When comparing tax rates between two major cities like Chicago and New York City (NYC), it is important to consider various factors that contribute to the overall tax burden. Tax rates alone do not provide a complete picture of the tax situation in each city. To get a clearer understanding, it is necessary to examine the different types of taxes and how they are applied.

In both Chicago and NYC, residents are subject to federal income tax, state income tax, and local taxes. However, the specific rates and rules differ between the two cities. Chicago, located in Illinois, has a flat state income tax rate of 4.95%. On the other hand, NYC, located in New York, has a progressive state income tax rate that ranges from 4% to 8.82% based on income brackets. Therefore, individuals earning higher incomes may be subject to higher state income tax rates in NYC compared to Chicago.

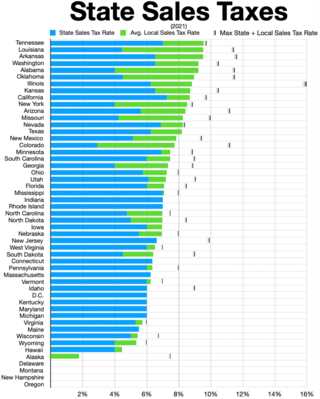

When it comes to local taxes, Chicago has a higher sales tax rate compared to NYC. The combined sales tax rate in Chicago is currently 10.25%, while NYC has a combined sales tax rate of 8.875%. This means that consumers in Chicago may pay slightly more in taxes when making purchases.

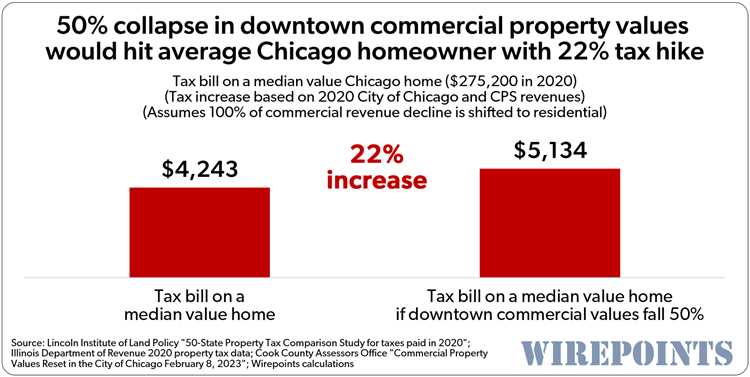

Another important factor to consider is property tax rates. In Chicago, the property tax rate is relatively high compared to other cities in the United States. According to recent data, the average property tax rate in Cook County, where Chicago is located, is around 2.14%. In contrast, NYC has a relatively lower property tax rate, with an average rate of 0.86%. This means that homeowners in Chicago may face higher property tax bills compared to those in NYC.

In conclusion, the comparison of tax rates between Chicago and NYC reveals that the tax burden can vary depending on different factors such as income, sales, and property ownership. The overall tax situation in each city is influenced by various local and state regulations. Therefore, it is important for individuals to consider their unique circumstances and consult with tax professionals to accurately assess their tax obligations in both cities.

- Determining Tax Rates: Chicago vs. NYC

- Tax Rates in Chicago

- Overview of Chicago’s Tax System

- Comparison of Individual Income Tax Rates in Chicago

- Comparison of Property Tax Rates in Chicago

- Question-answer:

- What are the tax rates in Chicago compared to New York City?

- Which city has higher income taxes?

- Are property taxes higher in Chicago or New York City?

- Which city has higher sales taxes?

- Overall, which city has higher total tax burden?

- What are the tax rates in Chicago compared to New York City?

Determining Tax Rates: Chicago vs. NYC

When comparing tax rates between cities, it is important to consider various factors that contribute to the final tax burden on residents. For both Chicago and New York City (NYC), the tax rates are determined by a combination of state, city, and local taxes.

In Chicago, the tax rates are primarily determined by the state of Illinois and the city of Chicago. The state of Illinois imposes an income tax, with a flat rate of 4.95%. This rate applies to all residents and is based on their taxable income. In addition to the state income tax, the city of Chicago also imposes its own tax on income earned within the city limits. Currently, this tax rate is set at 2.25%. Therefore, residents of Chicago pay a combined income tax rate of 7.20% (4.95% state tax + 2.25% city tax).

In NYC, the tax rates are determined by the state of New York and the city of New York. The state of New York has a progressive income tax system, which means that tax rates increase as taxable income increases. Currently, the highest tax rate in New York state is 8.82%, which applies to taxable income over $1,077,550. The city of New York also imposes its own tax on income earned within the city. This tax, known as the New York City personal income tax, ranges from 3.078% to 3.876% depending on the individual’s income level. Therefore, residents of NYC may pay a combined income tax rate of up to 12.696% (8.82% state tax + 3.876% city tax).

It is worth noting that these tax rates are subject to change, as they are determined by the respective state and city governments. Additionally, other factors such as deductions, exemptions, and credits can also affect the final tax burden for individuals.

When comparing tax rates between Chicago and NYC, it is clear that the tax burden can be higher in NYC due to the progressive income tax system and higher tax rates imposed by both the state and city. However, individuals in Chicago may also face a significant tax burden due to the combined state and city income tax rates.

| Tax Rates | Chicago | NYC |

|---|---|---|

| State Income Tax | 4.95% | Progressive |

| City Income Tax | 2.25% | 3.078% – 3.876% |

| Combined Income Tax Rate | 7.20% | Up to 12.696% |

Tax Rates in Chicago

When it comes to taxes, Chicago residents must be prepared for a variety of different rates. The city has a combination of federal, state, and local taxes that individuals and businesses must pay. Here is a breakdown of some of the key tax rates in Chicago:

| Tax Type | Rate |

|---|---|

| Federal Income Tax | 10% – 37% |

| Illinois State Income Tax | 4.95% |

| Chicago Sales Tax | 10.25% |

| Chicago Property Tax | 1.74% |

These rates can add up quickly and have a significant impact on residents’ finances. It is important for individuals and businesses in Chicago to carefully plan and budget for these taxes to avoid any surprises come tax time.

