When it comes to taxes, many people in Chicago wonder whether the tax rates in the Windy City are high compared to other major cities. Chicago is known for its stunning skyline, vibrant culture, and world-class attractions, but it’s also notorious for its taxes. In this article, we will delve into the tax rates in Chicago and explore whether they are indeed high.

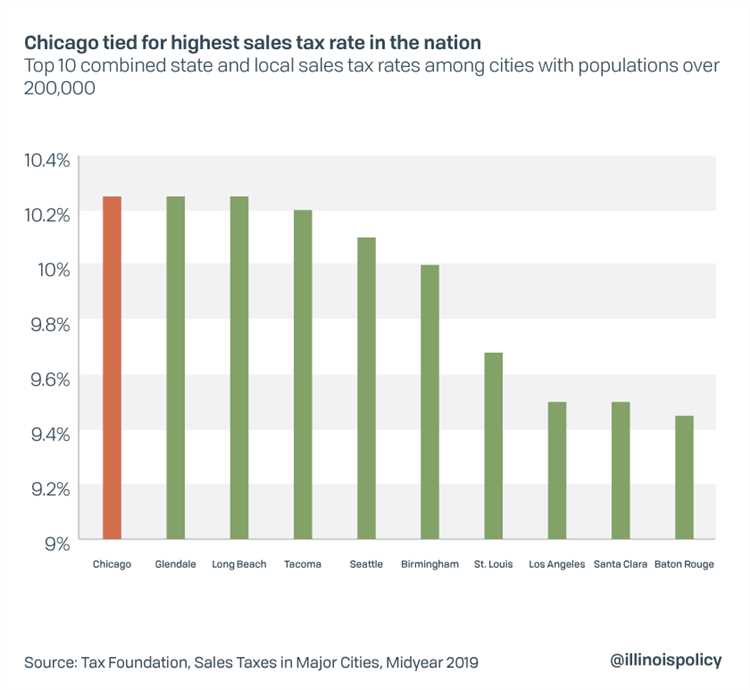

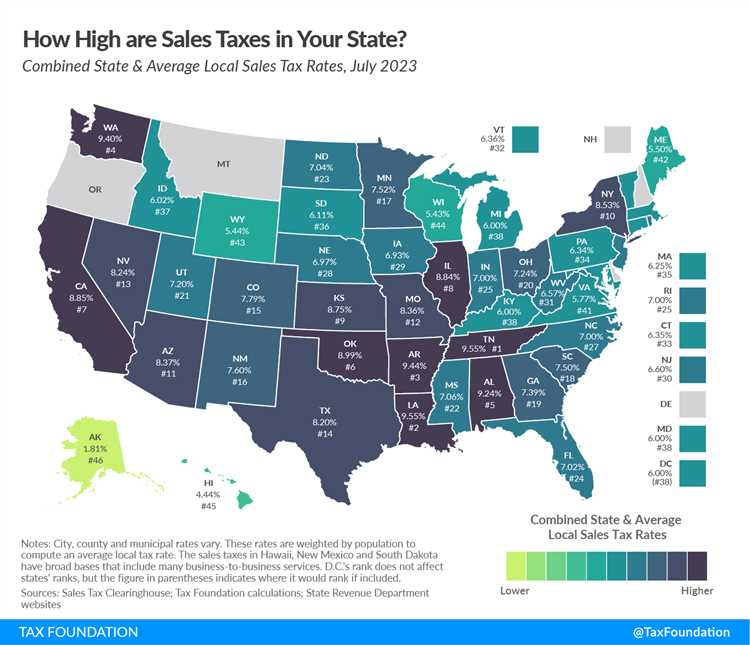

Chicago imposes a variety of taxes on its residents and visitors, including sales tax, property tax, and income tax. Sales tax in Chicago is one of the highest in the nation, currently standing at 10.25%. This means that for every dollar spent on taxable goods and services, an extra 10.25 cents go towards taxes. Although this may seem high, it’s important to note that other cities like Los Angeles and New York City also have similarly high sales tax rates.

