-friendly policies.

4. Texas: Texas is known for its business-friendly climate, with no state income tax and low business taxes. The state also offers various incentives and programs to support businesses and encourage economic growth.

5. Florida: Florida has no state income tax and a low overall tax burden. The state also offers various tax advantages for businesses, such as a research and development tax credit and a sales tax exemption on manufacturing equipment.

6. New Hampshire: While New Hampshire does have a state income tax, it does not tax personal income, capital gains, or dividends. The state also has no sales tax and minimal business taxes, making it a relatively tax-friendly option for businesses.

Choosing a tax-friendly state for your business can lead to significant tax savings and a more favorable operating environment. Consider these states when deciding where to start or relocate your business to maximize your tax benefits.

Q&A,

Which states have the lowest taxes?

The following states are known for having some of the lowest taxes: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

What are the advantages of living in a tax-friendly state?

Living in a tax-friendly state can have several advantages. Firstly, it allows you to keep more of your income, as you will have to pay lower income tax rates. Secondly, it can make housing more affordable, as property taxes tend to be lower in tax-friendly states. Finally, it can attract businesses and create more job opportunities due to the favorable tax environment.

Are tax-friendly states more suitable for retirees?

Yes, tax-friendly states can be a great choice for retirees. Retirees often live on a fixed income, and living in a state with lower taxes can help stretch their retirement savings further. Additionally, some tax-friendly states provide exemptions or credits for retirement income, making them even more attractive for retirees.

Do tax-friendly states provide quality public services?

Tax-friendly states do not necessarily provide low-quality public services. While these states may have lower taxes, they can still invest in education, healthcare, infrastructure, and other public services. However, the level of public services can vary from state to state, and it is important to research the specific state you are considering to ensure it meets your needs.

What factors should I consider when choosing a tax-friendly state to live in?

When choosing a tax-friendly state to live in, it is important to consider several factors. These include the overall tax burden, which includes income tax rates, property taxes, sales taxes, and any other taxes imposed by the state. You should also consider the cost of living, quality of life, job opportunities, climate, healthcare options, and any other factors that are important to you and your lifestyle.