It is worth noting that tax rates can vary based on factors such as income level, property value, and specific business types. Consulting with a tax professional can provide more personalized information regarding individual and business tax obligations in Chicago.

Overall, it is clear that Chicago residents face a variety of taxes that contribute to the overall tax burden in the city.

Overview of Chicago’s Tax System

Chicago has a complex tax system that includes various taxes imposed on its residents and businesses. One of the main sources of revenue for the city is the property tax, which is used to fund local government services and infrastructure projects. Property taxes in Chicago are based on the assessed value of the property and can vary depending on its location and type.

In addition to property taxes, Chicago also levies a sales tax on goods and services purchased within the city. The sales tax rate in Chicago can be higher than in other parts of Illinois due to additional local taxes imposed by the city and county. This can make the cost of living higher for residents and businesses located in the city.

Another important aspect of Chicago’s tax system is the income tax. Illinois has a flat income tax rate of 4.95%, which applies to both individuals and corporations. This means that everyone, regardless of their income level, pays the same rate. However, there have been discussions about implementing a progressive income tax system in the state, which would result in higher taxes for higher-income individuals.

Additionally, Chicago has various other taxes and fees, such as the gasoline tax, parking tax, and amusement tax. These taxes are used to generate revenue and fund specific programs or services within the city.

Overall, Chicago’s tax system is complex and includes multiple taxes that can impact residents and businesses. Understanding the various taxes and their implications is important for individuals and businesses operating within the city.

Comparison of Individual Income Tax Rates in Chicago

When it comes to individual income tax rates, Chicago has a progressive tax system that consists of several brackets. The tax rates in Chicago vary depending on the level of income that an individual earns.

In Chicago, the individual income tax rates range from 4.95% to 7.75%. Individuals who earn less than $10,000 per year are subject to a tax rate of 4.95%, while those who earn between $10,000 and $100,000 pay a tax rate of 5.95%. For individuals earning between $100,000 and $250,000, the tax rate is 6.95%. Finally, for individuals earning over $250,000, the highest tax rate of 7.75% applies.

It’s important to note that these tax rates are separate from the federal income tax rates and other taxes, such as social security and Medicare taxes, that individuals may be required to pay. Additionally, Chicago residents may also be subject to local taxes on top of the state income tax rates.

When comparing the individual income tax rates in Chicago to other cities, such as New York City, it’s crucial to take into account not only the tax rates themselves but also the overall cost of living and the potential deductions and exemptions that may apply.

In conclusion, Chicago has a progressive individual income tax system with rates ranging from 4.95% to 7.75%. Understanding the tax rates in Chicago is essential for individuals who reside or work in the city and can help in making informed financial decisions.

Comparison of Property Tax Rates in Chicago

One of the key factors that homeowners need to consider when choosing where to live is property tax rates. In the case of Chicago, the property tax rates can vary depending on the location and assessed value of the property.

Chicago has one of the highest property tax rates in the country. According to recent data, the average effective property tax rate in Chicago is around 2.14%. This means that for every $100 of assessed property value, homeowners in Chicago can expect to pay around $2.14 in property taxes.

It is important to note that property taxes in Chicago are calculated based on the assessed value of the property, which is determined by the Cook County Assessor’s Office. The assessed value is typically lower than the market value of the property.

In addition to the average effective property tax rate, there are other factors that can affect the overall property tax bill in Chicago. These factors include exemptions, such as the homeowner’s exemption and senior citizen exemption, which can reduce the taxable value of the property and lower the property tax bill.

It is also worth noting that property tax rates can vary within different neighborhoods and taxing districts within Chicago. Some neighborhoods may have higher or lower property tax rates compared to the citywide average. Homeowners should consider these factors when determining the overall cost of owning a home in Chicago.

Overall, when comparing property tax rates, Chicago tends to have higher rates compared to other cities. However, it is important to consider other factors such as local services, amenities, and quality of life when making a decision about where to live.

Question-answer:

What are the tax rates in Chicago compared to New York City?

The tax rates in Chicago and New York City vary depending on different factors such as income, property, and sales taxes. Generally, New York City has higher tax rates compared to Chicago.

Which city has higher income taxes?

New York City generally has higher income taxes compared to Chicago. The income tax rates in New York City can be as high as 8.82%, while in Chicago, the income tax rates are lower, with a maximum rate of 4.95%.

Are property taxes higher in Chicago or New York City?

Property taxes vary depending on the specific property and its assessed value, but generally, property taxes in New York City are higher compared to Chicago. The average effective property tax rate in New York City is around 0.88%, while in Chicago, it is about 1.74%.

Which city has higher sales taxes?

Chicago has a higher sales tax rate compared to New York City. In Chicago, the combined sales tax rate, including state, county, and city taxes, is 10.25%, while in New York City, the combined sales tax rate is 8.875%. However, it’s worth noting that certain items may be exempt from sales taxes in both cities.

Overall, which city has higher total tax burden?

Overall, New York City has a higher total tax burden compared to Chicago. This is due to higher income taxes, property taxes, and other taxes imposed by the city. However, it’s important to consider individual circumstances and factors such as income level and property value when determining the actual tax burden for an individual or business.

What are the tax rates in Chicago compared to New York City?

The tax rates in Chicago and New York City vary depending on the type of tax. However, Chicago generally has lower taxes compared to New York City.