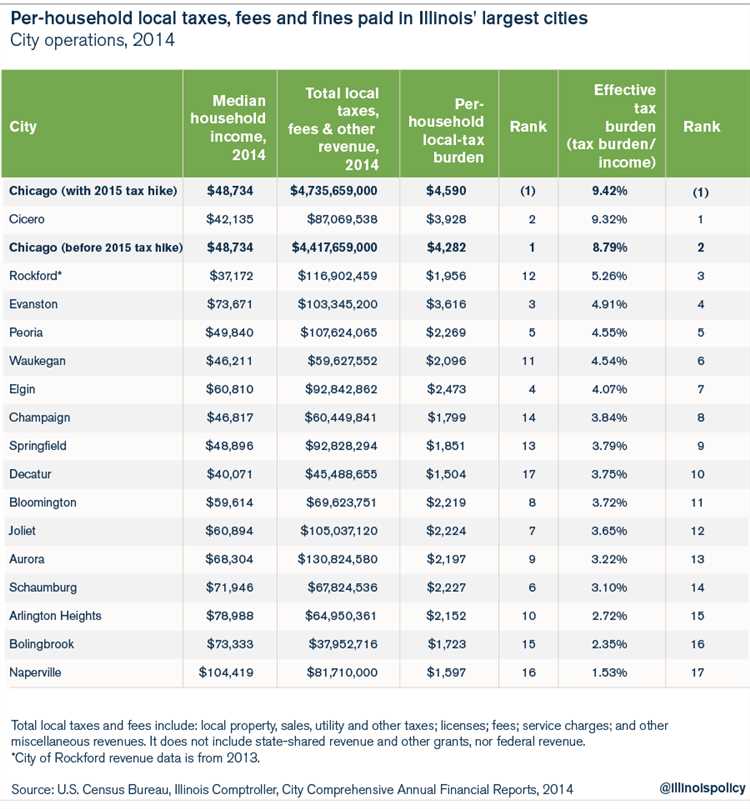

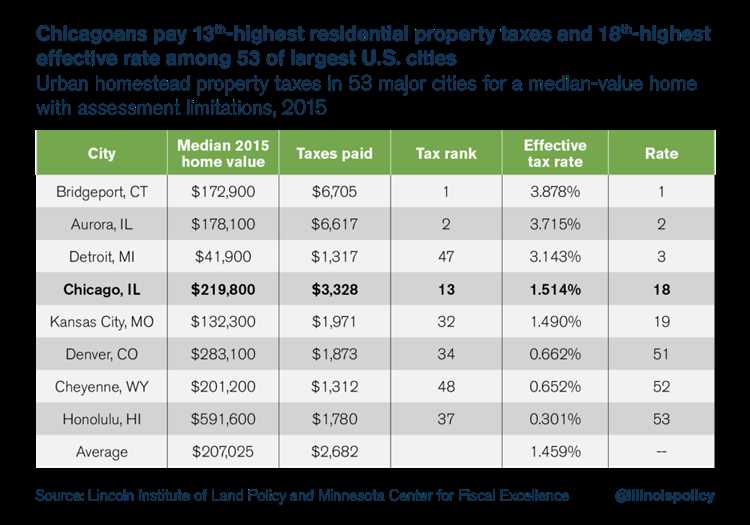

Another tax that Chicago residents have to contend with is the property tax. The property tax rates in Chicago are known to be relatively high compared to other cities in the United States. The average effective property tax rate in Cook County, where Chicago is located, is around 2.1%. This means that homeowners in Chicago pay 2.1% of their property’s assessed value in taxes each year. While this may seem high, it’s worth noting that property tax rates can vary based on the specific location within the city.

Lastly, let’s talk about income tax. Illinois, the state where Chicago is situated, has a flat income tax rate of 4.95%. This means that regardless of how much you earn, everyone pays the same income tax rate. When compared to some other states that have progressive income tax systems, where higher earners pay a higher percentage of their income in taxes, the flat tax rate in Illinois may seem more favorable for higher-income individuals.

In conclusion, while taxes in Chicago may be perceived as high, it’s important to take into account the context and compare them to tax rates in other major cities. While sales tax and property tax rates in Chicago may be on the higher side, other cities like Los Angeles and New York City also have similarly high rates. Additionally, the flat income tax rate in Illinois may be advantageous for higher-income individuals when compared to states with progressive income tax systems. Overall, understanding the tax rates in Chicago is crucial for residents and visitors alike, as it can have a significant impact on their financial planning and decision-making.

- Are Taxes High in Chicago?

- Exploring the Tax Rates in the Windy City

- Property Tax Rates

- Sales Tax Rates

- Income Tax Rates

- Conclusion

- Tax Rates on Property

- Tax Rates on Income

- Individual Income Tax Rates

- Business Taxes in Chicago

- 1. Business License Tax

- 2. Corporate Income Tax

- Question-answer:

- Are taxes in Chicago higher than in other cities? How do they compare to the national average?

- What are the different types of taxes in Chicago?

- Why are taxes in Chicago so high?

- Do the tax rates in Chicago vary by income level?

- What is the property tax rate in Chicago?

Are Taxes High in Chicago?

Chicago, also known as the Windy City, is home to millions of residents and thousands of businesses. One thing that is often a topic of discussion in Chicago is taxes. So, are taxes high in Chicago?

The answer to that question is not a simple yes or no. The tax rates in Chicago can vary depending on several factors, such as the type of tax and the specific location.

One of the most well-known taxes in Chicago is the sales tax. The sales tax rate in the city is currently 10.25%, which includes the state, county, and city sales tax. This rate is higher than the average sales tax rate in the United States, which is around 7%. So, if you’re a frequent shopper in Chicago, you may notice that you’re paying a bit more in taxes compared to other cities.

In addition to sales tax, Chicago also has other taxes such as property tax and income tax. The property tax rates in Chicago can vary depending on the specific location and property value. According to recent data, the average property tax rate in Chicago is around 2.14%. This rate is higher than the national average property tax rate, which is around 1.07%. So, if you own property in Chicago, you may be paying more in property taxes compared to other areas.

When it comes to income tax, Chicago residents pay both state and federal income taxes. The state income tax rate in Illinois is currently a flat rate of 4.95%. Additionally, individuals in Chicago are subject to federal income tax rates, which vary depending on their income bracket.

Overall, while taxes in Chicago may be higher compared to some other cities or states, it’s important to note that taxes play a crucial role in funding public services and infrastructure. The tax rates in Chicago are determined by various factors and are subject to change. It’s always a good idea to consult with a tax professional to understand your specific tax obligations.

In conclusion, taxes in Chicago can be considered high when compared to national averages. However, it’s important to consider the reasons behind these tax rates and the services they help fund.

Exploring the Tax Rates in the Windy City

Chicago, also known as the Windy City, is not only famous for its impressive skyline and vibrant culture, but also for its tax rates. As a resident or business owner in Chicago, it is essential to understand the various tax rates that apply to different aspects of life in the city.

Property Tax Rates

Property taxes in Chicago are known to be relatively high compared to other cities. The property tax rate is set by the Cook County Assessor’s Office and depends on the assessed value of the property. The tax rate in Chicago is a combination of rates from various taxing jurisdictions, such as the city, county, and local school district.

Sales Tax Rates

When it comes to sales tax, Chicago has one of the highest rates in the country. The combined state and local sales tax rate in Chicago is currently 10.25%. This means that for every dollar spent on taxable items, an additional 10.25 cents will be paid in sales tax.

It’s important to note that certain items, such as groceries and prescription medications, are exempt from sales tax in Chicago.

Income Tax Rates

Chicago residents are subject to both federal and state income taxes. The state of Illinois has a flat income tax rate of 4.95%. Additionally, residents of Chicago are also required to pay the city’s income tax, which is currently 4.95% as well.

It is worth mentioning that the city income tax rate may vary for non-residents who work in Chicago but live outside the city.

Conclusion

Overall, tax rates in the Windy City can be relatively high compared to other areas. Property taxes, sales taxes, and income taxes all contribute to the tax burden for residents and businesses in Chicago. Understanding and planning for these taxes is crucial for financial management in the city.

| Tax Type | Tax Rate |

|---|---|

| Property Tax | Varies based on assessed property value |

| Sales Tax | 10.25% |

| Income Tax | 4.95% (state and city) |

Tax Rates on Property

When it comes to property taxes in Chicago, residents can expect to pay some of the highest rates in the country. The city has a complex property tax system that includes multiple components, including assessments, tax rates, and exemptions.

In Chicago, property taxes are based on the assessed value of the property. The assessed value is determined by the Cook County Assessor’s Office, which values properties using a combination of market data, property inspections, and other factors.

Once the assessed value is determined, a tax rate is applied to calculate the property tax bill. The tax rate is set by various taxing authorities, including the city, county, school district, and other local entities. These tax rates can vary depending on the location and type of property.

Unfortunately, property tax rates in Chicago have been steadily increasing over the years. This has put a burden on homeowners and businesses, who often struggle to keep up with the rising costs. In some cases, high property taxes have even led to foreclosures and abandonment of properties.

Additionally, the city offers certain exemptions and incentives to help alleviate the burden of property taxes. These include exemptions for senior citizens, disabled individuals, and homeowners who make energy-efficient improvements to their properties.

It’s important for Chicago residents to be aware of the property tax rates and potential exemptions that may apply to their properties. By understanding the taxes they are obligated to pay, residents can better plan their finances and make informed decisions related to their properties.

| Property Type | Tax Rate |

|---|---|

| Residential | 2.108% |

| Commercial | 5.308% |

| Industrial | 4.920% |

Tax Rates on Income

When it comes to income taxes, Chicago has a progressive tax system, which means that the tax rate increases as the income level goes up. For residents of the city, the tax rates range from 4.95% to 7.75%.

The tax rates on income are determined by the Illinois state government, as Chicago itself does not levy its own income tax. The rates are based on the taxpayer’s annual income and are applied to the net income after deductions and exemptions.

Individual Income Tax Rates

For individuals, the tax rates in Chicago are as follows:

- 4.95% for income up to $10,000

- 4.95% for income between $10,001 and $100,000

- 7.75% for income over $100,000

It’s important to note that these rates are subject to change, so it’s always a good idea to check with the Illinois Department of Revenue or a tax professional for the most up-to-date information.

Business Taxes in Chicago

When it comes to business taxes in Chicago, the city imposes several taxes on businesses operating within its jurisdiction. These taxes play a key role in funding various city services and initiatives. As a result, it’s important for business owners and entrepreneurs to understand the different types of taxes they may be subject to.

1. Business License Tax

All businesses operating in Chicago are required to obtain a business license, and this license comes with an annual fee. The fee amount varies depending on the type of business, its size, and other factors. Additionally, businesses engaged in specific industries, such as tobacco or liquor, may be subject to additional license fees.

2. Corporate Income Tax

Chicago also levies a corporate income tax on businesses earning income within the city. This tax is in addition to the state and federal corporate income taxes businesses are already subject to. The corporate income tax rate in Chicago is based on a percentage of the net income earned by the business.

In addition to these two main taxes, businesses in Chicago may also be subject to other taxes such as property tax, sales tax, and payroll taxes. It’s important for business owners to consult with tax professionals and stay up-to-date with the city’s tax regulations to ensure compliance and minimize tax liabilities.

Overall, the business tax environment in Chicago can be complex, and it’s crucial for businesses to understand and plan for these taxes in their financial operations. By effectively managing their tax obligations, businesses can help contribute to the city’s economic growth and development.

Question-answer:

Are taxes in Chicago higher than in other cities? How do they compare to the national average?

Taxes in Chicago are generally higher compared to other cities in the United States. However, when compared to the national average, they are slightly lower. It’s important to note that tax rates can vary depending on the specific income level and property value.

What are the different types of taxes in Chicago?

Chicago imposes several different types of taxes, including sales tax, property tax, and income tax. Sales tax is added to the purchase price of most goods and services, while property tax is based on the assessed value of real estate. Income tax is levied on individuals and businesses based on their income.

Why are taxes in Chicago so high?

Taxes in Chicago are high for a few reasons. The city has a large population and relies on tax revenue to fund public services such as education, transportation, and healthcare. Additionally, Chicago has a high debt burden and needs to generate revenue to address financial obligations. The combination of these factors contributes to the higher tax rates in the city.

Do the tax rates in Chicago vary by income level?

Yes, the tax rates in Chicago can vary based on income level. The city has a progressive income tax system, which means that individuals with higher incomes are subject to higher tax rates. This helps to distribute the tax burden more evenly among residents and generate revenue for the city.

What is the property tax rate in Chicago?

The property tax rate in Chicago varies depending on the property’s assessed value and the specific tax district. On average, the property tax rate in Chicago is around 2.5% of the property’s assessed value. However, it’s important to note that this rate can vary significantly depending on the specific neighborhood and property type.